- Australia

- /

- Metals and Mining

- /

- ASX:KRR

If You Had Bought King River Resources (ASX:KRR) Shares Three Years Ago You'd Have Made 680%

For us, stock picking is in large part the hunt for the truly magnificent stocks. You won't get it right every time, but when you do, the returns can be truly splendid. One such superstar is King River Resources Limited (ASX:KRR), which saw its share price soar 680% in three years. On top of that, the share price is up 95% in about a quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for King River Resources

With just AU$3,358 worth of revenue in twelve months, we don't think the market considers King River Resources to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that King River Resources finds some valuable resources, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. King River Resources has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

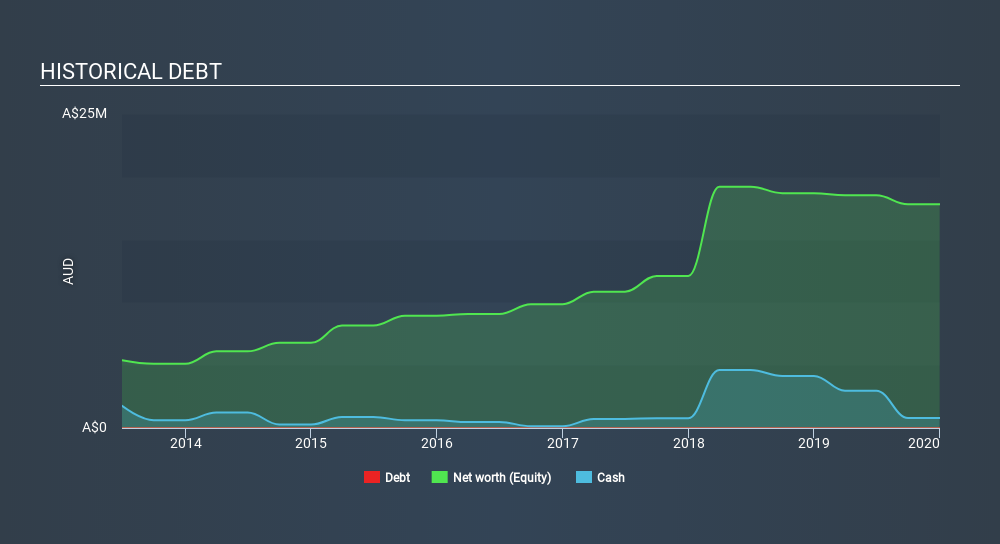

When it reported in December 2019 King River Resources had minimal cash in excess of all liabilities consider its expenditure: just AU$495k to be specific. So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. Given how low on cash it got, investors must really like its potential for the share price to be up 35% per year, over 3 years. You can see in the image below, how King River Resources's cash levels have changed over time (click to see the values).

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. However you can take a look at whether insiders have been buying up shares. It's usually a positive if they have, as it may indicate they see value in the stock. You can click here to see if there are insiders buying.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between King River Resources's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. King River Resources hasn't been paying dividends, but its TSR of 680% exceeds its share price return of 680%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that King River Resources shareholders have received a total shareholder return of 63% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 5.7% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 7 warning signs we've spotted with King River Resources (including 3 which is can't be ignored) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:KRR

King River Resources

Engages in the exploration and development of mineral resources in Australia.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)