- Australia

- /

- Metals and Mining

- /

- ASX:MIN

3 ASX Growth Companies With Insider Ownership Up To 22%

Reviewed by Simply Wall St

The Australian market is on the cusp of another record high, buoyed by strong performances in global indices and robust commodity prices, particularly in iron ore and precious metals. In this thriving environment, identifying growth companies with significant insider ownership can be a strategic move for investors looking to align with those who have a vested interest in their company's success.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Catalyst Metals (ASX:CYL) | 17% | 54.5% |

| Genmin (ASX:GEN) | 12% | 117.7% |

| AVA Risk Group (ASX:AVA) | 15.7% | 118.8% |

| Pointerra (ASX:3DP) | 18.7% | 126.4% |

| Liontown Resources (ASX:LTR) | 16.4% | 69.4% |

| Hillgrove Resources (ASX:HGO) | 10.4% | 70.9% |

| Acrux (ASX:ACR) | 17.4% | 91.6% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

Let's dive into some prime choices out of the screener.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★★

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and internationally with a market cap of A$715.98 million.

Operations: The company's revenue primarily comes from the biopharmaceutical sector, amounting to A$88.18 million.

Insider Ownership: 10.4%

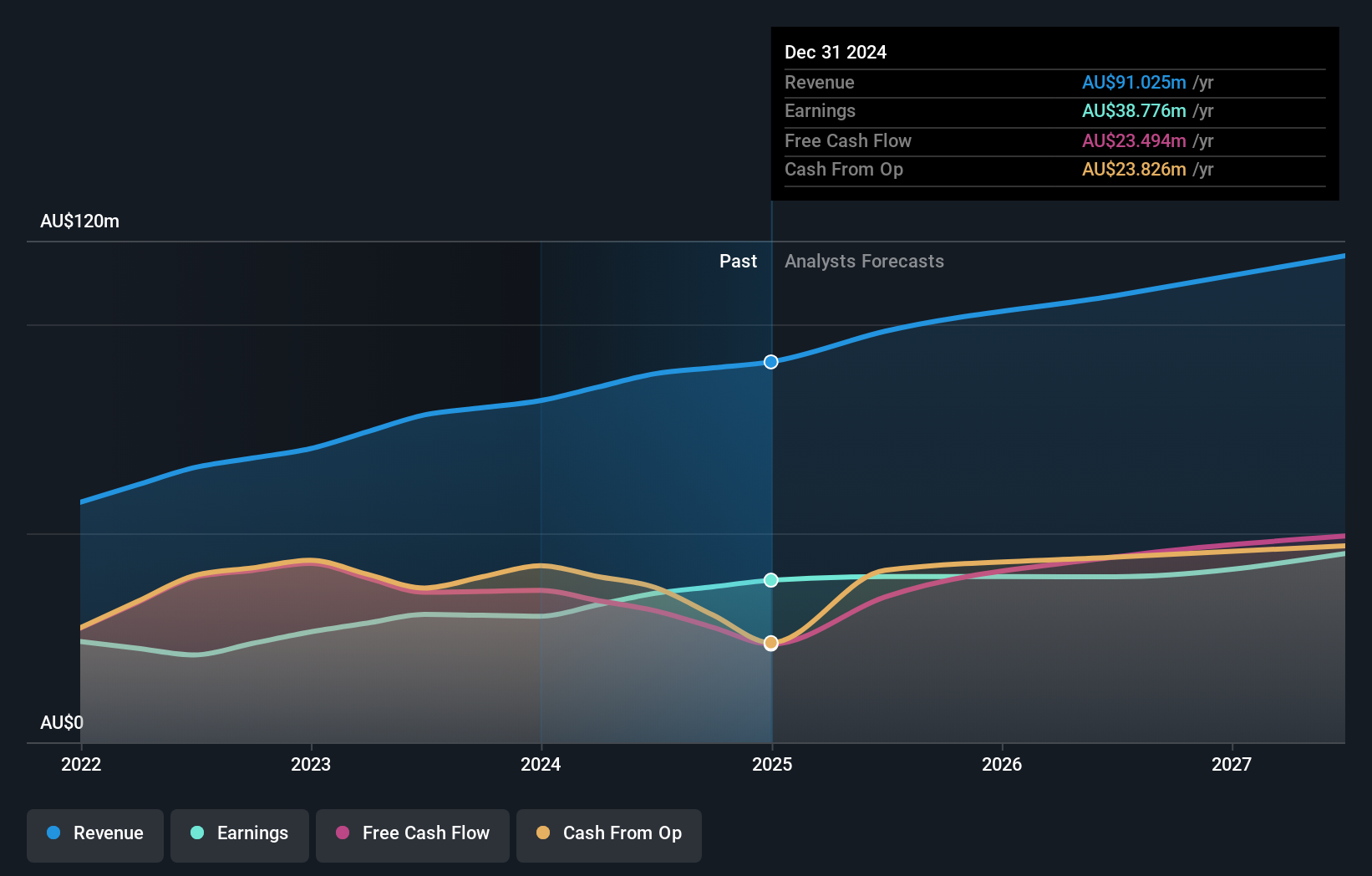

Clinuvel Pharmaceuticals, a growth company with high insider ownership, has reported substantial revenue and earnings growth, with revenues reaching A$95.31 million and net income of A$35.64 million for FY2024. The company is actively seeking M&A opportunities and has recently appointed three new non-executive directors to its board. Clinuvel's earnings are forecast to grow at 27.42% per year, significantly outpacing the Australian market average of 12.2%.

- Take a closer look at Clinuvel Pharmaceuticals' potential here in our earnings growth report.

- Our expertly prepared valuation report Clinuvel Pharmaceuticals implies its share price may be lower than expected.

Develop Global (ASX:DVP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Develop Global Limited, with a market cap of A$590.94 million, engages in the exploration and development of mineral resource properties in Australia through its subsidiaries.

Operations: Revenue Segments (in millions of A$): Develop Global generates revenue primarily from its Mining Services segment, which accounts for A$109.75 million.

