- Australia

- /

- Metals and Mining

- /

- ASX:ELV

Sayona Mining Limited's (ASX:SYA) Business And Shares Still Trailing The Industry

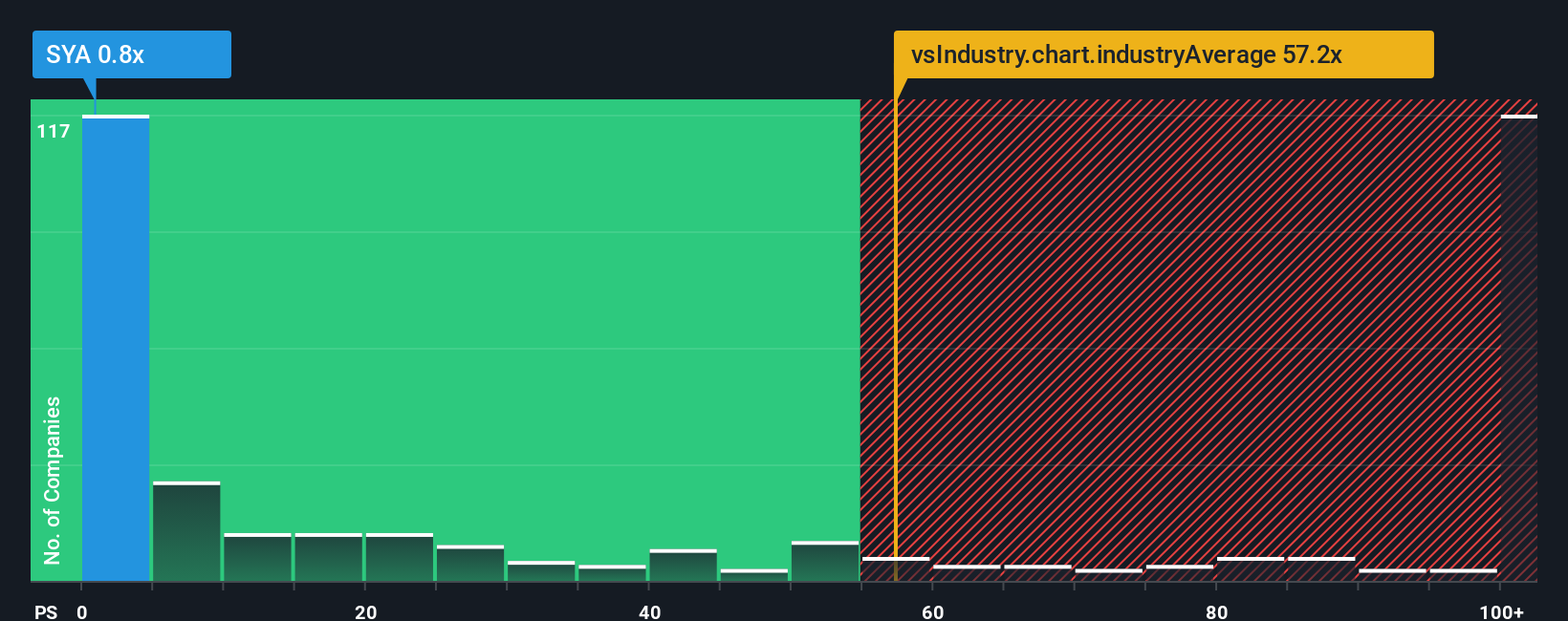

Sayona Mining Limited's (ASX:SYA) price-to-sales (or "P/S") ratio of 0.8x might make it look like a strong buy right now compared to the Metals and Mining industry in Australia, where around half of the companies have P/S ratios above 57.2x and even P/S above 386x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Sayona Mining

How Has Sayona Mining Performed Recently?

Recent times haven't been great for Sayona Mining as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sayona Mining.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Sayona Mining's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 73%. The latest three year period has also seen an excellent 88% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 20% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 73%, which is noticeably more attractive.

With this in consideration, its clear as to why Sayona Mining's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Sayona Mining maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Sayona Mining that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Elevra Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ELV

Elevra Lithium

Engages in the identification, acquisition, exploration, and development of mineral assets in Australia and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives