- Australia

- /

- Electrical

- /

- ASX:SKS

ASX Growth Companies With Insider Ownership For November 2025

Reviewed by Simply Wall St

The Australian market has recently mirrored Wall Street's downturn, with significant declines in the tech sector and widespread red across various indices, reflecting heightened investor anxiety. In such volatile times, companies with strong insider ownership can offer a level of confidence and alignment with shareholder interests, making them worth examining for potential growth opportunities amidst the current economic challenges.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.4% | 96.4% |

| Titomic (ASX:TTT) | 11.2% | 74.9% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IRIS Metals (ASX:IR1) | 23.5% | 144.4% |

| Emerald Resources (ASX:EMR) | 18.4% | 57.2% |

| Elsight (ASX:ELS) | 17.4% | 77% |

| Echo IQ (ASX:EIQ) | 19.1% | 49.9% |

| BlinkLab (ASX:BB1) | 35.4% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Here we highlight a subset of our preferred stocks from the screener.

SKS Technologies Group (ASX:SKS)

Simply Wall St Growth Rating: ★★★★☆☆

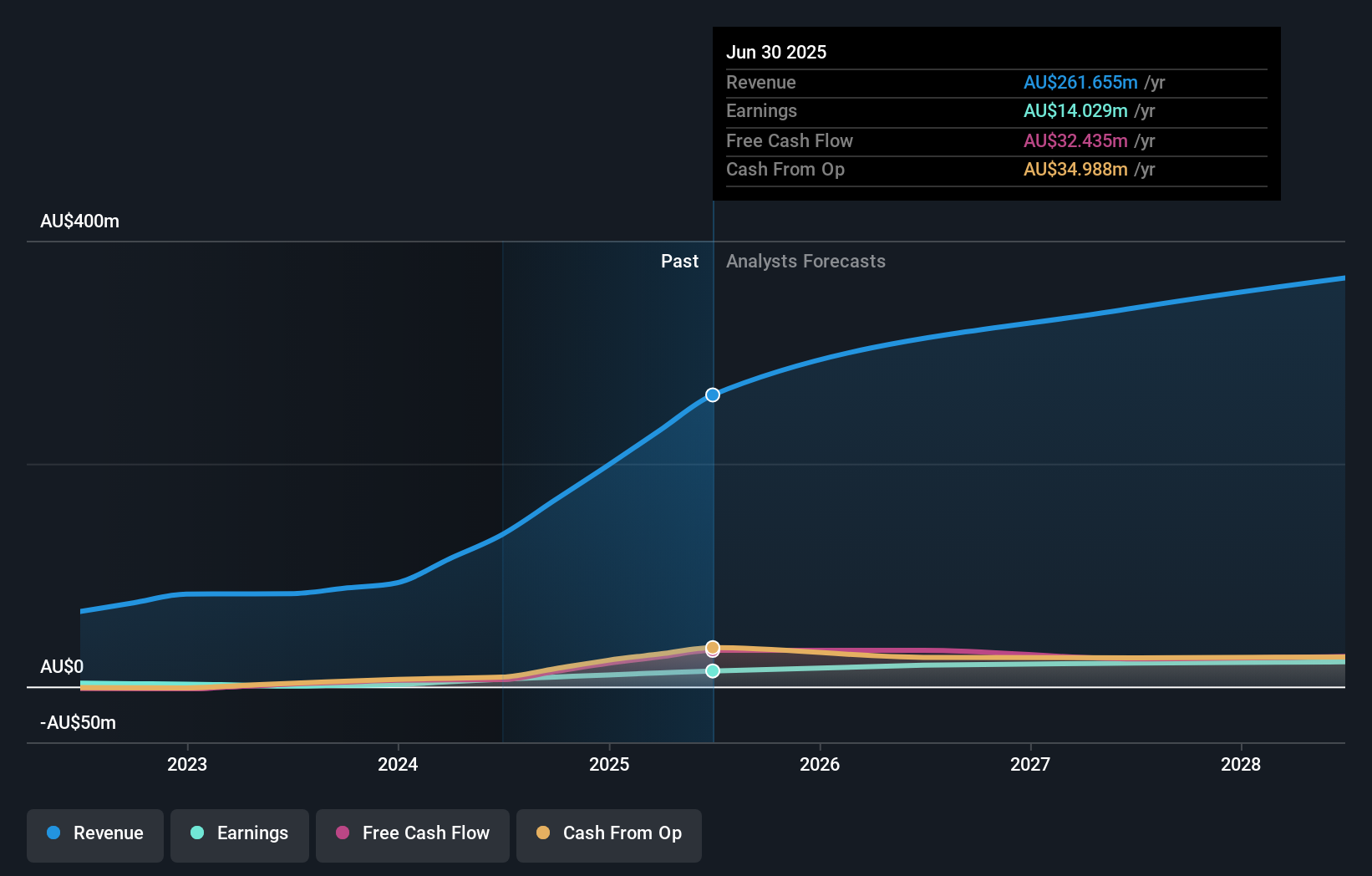

Overview: SKS Technologies Group Limited operates in Australia, focusing on the design, supply, and installation of audio visual, electrical, and communication products and services with a market cap of A$388.86 million.

Operations: The company generates revenue of A$261.66 million from its operations in the lighting and audio-visual markets.

Insider Ownership: 28.3%

Revenue Growth Forecast: 10.9% p.a.

SKS Technologies Group shows strong growth potential with earnings forecasted to grow faster than the Australian market at 13.9% annually. The company reported a significant increase in net income, reaching A$14.03 million for the year ended June 2025, up from A$6.62 million previously. Despite recent insider selling, SKS maintains a competitive price-to-earnings ratio of 27.7x, below the industry average, indicating potential value for investors focused on growth and insider ownership dynamics.

- Get an in-depth perspective on SKS Technologies Group's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that SKS Technologies Group's current price could be inflated.

Santana Minerals (ASX:SMI)

Simply Wall St Growth Rating: ★★★★☆☆

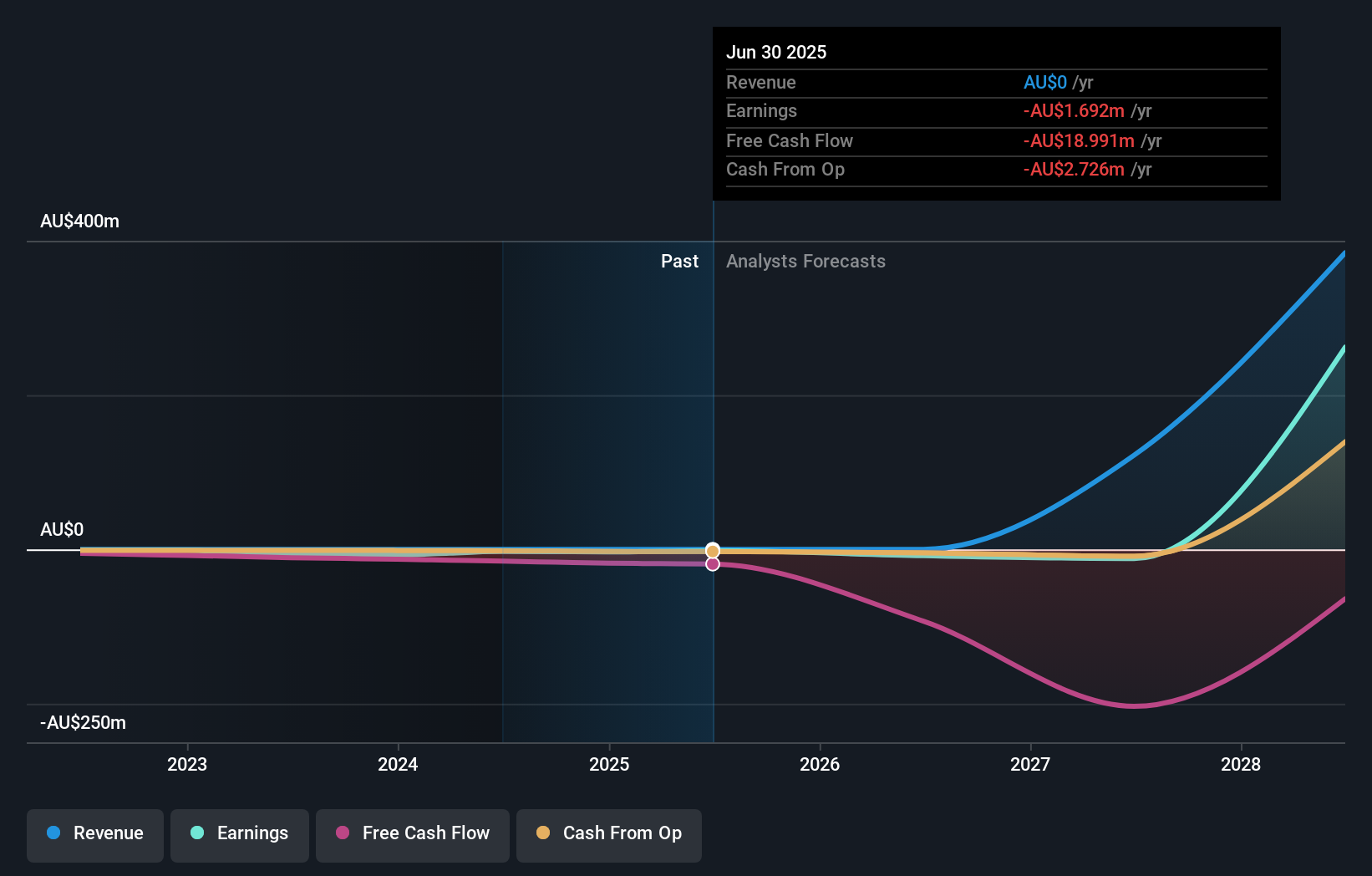

Overview: Santana Minerals Limited focuses on the exploration and evaluation of gold properties in New Zealand, Cambodia, and Mexico, with a market cap of A$673.38 million.

Operations: The company generates its revenue from the exploration and assessment of gold assets across New Zealand, Cambodia, and Mexico.

Insider Ownership: 13.4%

Revenue Growth Forecast: 47.7% p.a.

Santana Minerals is poised for growth, with insider ownership aligning interests. Despite past shareholder dilution, the company trades significantly below its estimated fair value and is expected to achieve profitability within three years. The recent granting of a 25-year mining permit for the Bendigo-Ophir Gold Project in New Zealand enhances its development prospects. Although revenue forecasts are low, strong assay results from ongoing drilling underscore potential resource upgrades, supporting long-term expansion and profitability ambitions.

- Click here to discover the nuances of Santana Minerals with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Santana Minerals' share price might be too optimistic.

WA1 Resources (ASX:WA1)

Simply Wall St Growth Rating: ★★★★☆☆

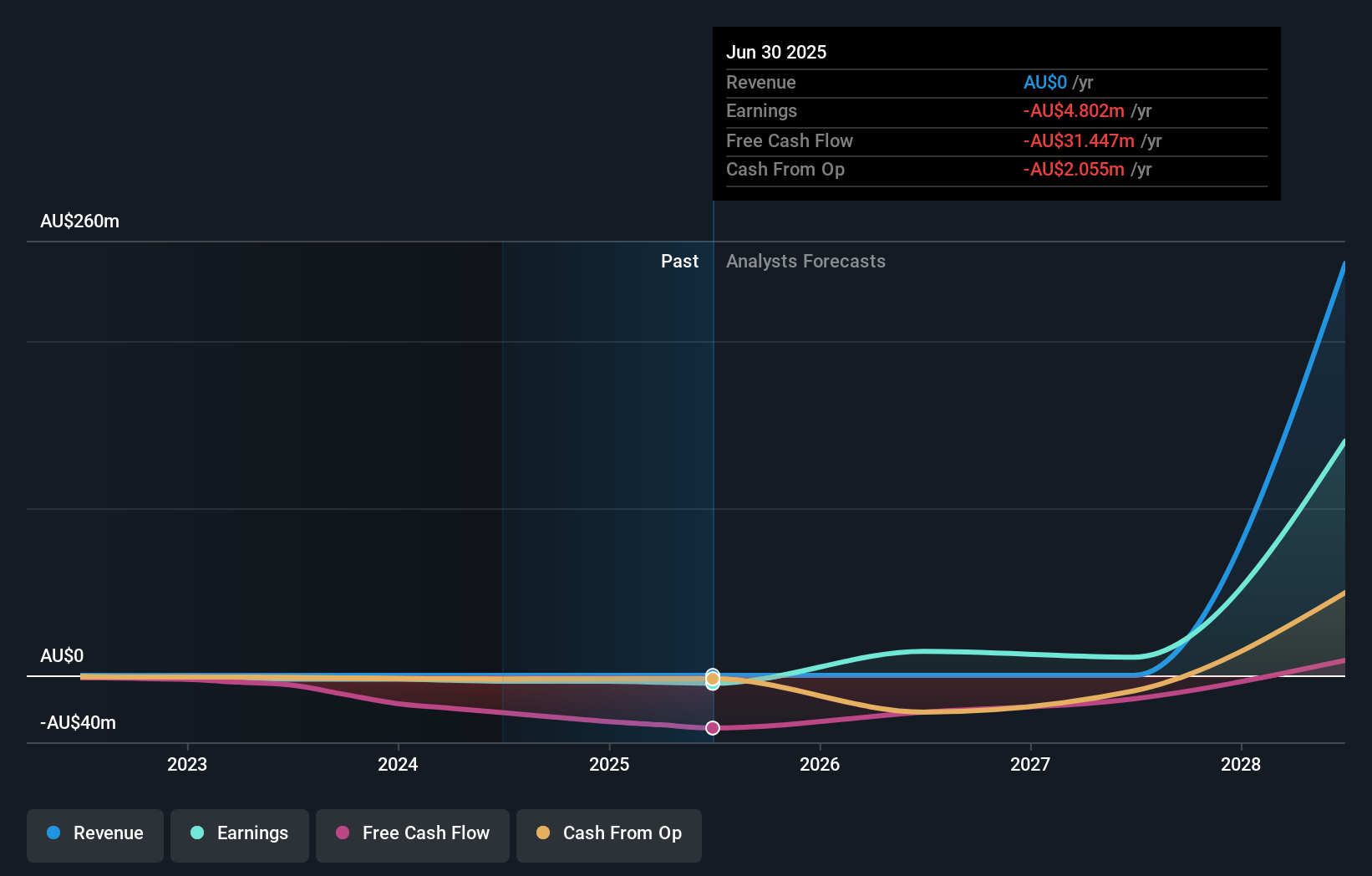

Overview: WA1 Resources Ltd focuses on the exploration and development of mineral resources in Western Australia and Northern Territory, with a market cap of A$1.12 billion.

Operations: The company does not currently report any revenue segments.

Insider Ownership: 20.4%

Revenue Growth Forecast: 120% p.a.

WA1 Resources, with significant insider ownership, is positioned for growth despite recent challenges. The company reported a net loss of A$4.8 million for the year ending June 2025 and completed a follow-on equity offering of A$100 million. Although current revenues are minimal, WA1's earnings are forecast to grow substantially over the next three years, potentially achieving profitability above market averages. However, no revenue is expected next year, indicating reliance on future strategic developments.

- Delve into the full analysis future growth report here for a deeper understanding of WA1 Resources.

- Our expertly prepared valuation report WA1 Resources implies its share price may be too high.

Seize The Opportunity

- Embark on your investment journey to our 110 Fast Growing ASX Companies With High Insider Ownership selection here.

- Searching for a Fresh Perspective? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SKS

SKS Technologies Group

Engages in the design, supply, and installation of audio visual, electrical, and communication products and services in Australia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives