- Australia

- /

- Metals and Mining

- /

- ASX:DRE

Dreadnought Resources (ASX:DRE) Is Up 40.6% After Striking 140m Rare Earths Intercept at Stinger Prospect

Reviewed by Sasha Jovanovic

- In recent days, Dreadnought Resources announced an unexpected 140-metre rare earth mineralisation intercept grading 0.9% TREO at its Stinger prospect within the Gifford Creek Carbonatite.

- This result has drawn sector attention and is shaping the company’s rare earth exploration approach as interest builds in the Mountain Pass-style mineralisation.

- We’ll explore how this significant mineral intercept influences Dreadnought Resources’ investment narrative and future exploration priorities.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Dreadnought Resources' Investment Narrative?

For shareholders of Dreadnought Resources, the conviction often rests on the potential to unlock valuable mineral discoveries at an early stage, despite high risks and no current revenue base. The recent 140-metre rare earth intercept at Stinger appears material for the company's immediate outlook, with shares surging in response as the find brings fresh attention and directs exploration momentum toward confirming Mountain Pass-style mineralisation in the Gifford Creek Carbonatite. This could signal a shift in the company’s near-term catalysts, making forthcoming drill results and further investor interest key to the story. However, Dreadnought remains loss-making, has rapidly increased its capital base through equity raises, and still operates with less than one year of cash runway. For now, while speculative optimism has grown, the business faces persistent risks if follow-on exploration or financing efforts fall short. On the other hand, capital dilution and cash runway risk should not be overlooked.

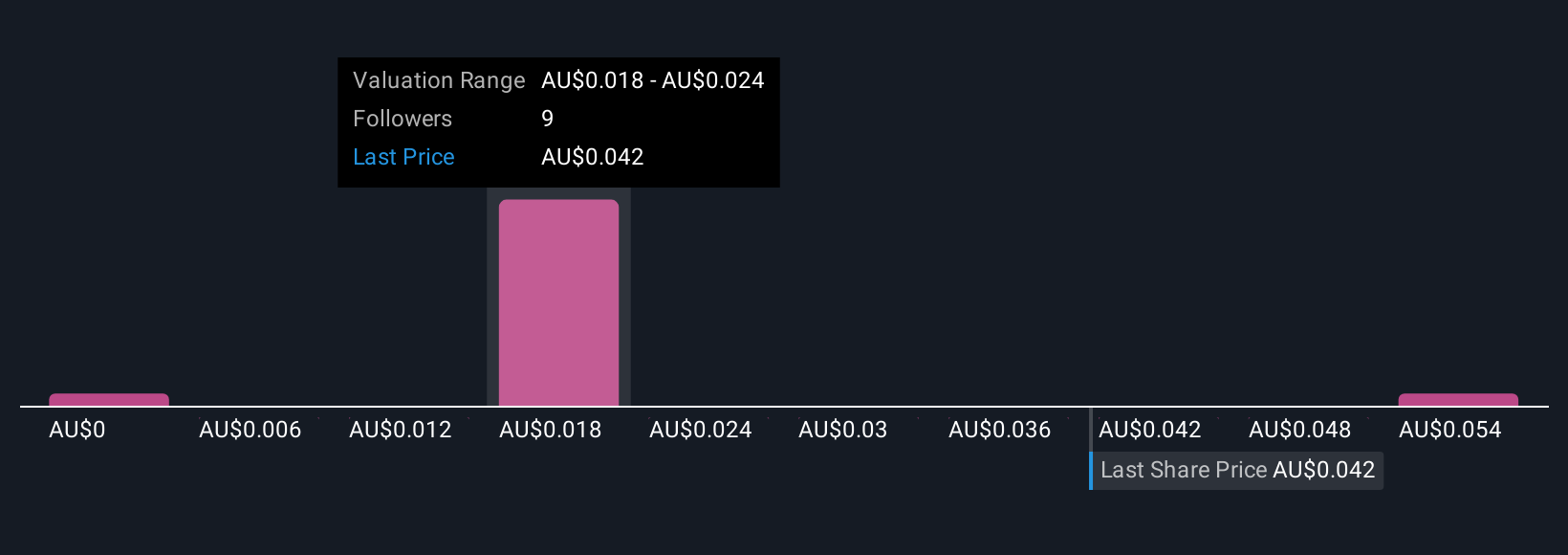

According our valuation report, there's an indication that Dreadnought Resources' share price might be on the expensive side.Exploring Other Perspectives

Explore 3 other fair value estimates on Dreadnought Resources - why the stock might be worth as much as 33% more than the current price!

Build Your Own Dreadnought Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dreadnought Resources research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Dreadnought Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dreadnought Resources' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DRE

Dreadnought Resources

Operates as mineral exploration and development company in Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives