- Australia

- /

- Metals and Mining

- /

- ASX:PLS

Pilbara Minerals (ASX:PLS): Assessing Valuation After 52-Week High on Lithium Market Strength

Reviewed by Simply Wall St

Pilbara Minerals (ASX:PLS) has surged to a new 52-week high as lithium prices rise and momentum builds among ASX-listed lithium peers. Investors are increasingly attentive to Pilbara’s growth, cost discipline, and balance sheet strength in this environment.

See our latest analysis for Pilbara Minerals.

Pilbara Minerals’ share price has soared nearly 90% year to date, with short-term momentum accelerating as a result of sector bullishness and renewed confidence in the lithium outlook. Over the past year, the total shareholder return stands at an impressive 49.6%, which reinforces the long-term growth narrative even after periods of volatility.

If Pilbara’s rapid ascent has you watching the sector closely, this is a perfect moment to discover fast growing stocks with high insider ownership

With shares near record highs and industry fundamentals looking strong, the key question for investors now is whether Pilbara Minerals still offers value at current levels, or if the market has already priced in much of its future growth potential.

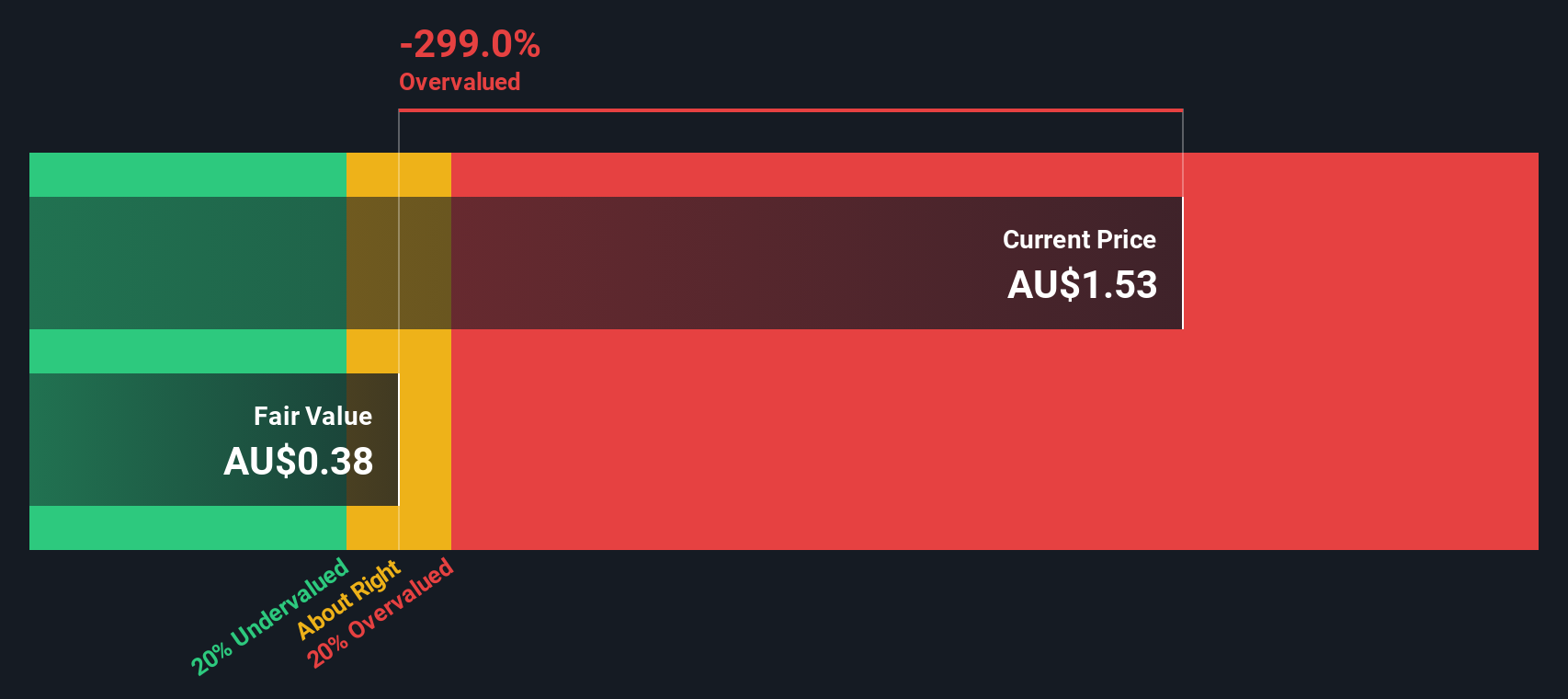

Most Popular Narrative: 45% Overvalued

With Pilbara Minerals’ last close at A$4.19 and the most popular fair value estimate at A$2.89, the market price stands well above what this widely followed narrative considers justified. This significant gap sets the stage for a closer look at the drivers behind analyst sentiment and what could be powering, and potentially tempering, further upside.

Pilbara Minerals has executed major production capacity expansions (for example, Pilgangoora P1000 and the world's largest lithium ore sorter), positioning the company to significantly increase output just as global electric vehicle (EV) adoption and energy storage penetration are expected to accelerate. This directly supports higher future revenues and operational leverage.

Want to know the growth blueprint behind this high valuation? This narrative depends on aggressive forecasts for Pilbara’s sales, profits, and a premium future earnings multiple usually seen in red-hot tech stocks. What bold financial leaps power this fair value? Dive in for the full breakdown—they may surprise you.

Result: Fair Value of $2.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent lithium price volatility or cost overruns in expansion projects could quickly undermine the positive outlook that currently drives the bullish narrative.

Find out about the key risks to this Pilbara Minerals narrative.

Another View: What Does the SWS DCF Model Suggest?

While the market’s favorite yardstick suggests Pilbara Minerals is richly valued, our SWS DCF model reaches an even starker conclusion. It values the company at just A$0.26 per share, which further reinforces an overvalued call. But are these models too conservative, or is the market ignoring risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pilbara Minerals Narrative

If you want to challenge these numbers or see the story through your own lens, it’s never been easier. Build your own narrative in just minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Pilbara Minerals.

Looking for more investment ideas?

Don't limit your portfolio to a single stock when potential game-changers are emerging every week. Now is the perfect moment to hunt for your next hidden winner using proven strategies.

- Capture reliable income by tapping into these 16 dividend stocks with yields > 3% with healthy yields and consistent payouts. This can help strengthen your returns.

- Spot the next breakthrough businesses by investigating these 26 quantum computing stocks at the forefront of tomorrow’s technology.

- Build long-term wealth by seizing opportunities among these 919 undervalued stocks based on cash flows trading below their intrinsic worth before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:PLS

Pilbara Minerals

Engages in the exploration, development, and operation of mineral resources in Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives