- Australia

- /

- Entertainment

- /

- ASX:BBL

3 Promising ASX Penny Stocks With Over A$90M Market Cap

Reviewed by Simply Wall St

As the Australian market steadies ahead of a significant Reserve Bank rate decision, investors are navigating a landscape marked by stable indices and cautious optimism. Penny stocks, often seen as relics of past market eras, continue to offer intriguing opportunities for growth through smaller or newer companies. With strong financial health and solid fundamentals, these stocks can provide a unique mix of affordability and potential returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.48 | A$137.56M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.23 | A$105.2M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.90 | A$56.04M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.86 | A$439.55M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.78 | A$278.99M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| LaserBond (ASX:LBL) | A$0.53 | A$62.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.16 | A$1.32B | ✅ 4 ⚠️ 1 View Analysis > |

| Fleetwood (ASX:FWD) | A$3.01 | A$277.93M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.41 | A$633.26M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 414 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Brisbane Broncos (ASX:BBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brisbane Broncos Limited, with a market cap of A$125 million, is engaged in managing and operating the Brisbane Broncos Rugby League Football teams in Australia.

Operations: The company's revenue is primarily derived from its Sports Management and Entertainment segment, amounting to A$65.79 million.

Market Cap: A$125M

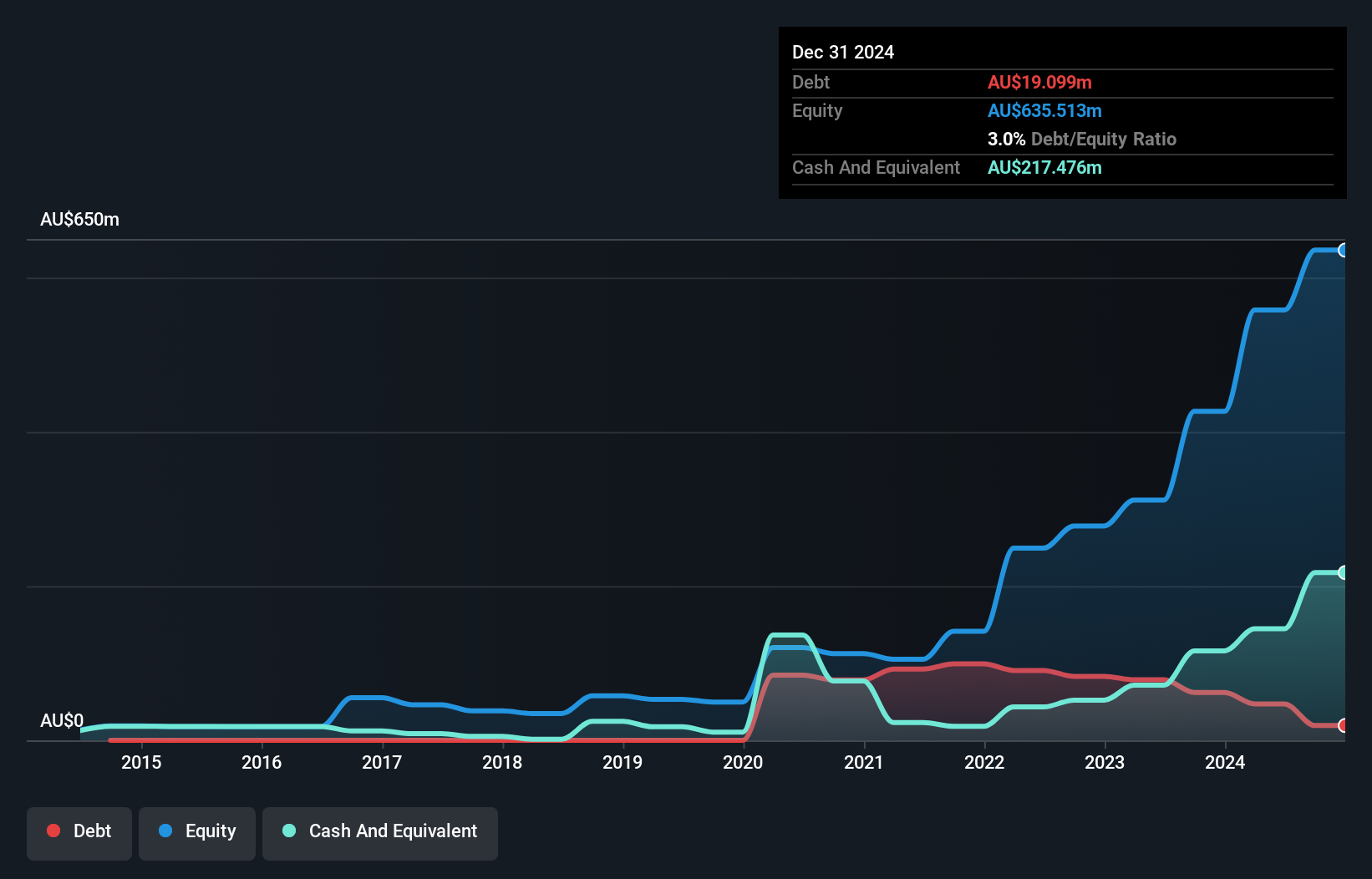

Brisbane Broncos Limited, with a market cap of A$125 million, has demonstrated stable financial performance with revenue growing to A$49.62 million for the half-year ending June 2025. The company reported a net income increase to A$6.01 million, reflecting improved profit margins and high-quality earnings. With no debt on its balance sheet and strong asset coverage of liabilities, Brisbane Broncos is financially robust among penny stocks. Its experienced management team and board contribute to its stability, while the price-to-earnings ratio of 16.7x suggests potential value compared to the broader Australian market average of 21.7x.

- Click to explore a detailed breakdown of our findings in Brisbane Broncos' financial health report.

- Assess Brisbane Broncos' previous results with our detailed historical performance reports.

Emerald Resources (ASX:EMR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$3.19 billion.

Operations: The company generates revenue primarily from its mine operations, which contributed A$430.41 million.

Market Cap: A$3.19B

Emerald Resources NL, with a market cap of A$3.19 billion, has shown financial stability and growth potential in the penny stock space. The company reported A$437.79 million in sales for the year ending June 2025, with net income reaching A$87.61 million. Despite facing production challenges at its Okvau Gold Mine due to heavy rainfall, Emerald reaffirmed its annual guidance and plans further expansion. The company is debt-free, with strong asset coverage over liabilities and seasoned management and board teams contributing to its operational resilience. However, recent earnings growth has slowed compared to historical performance rates.

- Unlock comprehensive insights into our analysis of Emerald Resources stock in this financial health report.

- Explore Emerald Resources' analyst forecasts in our growth report.

Raiz Invest (ASX:RZI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raiz Invest Limited operates a mobile micro-investing platform offering financial services and products in Australia, with a market cap of A$96.43 million.

Operations: The company generates revenue primarily through its Raiz Platform, which accounted for A$24.07 million.

Market Cap: A$96.43M

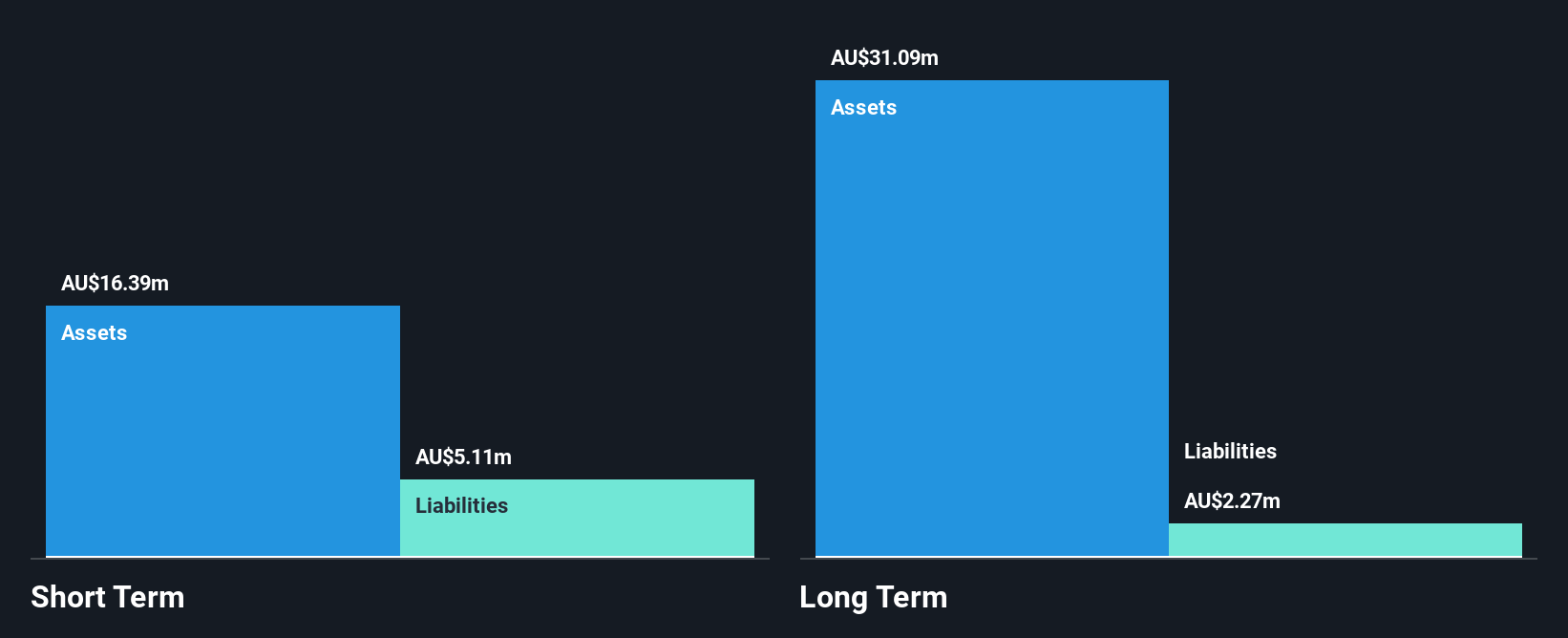

Raiz Invest Limited, with a market cap of A$96.43 million, operates in the micro-investing sector and reported A$24.07 million in revenue for the year ending June 2025, reducing its net loss to A$0.31 million from A$1.87 million the previous year. The company is debt-free and has sufficient cash runway for over three years if free cash flow continues to grow at historical rates. While Raiz's management and board are relatively new with limited tenure, its short-term assets comfortably cover both short- and long-term liabilities, providing a stable financial footing despite ongoing unprofitability challenges.

- Click here to discover the nuances of Raiz Invest with our detailed analytical financial health report.

- Explore historical data to track Raiz Invest's performance over time in our past results report.

Key Takeaways

- Unlock our comprehensive list of 414 ASX Penny Stocks by clicking here.

- Looking For Alternative Opportunities? The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brisbane Broncos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BBL

Brisbane Broncos

Brisbane Broncos Limited, together with its subsidiaries, is involved in the management and operation of the Brisbane Broncos Rugby League Football teams in Australia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives