Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Mineral Commodities Ltd (ASX:MRC) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Mineral Commodities

What Is Mineral Commodities's Debt?

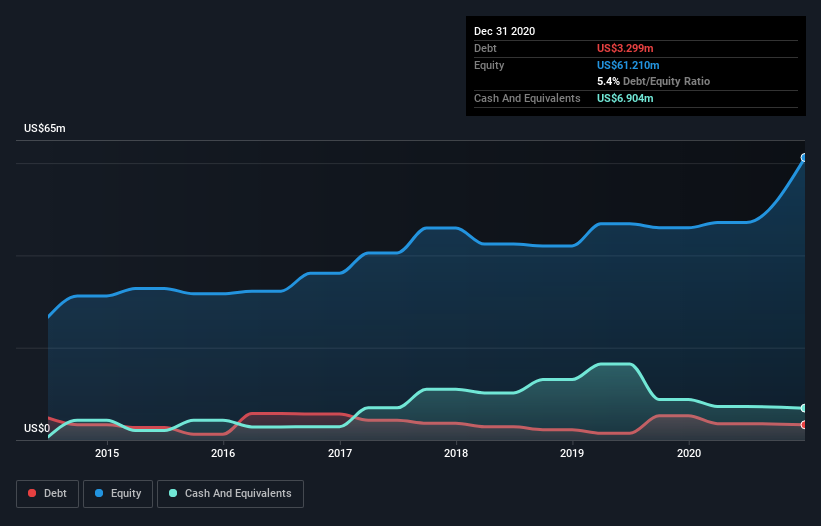

The image below, which you can click on for greater detail, shows that Mineral Commodities had debt of US$3.30m at the end of December 2020, a reduction from US$5.24m over a year. However, its balance sheet shows it holds US$6.90m in cash, so it actually has US$3.61m net cash.

How Strong Is Mineral Commodities' Balance Sheet?

The latest balance sheet data shows that Mineral Commodities had liabilities of US$14.0m due within a year, and liabilities of US$10.5m falling due after that. Offsetting this, it had US$6.90m in cash and US$13.4m in receivables that were due within 12 months. So its liabilities total US$4.18m more than the combination of its cash and short-term receivables.

Since publicly traded Mineral Commodities shares are worth a total of US$77.2m, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Mineral Commodities boasts net cash, so it's fair to say it does not have a heavy debt load!

Another good sign is that Mineral Commodities has been able to increase its EBIT by 23% in twelve months, making it easier to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Mineral Commodities's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Mineral Commodities has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, Mineral Commodities's free cash flow amounted to 27% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Mineral Commodities has US$3.61m in net cash. And we liked the look of last year's 23% year-on-year EBIT growth. So is Mineral Commodities's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Mineral Commodities (of which 1 is concerning!) you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Mineral Commodities or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:MRC

Mineral Commodities

Operates as a mining and development company with a primary focus on the development of mineral deposits within the industrial and battery minerals sectors.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives