- Australia

- /

- Metals and Mining

- /

- ASX:TIG

Tigers Realm Coal Limited's (ASX:TIG) Revenues Are Not Doing Enough For Some Investors

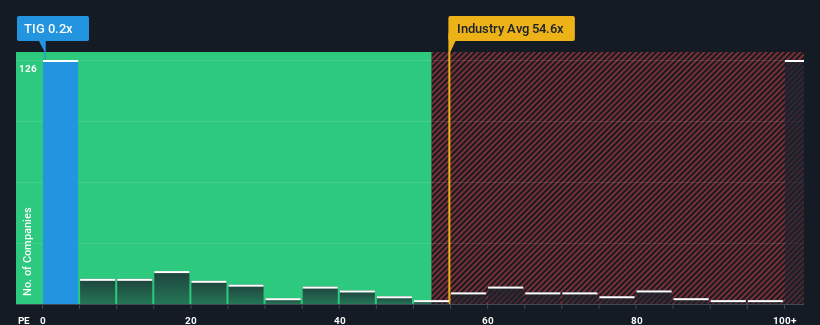

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Tigers Realm Coal Limited (ASX:TIG) is definitely a stock worth checking out, seeing as almost half of all the Metals and Mining companies in Australia have P/S ratios greater than 54.6x and even P/S above 296x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Tigers Realm Coal

How Tigers Realm Coal Has Been Performing

For example, consider that Tigers Realm Coal's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tigers Realm Coal's earnings, revenue and cash flow.How Is Tigers Realm Coal's Revenue Growth Trending?

In order to justify its P/S ratio, Tigers Realm Coal would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. Even so, admirably revenue has lifted 152% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is predicted to deliver 279% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Tigers Realm Coal's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Tigers Realm Coal's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Tigers Realm Coal revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Tigers Realm Coal (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If you're unsure about the strength of Tigers Realm Coal's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tigers Realm Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:TIG

Tigers Realm Coal

Engages in the identification, exploration, development, mining, and sale of coal from deposits in the Far East of the Russian Federation.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives