- Australia

- /

- Metals and Mining

- /

- ASX:DVP

Will Leadership Changes at Develop Global (ASX:DVP) Rethink Its Long-Term Expansion Strategy?

Reviewed by Sasha Jovanovic

- Develop Global Limited has announced the appointment of three highly experienced executives, including Duncan Bradford as Non-executive Director, to support its accelerated growth strategy.

- These leadership additions bring a wealth of operational, technical, and financial expertise from global mining giants, underpinning the company’s ambitions for expansion and partnership opportunities.

- We’ll explore how the infusion of global mining expertise at senior levels could shape Develop Global's investment narrative moving forward.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Develop Global's Investment Narrative?

For shareholders in Develop Global, the big picture hinges on whether operational momentum and profitable growth can be sustained as the company expands. The recent appointment of three industry veterans to senior roles, each bringing substantial international mining, metallurgical, and finance experience, appears well timed, especially as management looks to capitalize on increased scale and new partnerships. These moves could boost confidence in delivery of near-term catalysts, such as successful project execution and integration of new capital from recent equity raises of A$180 million. In the short term, these appointments may ease some concerns about management depth and execution risk. However, given the recent double-digit share price decline over the past month, underlying market sentiment still seems cautious, possibly reflecting ongoing sector risks like project cost overruns, capital allocation questions, and a low forecast return on equity. The real test will be translating this enhanced expertise into consistent, profitable outcomes.

In contrast, underlying project risks and operational hurdles remain key watchpoints for anyone considering this stock.

Exploring Other Perspectives

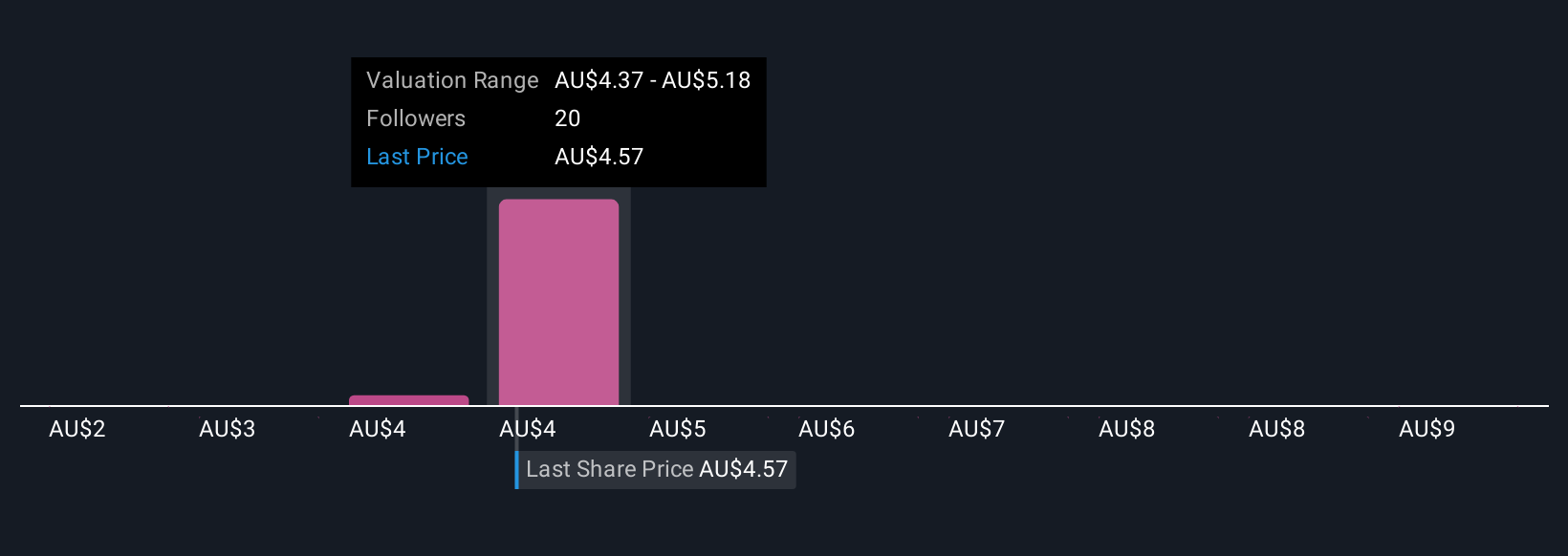

Explore 6 other fair value estimates on Develop Global - why the stock might be worth over 2x more than the current price!

Build Your Own Develop Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Develop Global research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Develop Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Develop Global's overall financial health at a glance.

No Opportunity In Develop Global?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DVP

Develop Global

Engages in the exploration and development of mineral resource properties in Australia.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives