Sentiment Still Eluding Pro-Pac Packaging Limited (ASX:PPG)

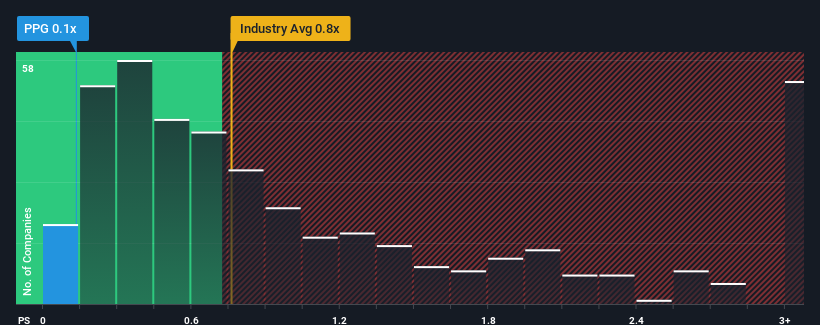

When close to half the companies operating in the Packaging industry in Australia have price-to-sales ratios (or "P/S") above 0.8x, you may consider Pro-Pac Packaging Limited (ASX:PPG) as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Pro-Pac Packaging

What Does Pro-Pac Packaging's P/S Mean For Shareholders?

Pro-Pac Packaging hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Pro-Pac Packaging's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Pro-Pac Packaging would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. This means it has also seen a slide in revenue over the longer-term as revenue is down 32% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 1.6% over the next year. Meanwhile, the rest of the industry is forecast to expand by 2.8%, which is not materially different.

With this information, we find it odd that Pro-Pac Packaging is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Pro-Pac Packaging's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Pro-Pac Packaging (1 makes us a bit uncomfortable!) that you need to be mindful of.

If you're unsure about the strength of Pro-Pac Packaging's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:PPG

Pro-Pac Packaging

Manufactures and distributes flexible and industrial packaging products in Australia and New Zealand.

Slight risk and slightly overvalued.

Market Insights

Community Narratives