The Australian market is enjoying a positive boost, with shares heading higher following strong earnings from Nvidia, which has set an optimistic tone for the day. For investors looking beyond the major players, penny stocks—often representing smaller or newer companies—can offer intriguing opportunities despite their somewhat outdated label. These stocks may present hidden value and potential growth when backed by solid financials and fundamentals; in this article, we explore three such ASX-listed penny stocks that stand out as promising investment prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.39 | A$112.74M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.82 | A$51.06M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$444.16M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.61 | A$266.44M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.49 | A$57.86M | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.77 | A$368.39M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.13 | A$1.3B | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.38 | A$132.2M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.38 | A$624.51M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 411 stocks from our ASX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AnteoTech (ASX:ADO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AnteoTech Limited is engaged in the development, manufacturing, commercialization, and distribution of products for clean energy technology and life science markets across Australia, Asia, Europe, and North America with a market cap of A$51.82 million.

Operations: AnteoTech generates revenue primarily from the development of its intellectual property, amounting to A$0.97 million.

Market Cap: A$51.82M

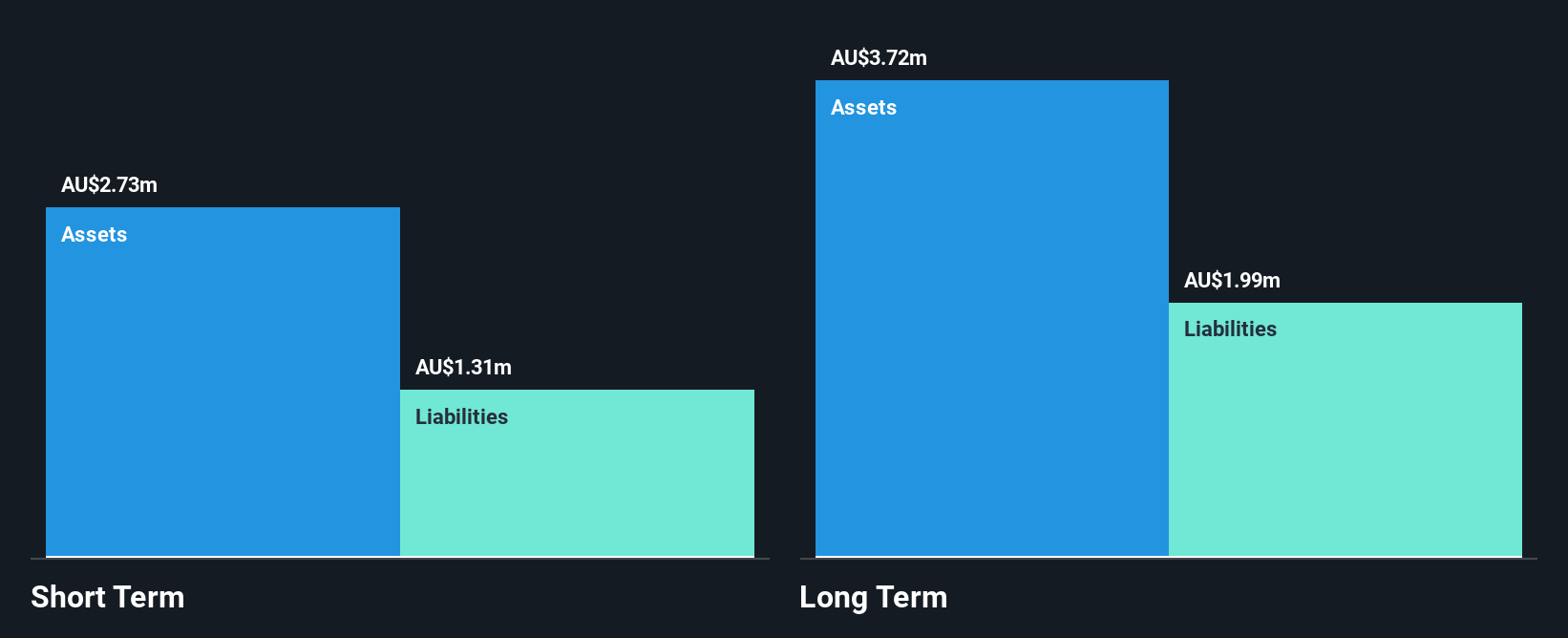

AnteoTech Limited, with a market cap of A$51.82 million, remains pre-revenue, generating A$0.97 million from its intellectual property development. Despite being unprofitable and not expected to achieve profitability in the next three years, it has seen revenue growth from A$0.46 million to A$3.46 million over the past year while reducing net losses slightly from A$8.88 million to A$6.76 million. The company faces financial challenges with less than a year of cash runway and auditor concerns about its ability to continue as a going concern, though its short-term assets cover both short- and long-term liabilities.

- Navigate through the intricacies of AnteoTech with our comprehensive balance sheet health report here.

- Gain insights into AnteoTech's outlook and expected performance with our report on the company's earnings estimates.

Future Battery Minerals (ASX:FBM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Future Battery Minerals Limited is engaged in the exploration and development of mineral properties in Australia and the United States, with a market cap of A$41.83 million.

Operations: No revenue segments are reported for Future Battery Minerals Limited.

Market Cap: A$41.83M

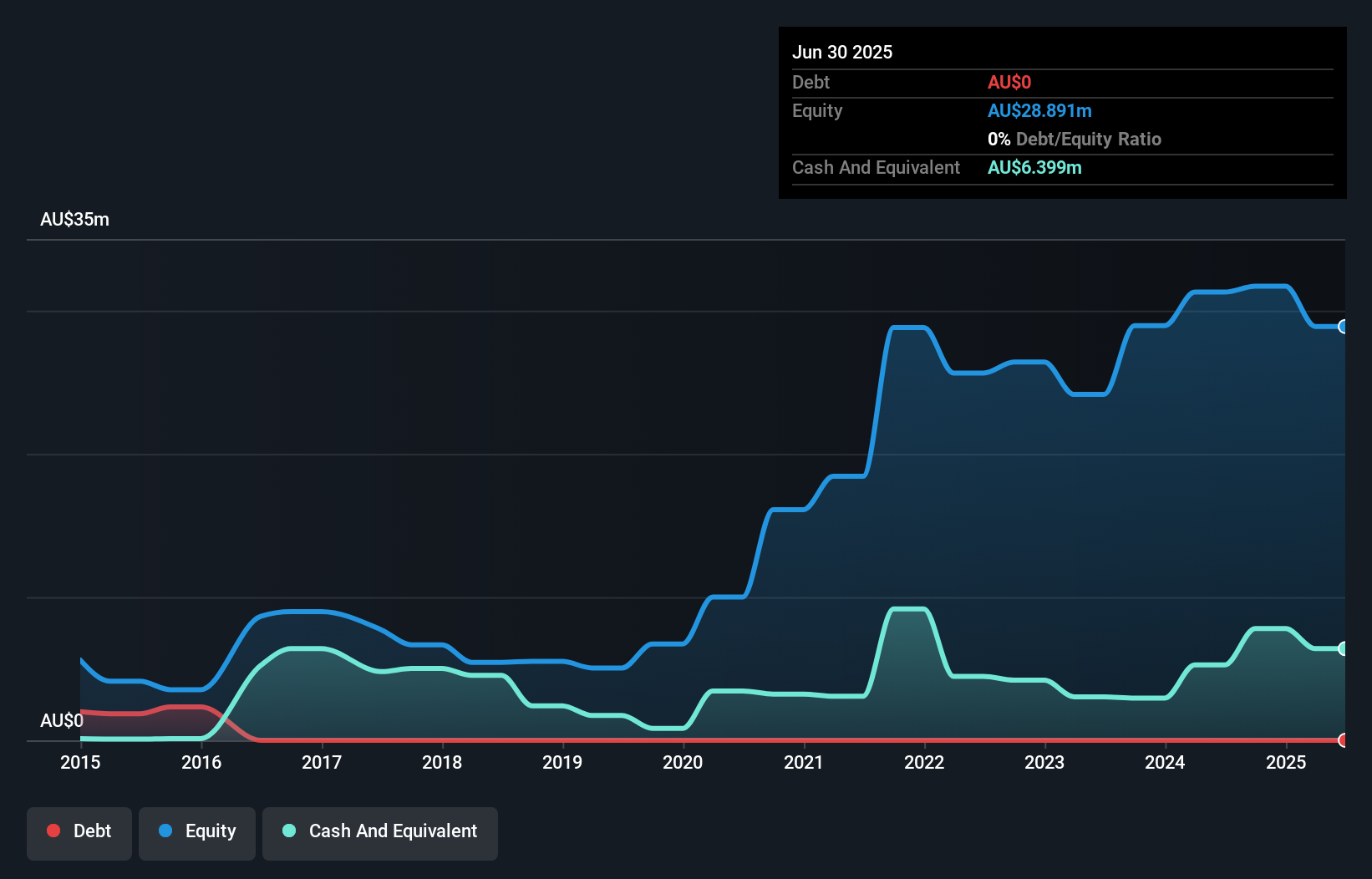

Future Battery Minerals Limited, with a market cap of A$41.83 million, is pre-revenue and currently unprofitable, reporting a net loss of A$2.9 million for the year ending June 30, 2025. Despite this, the company maintains a robust cash position with short-term assets of A$6.5 million exceeding both its short- and long-term liabilities. The management team is relatively experienced with an average tenure of 2.8 years; however, the board is less seasoned. The stock has shown high volatility over recent months but has not experienced significant shareholder dilution in the past year.

- Jump into the full analysis health report here for a deeper understanding of Future Battery Minerals.

- Explore historical data to track Future Battery Minerals' performance over time in our past results report.

MaxiPARTS (ASX:MXI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MaxiPARTS Limited, with a market cap of A$132.20 million, distributes and sells commercial truck and trailer parts as well as automotive tools and workshop consumables in Australia.

Operations: The company's revenue is primarily derived from MaxiPARTS Operations, contributing A$246.74 million, and Förch Australia, which adds A$21.36 million.

Market Cap: A$132.2M

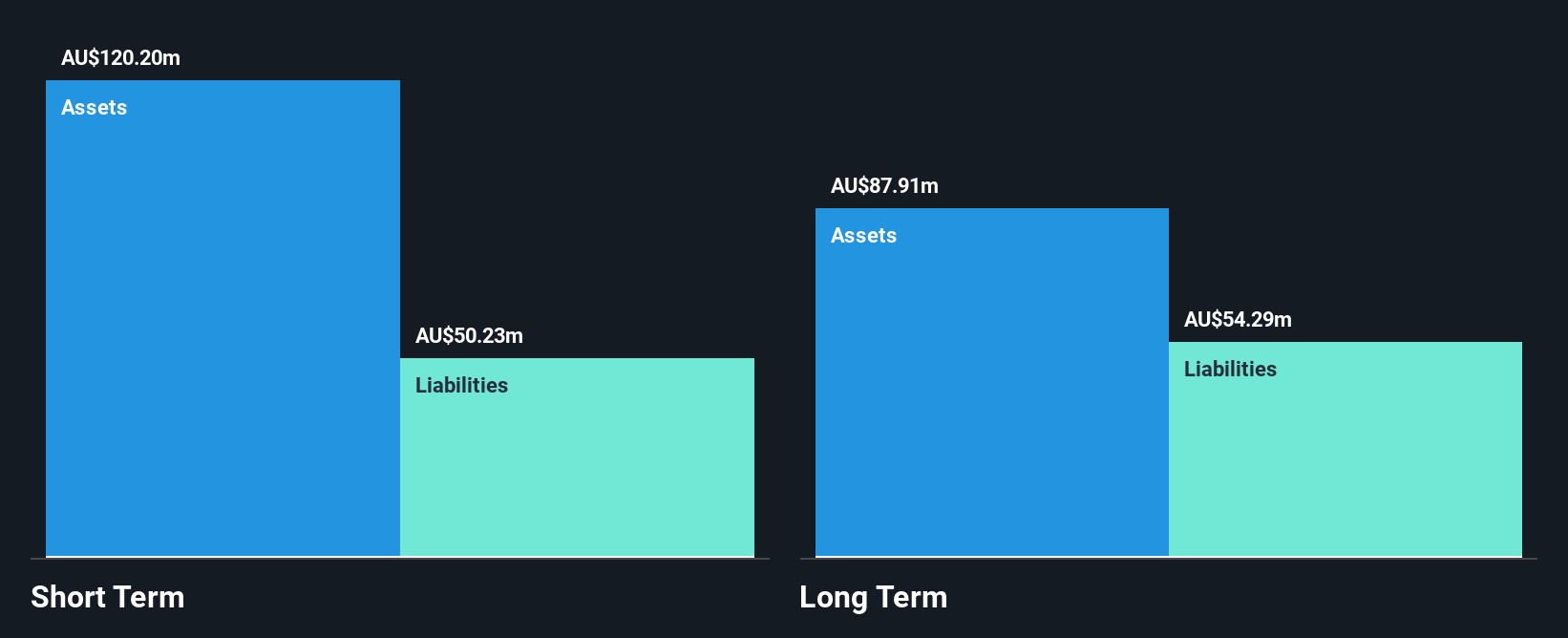

MaxiPARTS Limited, with a market cap of A$132.20 million, demonstrates financial stability and growth potential within the penny stock category. The company reported a net income of A$7.72 million for the year ending June 30, 2025, reflecting substantial earnings growth of 52.6% over the past year, outpacing the industry average. Its short-term assets significantly exceed both short- and long-term liabilities, indicating strong liquidity management. While its return on equity is low at 8.3%, debt levels are satisfactory with interest well covered by EBIT (4.1x). Despite an unstable dividend track record, MaxiPARTS has not faced significant shareholder dilution recently and trades below estimated fair value by approximately 59%.

- Take a closer look at MaxiPARTS' potential here in our financial health report.

- Review our growth performance report to gain insights into MaxiPARTS' future.

Next Steps

- Get an in-depth perspective on all 411 ASX Penny Stocks by using our screener here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ADO

AnteoTech

Develops, manufactures, commercializes, and distributes products for clean energy technology and life science markets primarily in Australia, Asia, Europe, and North America.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives