Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Bathurst Resources Limited (ASX:BRL) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Bathurst Resources

What Is Bathurst Resources's Debt?

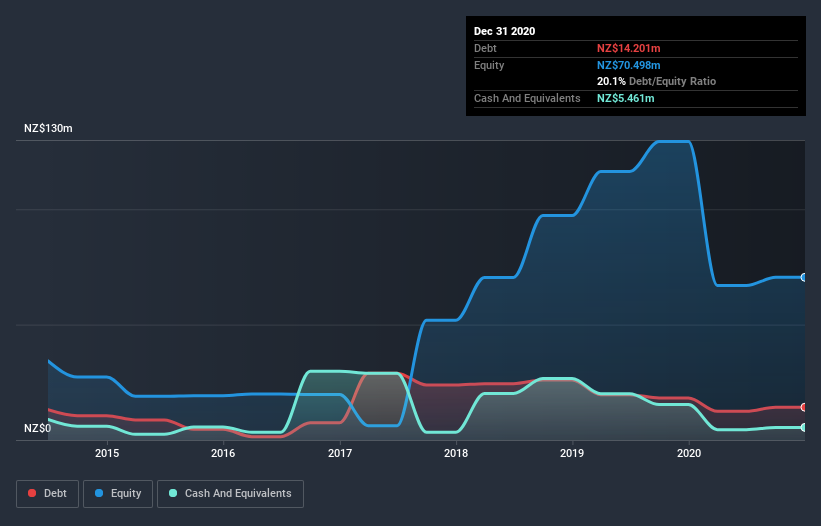

As you can see below, Bathurst Resources had NZ$11.0m of debt at December 2020, down from NZ$18.2m a year prior. On the flip side, it has NZ$5.46m in cash leading to net debt of about NZ$5.52m.

How Healthy Is Bathurst Resources' Balance Sheet?

We can see from the most recent balance sheet that Bathurst Resources had liabilities of NZ$93.0m falling due within a year, and liabilities of NZ$8.54m due beyond that. Offsetting these obligations, it had cash of NZ$5.46m as well as receivables valued at NZ$7.54m due within 12 months. So it has liabilities totalling NZ$88.5m more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's NZ$75.0m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Bathurst Resources's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Bathurst Resources had a loss before interest and tax, and actually shrunk its revenue by 4.6%, to NZ$47m. We would much prefer see growth.

Caveat Emptor

Importantly, Bathurst Resources had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable NZ$8.1m at the EBIT level. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. It's fair to say the loss of NZ$58m didn't encourage us either; we'd like to see a profit. And until that time we think this is a risky stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Bathurst Resources has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Bathurst Resources, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bathurst Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:BRL

Bathurst Resources

Engages in the exploration, development, and production of bituminous and coking coal in New Zealand and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives