Stock Analysis

High Insider Ownership Growth Companies On The ASX June 2024

Reviewed by Simply Wall St

Despite a generally downward trend in the ASX200 this week, with most sectors finishing in the red, there were notable exceptions in Consumer Discretionary and Healthcare sectors which experienced gains. This mixed market landscape sets an interesting stage for examining growth companies with high insider ownership on the ASX. In such a fluctuating market, companies with substantial insider ownership can be particularly compelling as these insiders often have a vested interest in the company’s long-term success, aligning their goals closely with those of external shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

| Cettire (ASX:CTT) | 28.7% | 30.1% |

| Gratifii (ASX:GTI) | 14.3% | 112.4% |

| Acrux (ASX:ACR) | 14.6% | 115.3% |

| Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

| Change Financial (ASX:CCA) | 26.6% | 85.4% |

| Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

| Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

Let's review some notable picks from our screened stocks.

Botanix Pharmaceuticals (ASX:BOT)

Simply Wall St Growth Rating: ★★★★★★

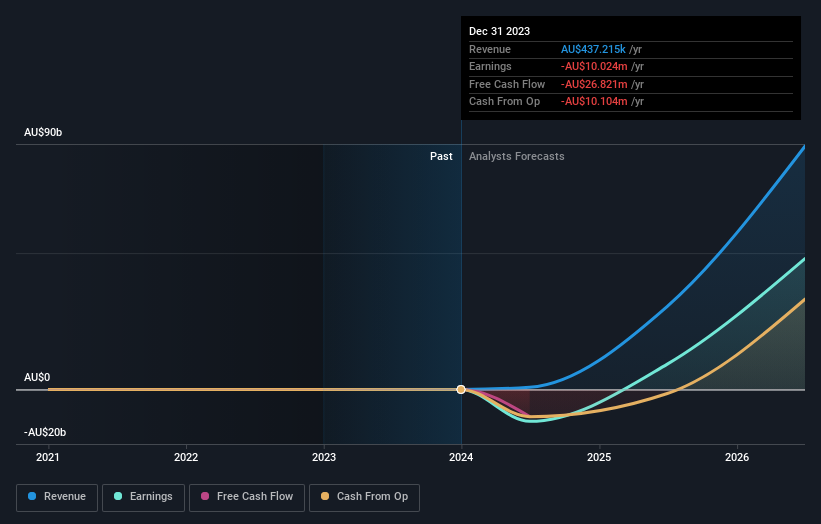

Overview: Botanix Pharmaceuticals Limited, based in Australia, focuses on the research and development of dermatology and antimicrobial products with a market capitalization of approximately A$519.80 million.

Operations: The company generates revenue primarily from its research and development activities in the dermatology and antimicrobial sectors, totaling A$0.44 million.

Insider Ownership: 11.4%

Botanix Pharmaceuticals, with less than A$1 million in revenue, is poised for significant growth. Despite recent shareholder dilution, the company is expected to become profitable within three years, driven by a forecasted annual revenue increase of 120.4%. However, its financial position shows less than one year of cash runway. Notably absent are insider trading activities over the past three months. A special call on May 6, 2024 discussed upcoming commercial launch plans for SofdraÔ as approval nears.

- Dive into the specifics of Botanix Pharmaceuticals here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Botanix Pharmaceuticals is trading beyond its estimated value.

Ora Banda Mining (ASX:OBM)

Simply Wall St Growth Rating: ★★★★★☆

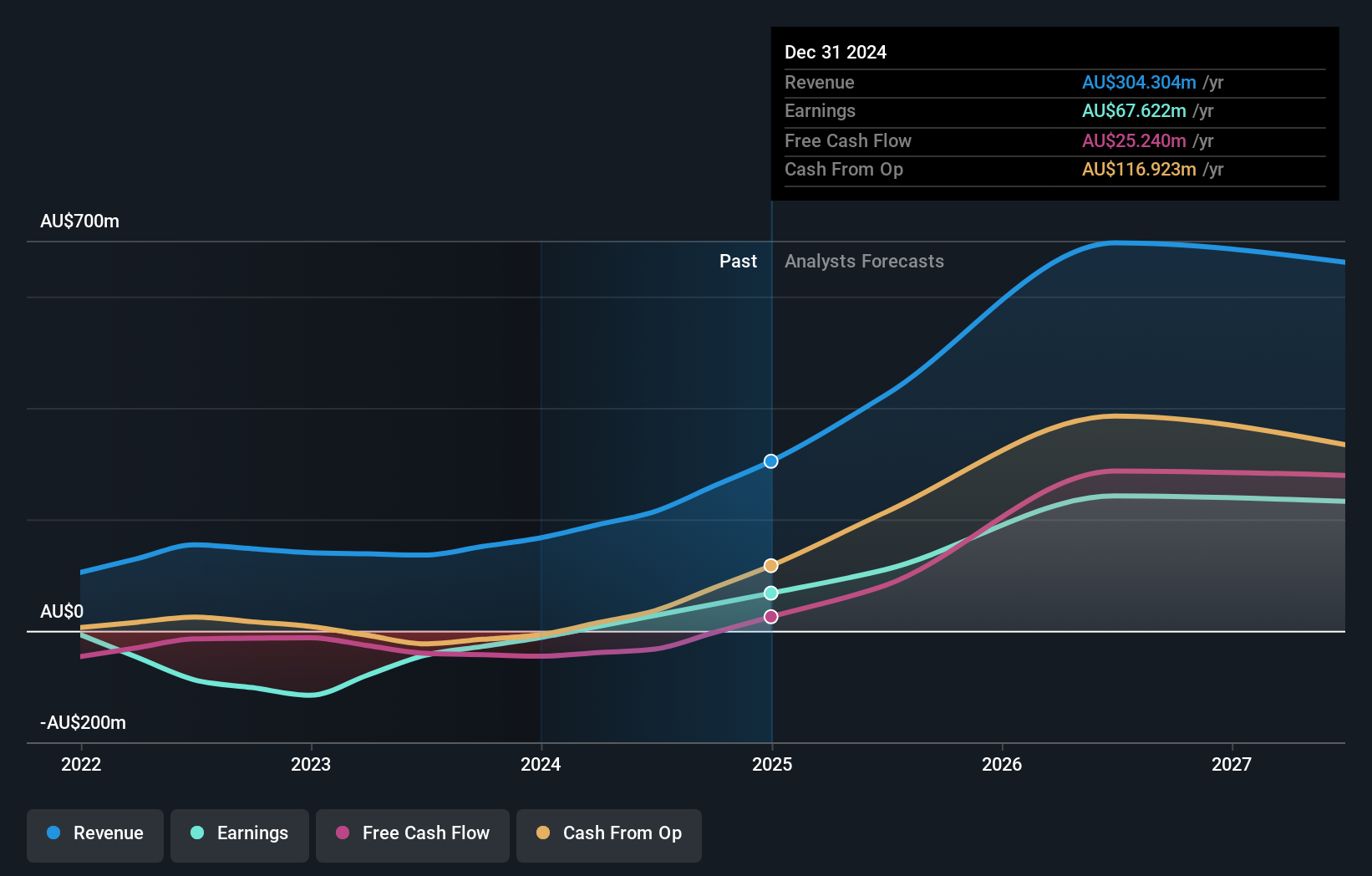

Overview: Ora Banda Mining Limited is an Australian company focused on the exploration, operation, and development of mineral properties, with a market capitalization of approximately A$705.51 million.

Operations: The company generates revenue primarily from gold mining activities, totaling A$166.66 million.

Insider Ownership: 10.2%

Ora Banda Mining is projected to achieve profitability within three years, supported by a significant expected annual revenue growth rate of 41.9%. Despite trading at 91.7% below its estimated fair value and experiencing shareholder dilution over the past year, the company's earnings are anticipated to grow by 93.57% annually. Recent activities include a presentation at the 121 Mining Investment London event on May 15, 2024, highlighting its ongoing development and market strategies.

- Delve into the full analysis future growth report here for a deeper understanding of Ora Banda Mining.

- The analysis detailed in our Ora Banda Mining valuation report hints at an deflated share price compared to its estimated value.

Vulcan Steel (ASX:VSL)

Simply Wall St Growth Rating: ★★★★☆☆

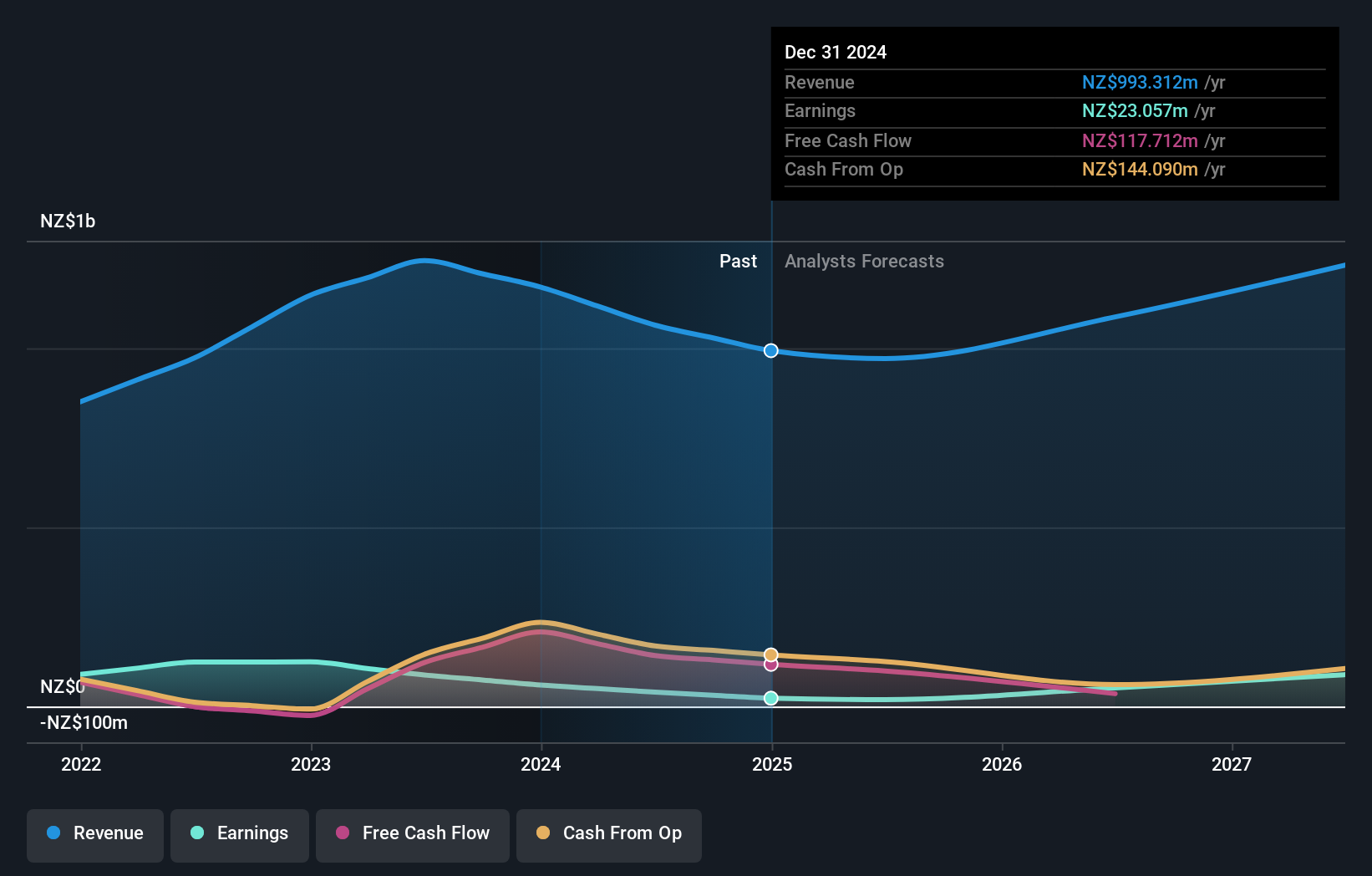

Overview: Vulcan Steel Limited operates in New Zealand and Australia, focusing on the sale and distribution of steel and metal products, with a market capitalization of approximately A$931.69 million.

Operations: The company generates revenue primarily through two segments: Metals, which brings in NZ$638.86 million, and Wholesale - Miscellaneous, contributing NZ$532.02 million.

Insider Ownership: 34.5%

Vulcan Steel, with its insider ownership, shows promise as a growth company in Australia. Its earnings are expected to increase by 25.9% annually over the next three years, outpacing the broader Australian market's forecast of 13.7%. However, challenges include a high debt level and slower revenue growth at 2.4% per year compared to the market average of 5.4%. Additionally, its profit margins have declined from last year's 10.8% to the current 5.1%.

- Click here and access our complete growth analysis report to understand the dynamics of Vulcan Steel.

- Our valuation report here indicates Vulcan Steel may be overvalued.

Taking Advantage

- Explore the 90 names from our Fast Growing ASX Companies With High Insider Ownership screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Botanix Pharmaceuticals is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BOT

Botanix Pharmaceuticals

Engages in the research and development of dermatology and antimicrobial products in Australia.

Exceptional growth potential with adequate balance sheet.