- Australia

- /

- Metals and Mining

- /

- ASX:JRV

There Is A Reason Jervois Global Limited's (ASX:JRV) Price Is Undemanding

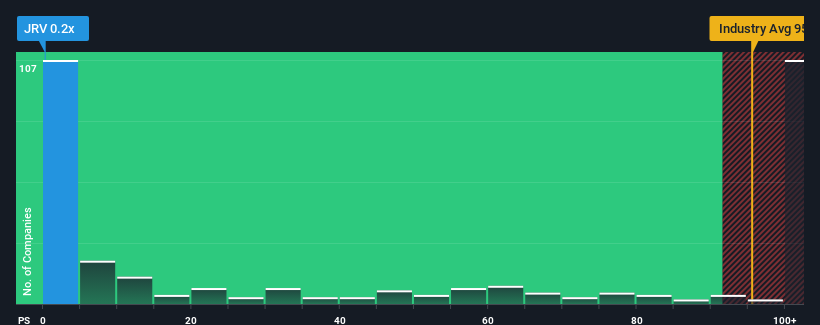

Jervois Global Limited's (ASX:JRV) price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the Metals and Mining industry in Australia, where around half of the companies have P/S ratios above 95.5x and even P/S above 527x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Jervois Global

What Does Jervois Global's Recent Performance Look Like?

Jervois Global could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Jervois Global will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Jervois Global would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 22% as estimated by the three analysts watching the company. Meanwhile, the broader industry is forecast to expand by 29%, which paints a poor picture.

With this information, we are not surprised that Jervois Global is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Jervois Global's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. As other companies in the industry are forecasting revenue growth, Jervois Global's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Jervois Global you should know about.

If you're unsure about the strength of Jervois Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:JRV

Jervois Global

Engages in the exploration, development, and production of mineral properties.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives