- Australia

- /

- Metals and Mining

- /

- ASX:IPX

IperionX (ASX:IPX) Valuation in Focus After Titanium Production Boost and Strategic U.S. Defense Backing

Reviewed by Simply Wall St

If you have been tracking IperionX (ASX:IPX), there is a good reason to take notice right now. The company has just announced a big step forward in its titanium business, confirming a 60% increase in annual powder production capacity and a meaningful drop in projected unit costs thanks to operational upgrades and process innovations. In addition, IperionX has secured substantial U.S. Department of Defense funding, which is set to help underwrite an ambitious expansion. With proven technology and government support, these moves appear likely to reinforce IperionX’s strategic place in the American titanium supply chain and could reshape how investors view its growth path.

Momentum has certainly picked up for IperionX in recent months. The stock has seen significant share price gains over the past three months and a dramatic upswing in the past year, suggesting that investor confidence is building. The company has combined strong annual revenue and profit growth rates with a series of high-profile client and government announcements, marking a real shift from its early days as a speculative bet. Backed by contracts, capital, and technology, IperionX is now scaling operations and seeking a cost edge in titanium manufacturing.

So the big question for investors is whether, after this sharp re-rating, IperionX is still a bargain with more upside, or if the market has already priced in all the good news.

Price-to-Book of 14x: Is it justified?

Compared to its peers and the broader Australian Metals and Mining sector, IperionX currently trades at a price-to-book (P/B) multiple of 14 times. This is dramatically higher than the industry average of 1.7 times and the peer group average of 4.5 times. This suggests that the stock is priced at a significant premium relative to the tangible assets on its balance sheet.

The price-to-book ratio is a commonly used metric in the mining and materials sector, as it compares a company’s market value to its book value. A higher P/B ratio can indicate that investors expect robust growth or believe the firm’s assets are significantly undervalued. It can also mean that the stock is overvalued if the expectations are not met by future performance.

Given IperionX’s high P/B multiple, the market appears to be highly optimistic about its future revenue potential, technology edge, or strategic positioning. However, with current profitability still negative and many operational milestones ahead, investors will need to keep a close eye on whether these lofty valuations can be supported by sustained business progress.

Result: Fair Value of A$83.53 (UNDERVALUED)

See our latest analysis for IperionX.However, challenges remain, including IperionX's negative net income and the potential for volatility if operational milestones are not met as expected.

Find out about the key risks to this IperionX narrative.Another View: DCF Model Suggests Upside

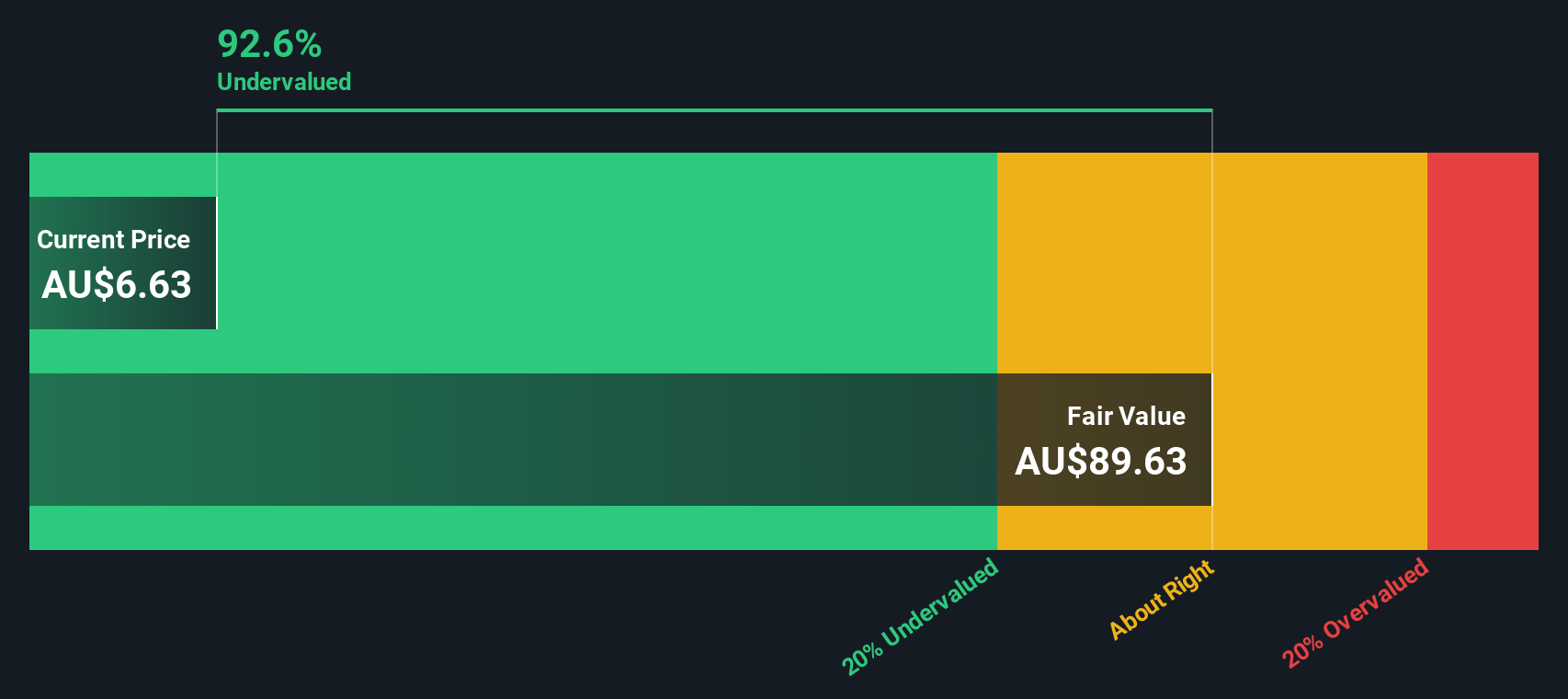

Looking at IperionX through the lens of our DCF model offers a different angle. This method suggests the shares could be significantly undervalued by the market. This raises questions about which approach gets closer to reality.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own IperionX Narrative

If these conclusions don’t fit with your perspective or you trust your own analysis, you can develop your personal take on IperionX in just a few minutes, and Do it your way.

A great starting point for your IperionX research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

Take your investing strategy to the next level with dynamic stock ideas tailored to your interests. Act now and unlock opportunities that others might miss.

- Uncover opportunities in fast-growing healthcare technology with insights from our healthcare AI stocks.

- Set your sights on long-term returns by seeking out companies delivering strong, reliable income through dividend stocks with yields > 3%.

- Tap into the next generation of innovation with forward-thinking businesses in the quantum computing space, featured in our quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ASX:IPX

IperionX

Engages in the development of its mineral properties in the United States.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives