Imagine Holding SECOS Group (ASX:SES) Shares While The Price Zoomed 409% Higher

It might be of some concern to shareholders to see the SECOS Group Limited (ASX:SES) share price down 18% in the last month. But over the last year the share price has taken off like one of Elon Musk's rockets. Few could complain about the impressive 409% rise, throughout the period. So it is not that surprising to see the stock retrace a little. Of course, winners often do keep winning, so there may be more gains to come (if the business fundamentals stack up).

See our latest analysis for SECOS Group

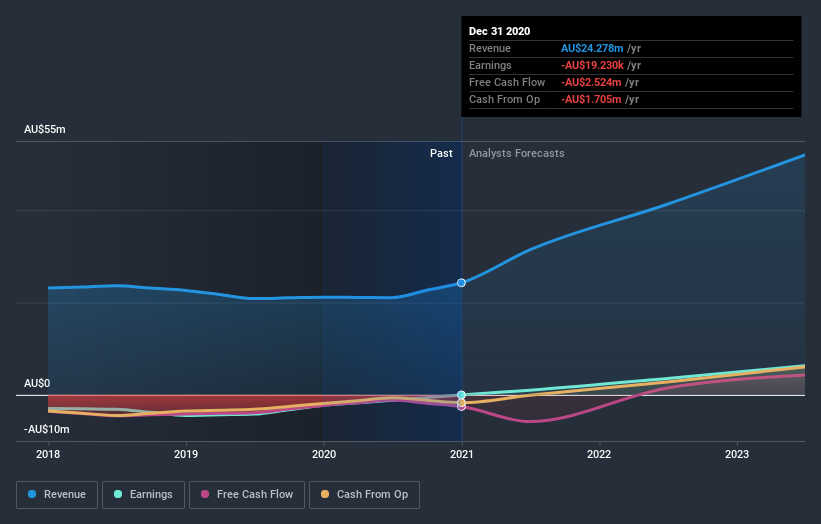

Given that SECOS Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year SECOS Group saw its revenue grow by 15%. We respect that sort of growth, no doubt. But the market is even more excited about it, with the price apparently bound for the moon, up 409% in one of earth's orbits. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on SECOS Group.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that SECOS Group shareholders have received a total shareholder return of 409% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 26% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for SECOS Group that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you decide to trade SECOS Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MCO

Myeco Group

Develops, manufactures, and sells sustainable packaging and materials in Oceanic, Asia, the United States, Europe, and Africa.

Adequate balance sheet with low risk.

Market Insights

Community Narratives