- Australia

- /

- Metals and Mining

- /

- ASX:JRV

There's No Escaping Jervois Global Limited's (ASX:JRV) Muted Revenues Despite A 27% Share Price Rise

Jervois Global Limited (ASX:JRV) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 59% share price drop in the last twelve months.

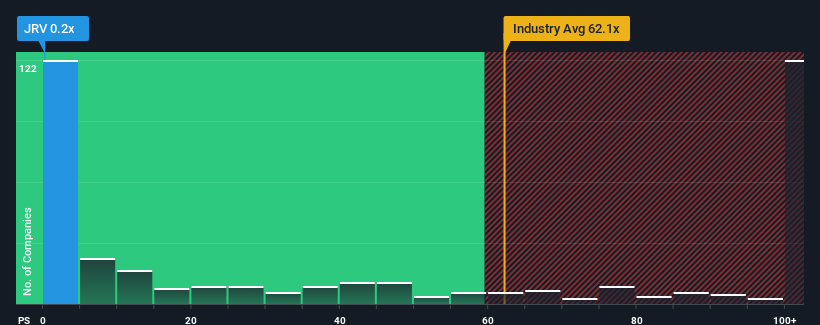

In spite of the firm bounce in price, Jervois Global may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 62.1x and even P/S higher than 362x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Jervois Global

What Does Jervois Global's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Jervois Global over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Jervois Global, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Jervois Global?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Jervois Global's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 281% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Jervois Global is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Jervois Global's P/S

Shares in Jervois Global have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Jervois Global revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you settle on your opinion, we've discovered 4 warning signs for Jervois Global (3 can't be ignored!) that you should be aware of.

If you're unsure about the strength of Jervois Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:JRV

Jervois Global

Engages in the exploration, development, and production of mineral properties.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives