- Australia

- /

- Metals and Mining

- /

- ASX:HAW

Have Hawthorn Resources Limited (ASX:HAW) Insiders Been Selling Their Stock?

We'd be surprised if Hawthorn Resources Limited (ASX:HAW) shareholders haven't noticed that the MD, CEO & Director, Mark Kerr, recently sold AU$157k worth of stock at AU$0.12 per share. The eyebrow raising move amounted to a reduction of 18% in their holding.

See our latest analysis for Hawthorn Resources

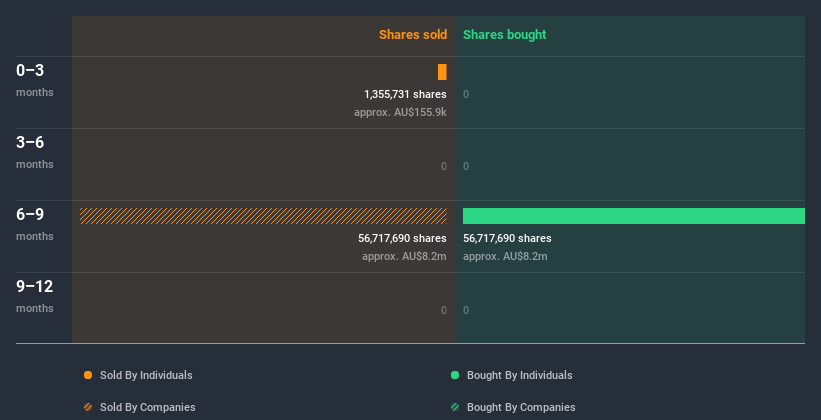

Hawthorn Resources Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by Non Executive Director Christopher Corrigan for AU$8.4m worth of shares, at about AU$0.15 per share. That means that an insider was happy to buy shares at above the current price of AU$0.11. Their view may have changed since then, but at least it shows they felt optimistic at the time. To us, it's very important to consider the price insiders pay for shares. As a general rule, we feel more positive about a stock when an insider has bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price. Christopher Corrigan was the only individual insider to buy during the last year.

You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Does Hawthorn Resources Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. It appears that Hawthorn Resources insiders own 28% of the company, worth about AU$10m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Do The Hawthorn Resources Insider Transactions Indicate?

An insider sold Hawthorn Resources shares recently, but they didn't buy any. But we take heart from prior transactions. It's good to see insiders are shareholders. So we're not overly bothered by recent selling. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Case in point: We've spotted 5 warning signs for Hawthorn Resources you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Hawthorn Resources, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hawthorn Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:HAW

Hawthorn Resources

Engages in the exploration and development of mineral resources in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.