- Australia

- /

- Construction

- /

- ASX:SND

Discover 3 Promising ASX Penny Stocks Under A$200M Market Cap

Reviewed by Simply Wall St

As the Australian market navigates through the complexities of global trade tensions and a fluctuating commodities landscape, investors are keeping a close eye on opportunities that might arise amidst these shifts. Penny stocks, often representing smaller or newer companies, continue to capture interest due to their potential for unexpected growth. Despite being an older term in investment circles, these stocks can still offer intriguing prospects when backed by solid financial health and resilience.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$66.82M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$3.00 | A$247.9M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.535 | A$105.06M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.94 | A$322.38M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.90 | A$106.21M | ★★★★★★ |

| IVE Group (ASX:IGL) | A$2.20 | A$334.56M | ★★★★☆☆ |

| Centrepoint Alliance (ASX:CAF) | A$0.31 | A$61.65M | ★★★★★☆ |

| Nickel Industries (ASX:NIC) | A$0.745 | A$3.2B | ★★★★★☆ |

Click here to see the full list of 1,032 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Integrated Research (ASX:IRI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Integrated Research Limited designs, develops, implements, and sells systems and applications management computer software for business-critical computing, unified communication, and payment networks with a market cap of A$78.04 million.

Operations: The company generates revenue of A$83.29 million from its software and programming segment.

Market Cap: A$78.04M

Integrated Research Limited, with a market cap of A$78.04 million, recently achieved profitability, a significant milestone for a company in its segment. The firm generates revenue of A$83.29 million from its software and programming operations and maintains a debt-free balance sheet, which enhances financial stability. Its short-term assets comfortably cover both short- and long-term liabilities, reducing financial risk. However, the management team and board are relatively inexperienced with average tenures under two years. Despite trading at an attractive price-to-earnings ratio of 2.9x compared to the broader Australian market's 19.3x, earnings are forecast to decline over the next three years.

- Jump into the full analysis health report here for a deeper understanding of Integrated Research.

- Review our growth performance report to gain insights into Integrated Research's future.

OzAurum Resources (ASX:OZM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OzAurum Resources Limited is involved in the development and exploration of gold, lithium, and rare earth elements in Western Australia, with a market cap of A$10.32 million.

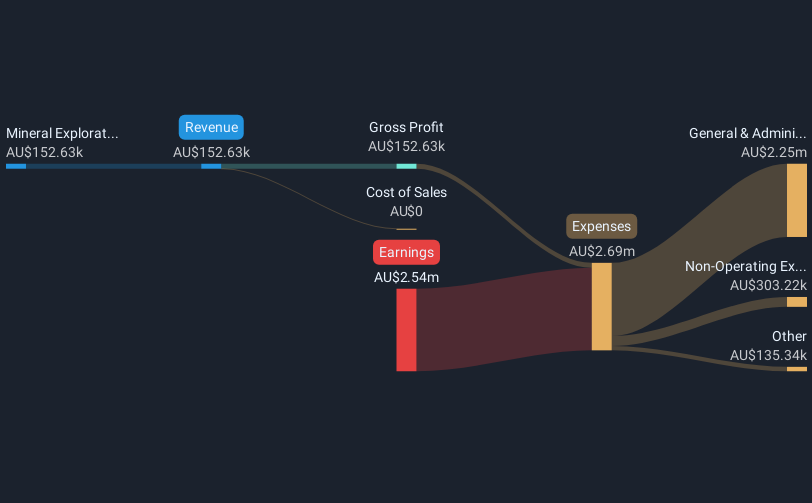

Operations: The company generates revenue primarily from its mineral exploration activities, amounting to A$0.15 million.

Market Cap: A$10.32M

OzAurum Resources Limited, with a market cap of A$10.32 million, is pre-revenue and focuses on gold, lithium, and rare earth exploration in Western Australia. The company remains debt-free and has short-term assets of A$1.2 million that exceed both its short- and long-term liabilities. Despite high volatility in share price over the past three months, OzAurum's recent capital raise bolsters its cash runway to six months. The addition of Jessica Fertig as an independent director brings valuable expertise in investor relations to the board following Andy Tudor's resignation, potentially enhancing strategic direction amidst ongoing exploration efforts.

- Click to explore a detailed breakdown of our findings in OzAurum Resources' financial health report.

- Review our historical performance report to gain insights into OzAurum Resources' track record.

Saunders International (ASX:SND)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Saunders International Limited, with a market cap of A$132.74 million, offers design, construction, fabrication, shutdown, maintenance, and industrial automation services for steel storage tanks and concrete bridges in Australia and the Pacific Region.

Operations: Saunders International generates revenue of A$216.08 million from its steel storage tanks, concrete bridges, and structural mechanical piping segments.

Market Cap: A$132.74M

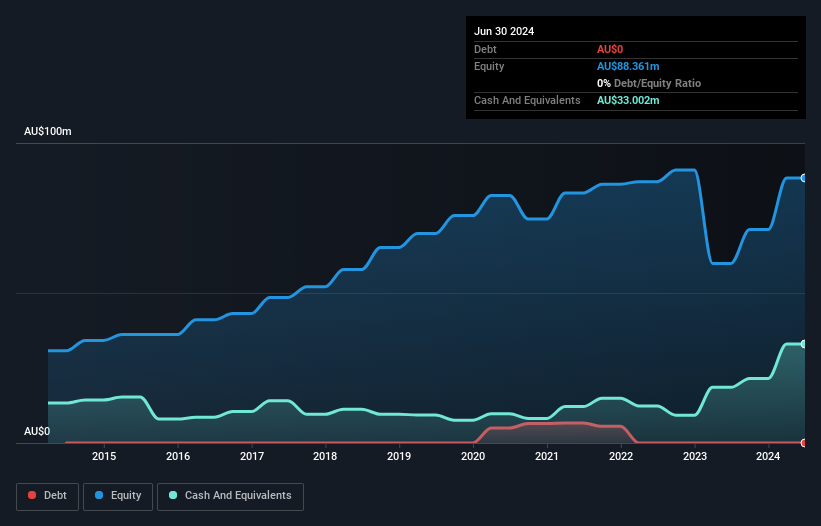

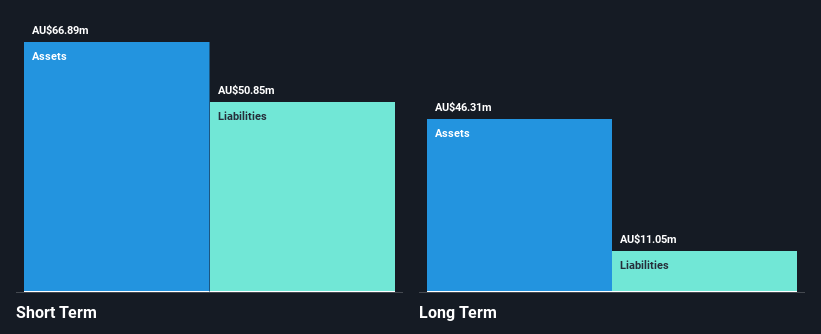

Saunders International Limited, with a market cap of A$132.74 million, has demonstrated financial stability with short-term assets of A$66.9 million surpassing both short- and long-term liabilities. The company is debt-free, reducing financial risk, and its earnings have grown significantly over the past five years despite recent negative growth. Trading at 60.1% below estimated fair value suggests potential undervaluation, though insider selling in the last quarter raises caution. While Saunders maintains high-quality earnings and an experienced board, its dividend history is unstable and return on equity remains low at 18.3%, indicating room for improvement in profitability metrics.

- Unlock comprehensive insights into our analysis of Saunders International stock in this financial health report.

- Examine Saunders International's past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Access the full spectrum of 1,032 ASX Penny Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SND

Saunders International

Provides design, construction, fabrication, shutdown, maintenance, and industrial automation services to organizations of steel storage tanks and concrete bridges in Australia and the Pacific Region.

Adequate balance sheet and fair value.

Market Insights

Community Narratives