Insider Ownership: 22.6%

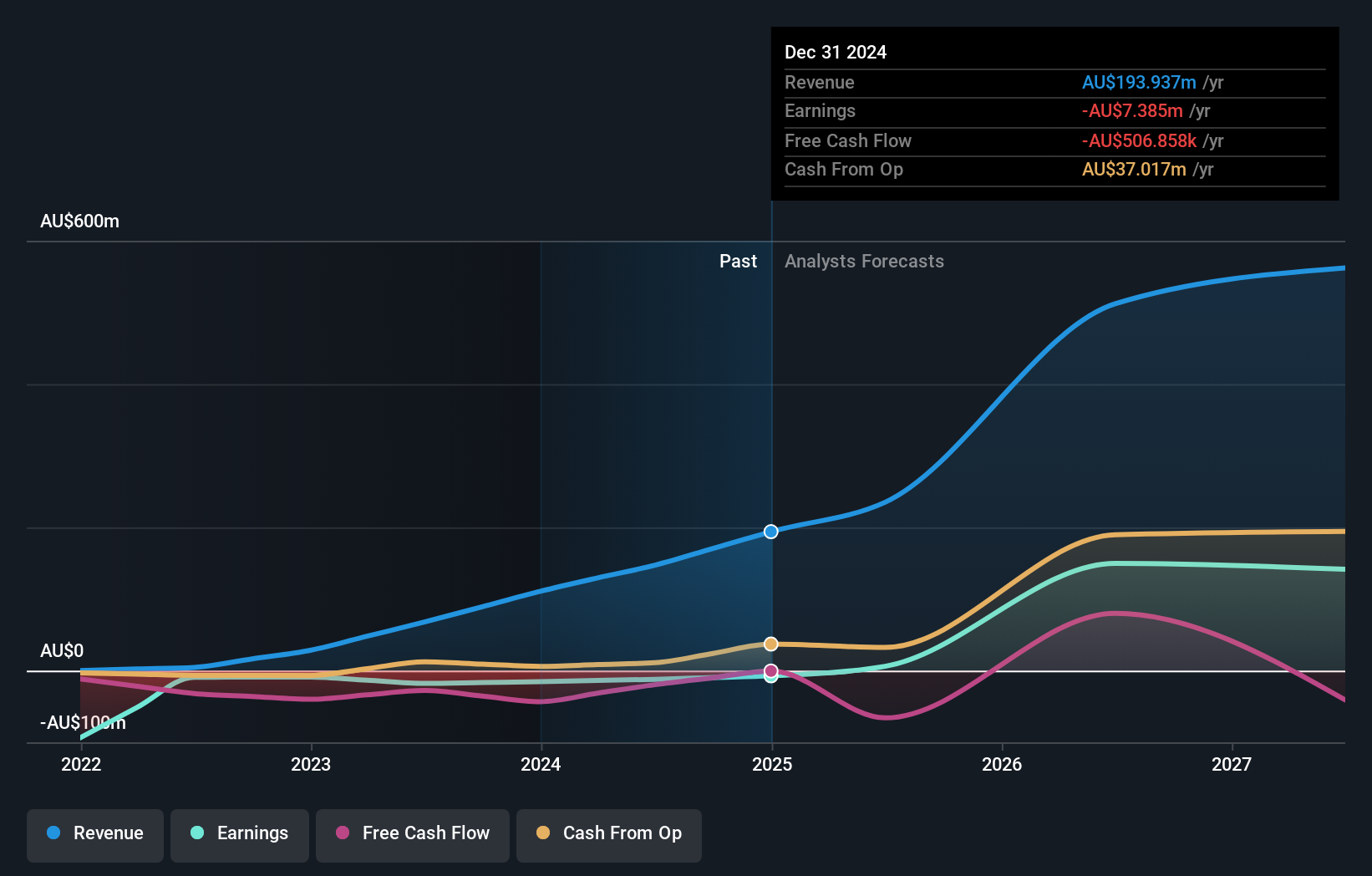

Develop Global reported significant revenue growth, with sales reaching A$147.23 million for FY2024, up from A$67.76 million the previous year. Despite a net loss of A$11.96 million, this marks an improvement from the prior year's loss of A$17.89 million. The company is forecast to achieve annual earnings growth of 132.8% and revenue growth of 57.5%, both well above market averages, though recent shareholder dilution and low forecasted return on equity (13.1%) are concerns.

- Navigate through the intricacies of Develop Global with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Develop Global is trading behind its estimated value.

Mineral Resources (ASX:MIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mineral Resources Limited, with a market cap of A$8.41 billion, operates as a mining services company in Australia, Asia, and internationally through its subsidiaries.

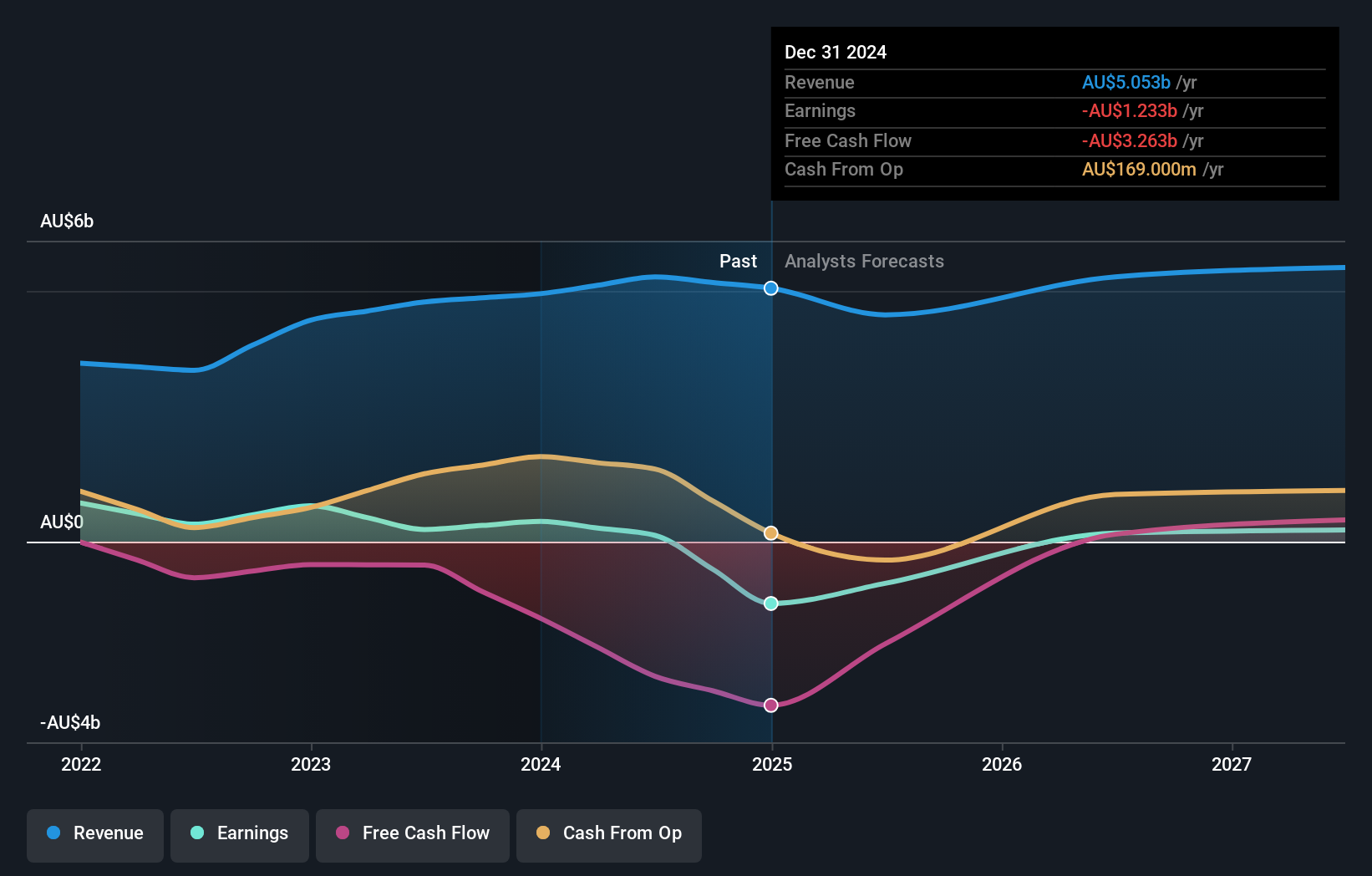

Operations: The company's revenue segments include Energy (A$16 million), Lithium (A$1.41 billion), Iron Ore (A$2.58 billion), and Mining Services (A$3.38 billion).

Insider Ownership: 11.7%

Mineral Resources Limited reported FY2024 sales of A$5.28 billion, up from A$4.78 billion the previous year, though net income dropped to A$125 million from A$243 million. Despite this, the company is forecasted to achieve annual earnings growth of 38.3%, significantly outpacing the Australian market's average. Insider activity shows more buying than selling recently, indicating confidence in future prospects despite lower profit margins and interest coverage concerns.

- Get an in-depth perspective on Mineral Resources' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Mineral Resources' share price might be too optimistic.

Summing It All Up

- Investigate our full lineup of 101 Fast Growing ASX Companies With High Insider Ownership right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:MIN

Mineral Resources

Together with subsidiaries, operates as a mining services company in Australia, Asia, and internationally.

Reasonable growth potential low.