- Australia

- /

- Metals and Mining

- /

- ASX:MRC

Returns On Capital At Mineral Commodities (ASX:MRC) Paint An Interesting Picture

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. In light of that, when we looked at Mineral Commodities (ASX:MRC) and its ROCE trend, we weren't exactly thrilled.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Mineral Commodities is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = US$10m ÷ (US$92m - US$38m) (Based on the trailing twelve months to June 2020).

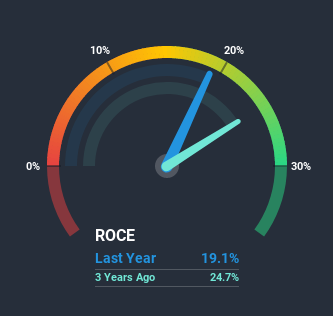

Therefore, Mineral Commodities has an ROCE of 19%. In absolute terms, that's a satisfactory return, but compared to the Metals and Mining industry average of 9.5% it's much better.

View our latest analysis for Mineral Commodities

Above you can see how the current ROCE for Mineral Commodities compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Mineral Commodities.

The Trend Of ROCE

We weren't thrilled with the trend because Mineral Commodities' ROCE has reduced by 23% over the last five years, while the business employed 58% more capital. That being said, Mineral Commodities raised some capital prior to their latest results being released, so that could partly explain the increase in capital employed. It's unlikely that all of the funds raised have been put to work yet, so as a consequence Mineral Commodities might not have received a full period of earnings contribution from it.

While on the subject, we noticed that the ratio of current liabilities to total assets has risen to 41%, which has impacted the ROCE. If current liabilities hadn't increased as much as they did, the ROCE could actually be even lower. And with current liabilities at these levels, suppliers or short-term creditors are effectively funding a large part of the business, which can introduce some risks.What We Can Learn From Mineral Commodities' ROCE

In summary, we're somewhat concerned by Mineral Commodities' diminishing returns on increasing amounts of capital. Since the stock has skyrocketed 375% over the last five years, it looks like investors have high expectations of the stock. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 5 warning signs for Mineral Commodities (of which 2 can't be ignored!) that you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

When trading Mineral Commodities or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:MRC

Mineral Commodities

Operates as a mining and development company with a primary focus on the development of mineral deposits within the industrial and battery minerals sectors.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives