- Australia

- /

- Metals and Mining

- /

- ASX:GMD

Genesis Minerals Limited (ASX:GMD) Held Back By Insufficient Growth Even After Shares Climb 27%

Genesis Minerals Limited (ASX:GMD) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 104% following the latest surge, making investors sit up and take notice.

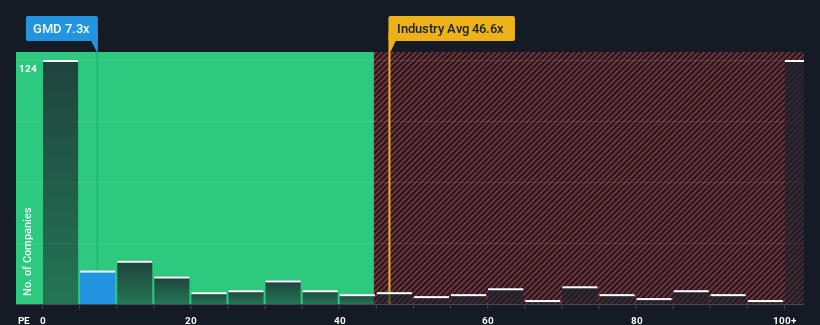

Although its price has surged higher, Genesis Minerals' price-to-sales (or "P/S") ratio of 7.8x might still make it look like a strong buy right now compared to the wider Metals and Mining industry in Australia, where around half of the companies have P/S ratios above 45.8x and even P/S above 328x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Genesis Minerals

What Does Genesis Minerals' Recent Performance Look Like?

Genesis Minerals could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Genesis Minerals' future stacks up against the industry? In that case, our free report is a great place to start .How Is Genesis Minerals' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Genesis Minerals' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 125% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 28% per year during the coming three years according to the nine analysts following the company. With the industry predicted to deliver 89% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Genesis Minerals' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Genesis Minerals' P/S

Shares in Genesis Minerals have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Genesis Minerals maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Genesis Minerals with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:GMD

Genesis Minerals

Engages in the gold mining, project development and exploration activities in Western Australia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives