- Australia

- /

- Metals and Mining

- /

- ASX:NST

Consider These Factors, Then Buy Northern Star Resources Limited (ASX:NST)

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

When everything is going down, the best mindset to have is a long term one. Longstanding stocks such as Northern Star Resources Limited has fared well over time in a volatile stock market, which is why it’s my top pick to invest in. Below I take a look at three key characteristics of what makes a strong defensive stock investment: its size, financial health and track record.

Check out our latest analysis for Northern Star Resources

Northern Star Resources Limited engages in the exploration, development, mining, processing, and sale of gold deposits in Australia. Founded in 2000, and run by CEO Stuart Tonkin, the company employs 1.21k people and with the company's market capitalisation at AU$6.3b, we can put it in the mid-cap category. Typically, large companies are well-established and highly resourced, meaning that stock market volatility may impact some short-term strategic decisions but unlikely to matter in the long run. Therefore, large-cap stocks are a safe bet to buy more of when the general market is selling off.

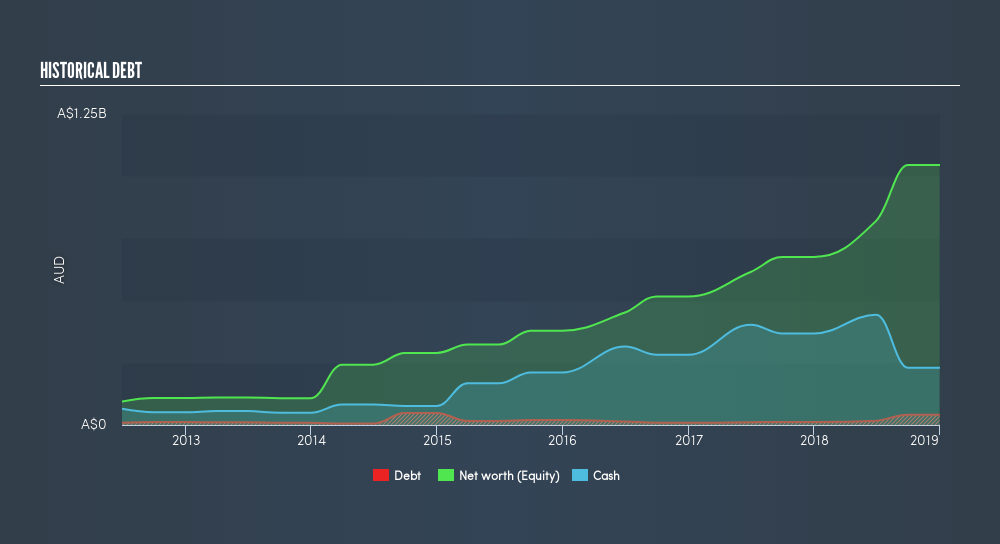

Currently Northern Star Resources has AU$42m on its balance sheet, which requires regular interest payments. This requires the business to have enough cash to meet these upcoming interest expenses. Northern Star Resources generates enough earnings to cover its interest payments, however its interest expenses are already well-covered by its interest income. Furthermore, its operating cash flows amply covers its total debt by over 2x, much higher than the safe minimum of 0.2x. Not to mention, it meets the basic liquidity requirement with current assets exceeding liabilities, which further builds on its financial strength in the face of a volatile market.

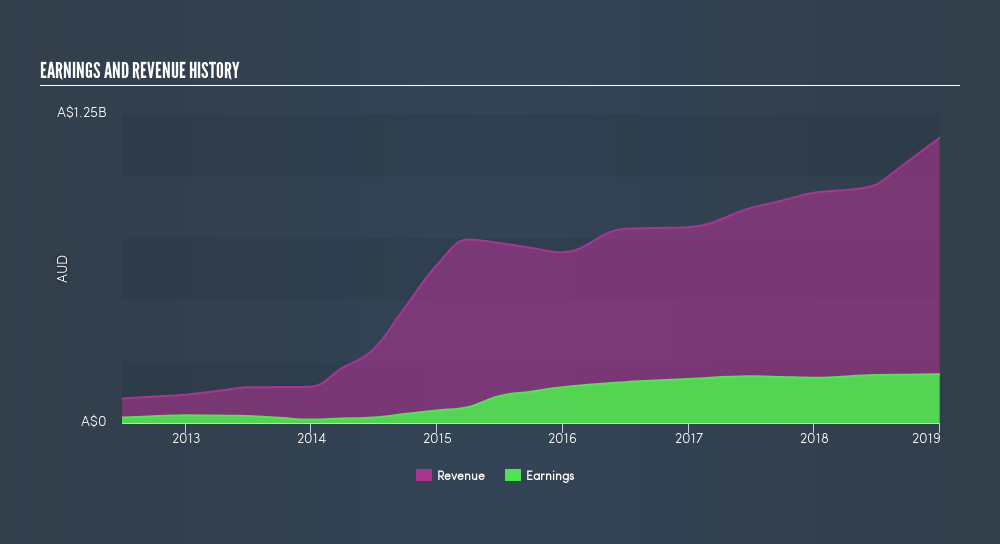

NST’s profit growth over the previous five years has been positive, with an average annual rate of 33%, beating the market growth rate of 19%. It has also returned an ROE of 19% recently, above the industry return of 14%. This consistent market outperformance illustrates a robust track record of delivering strong returns over a number of years, increasing my conviction in Northern Star Resources as an investment over the long run.

Next Steps:

Northern Star Resources makes for a robust long-term investment based on its scale, financial health and track record. Remember, in bear markets, sell-offs can be unjustified. Ask yourself, has anything really changed with Northern Star Resources? If not, then why not scoop it up at a discount? Lining your portfolio with a few well-established companies can reduce your risk and help you scale your wealth in the long run. One thing you should remember though, is to do your homework. Do your own research, come up with your point of view. Below is a list I've put together of other things you should consider before you buy:- Future Outlook: What are well-informed industry analysts predicting for NST’s future growth? Take a look at our free research report of analyst consensus for NST’s outlook.

- Valuation: What is NST worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether NST is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:NST

Northern Star Resources

Engages in the exploration, development, mining, and processing of gold deposits.

Adequate balance sheet average dividend payer.