- Australia

- /

- Metals and Mining

- /

- ASX:BIS

Will Bisalloy Steel Group's (ASX:BIS) Incentive Plan Reveal More About Its Long-Term Leadership Vision?

Reviewed by Sasha Jovanovic

- Bisalloy Steel Group recently issued 75,632 unquoted performance share rights as part of an employee incentive scheme, and announced its 2025 Annual General Meeting to be held virtually on November 6.

- These initiatives focus on aligning employee interests with company goals and providing greater transparency on strategic direction for stakeholders.

- We'll explore how Bisalloy's stepped-up employee engagement through performance share rights could influence its future investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Bisalloy Steel Group's Investment Narrative?

For investors eyeing Bisalloy Steel Group, the big-picture narrative has centered on steady earnings growth, reliable dividends, and the company’s niche as Australia’s only local producer of high-strength, wear-resistant steel plates. The recent issue of performance share rights signals a desire to sharpen operational alignment and keep key employees motivated, which could help offset slower top-line growth relative to the market and support ongoing margin improvements. While the scheme’s direct financial impact may not fundamentally shift near-term catalysts, such as order volumes from mining, construction, and defense, the considerable recent share price gains suggest market participants may be pricing in higher expectations for delivery. Key risks remain, particularly around dividend sustainability given coverage by free cash flows and an experienced but low-refresh board. Investors should monitor how ongoing incentive and governance moves play into future results and stakeholder confidence.

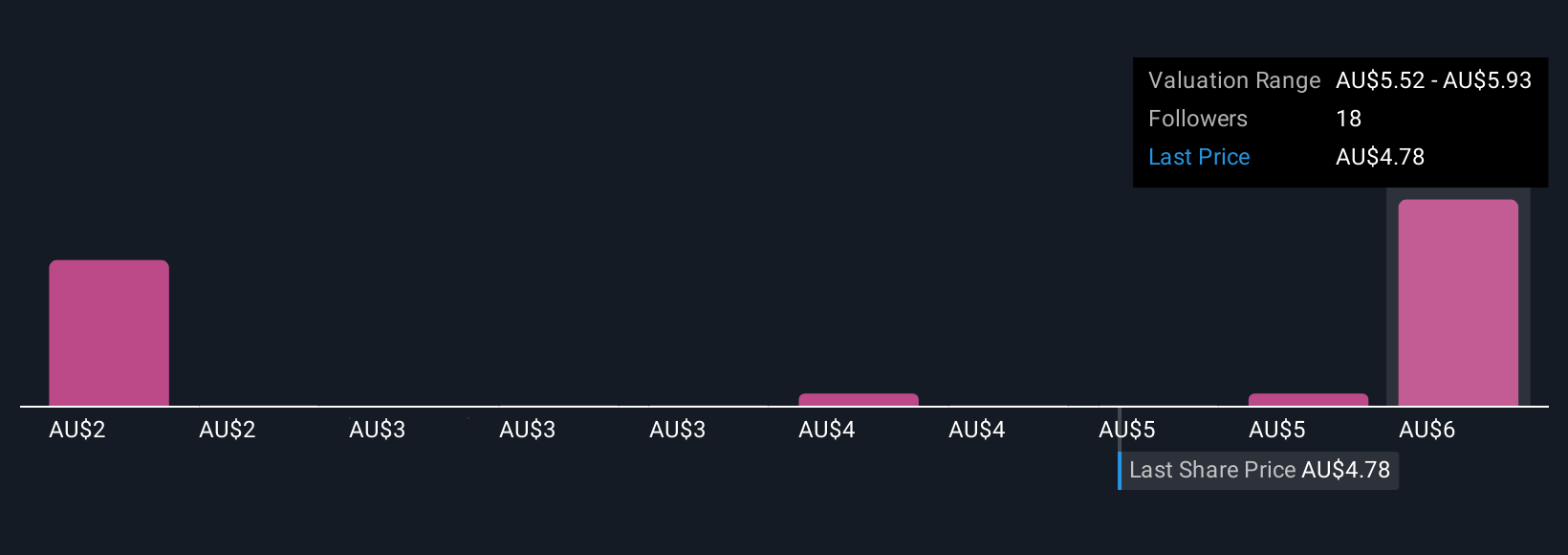

Contrasting the strong run, dividend sustainability remains a relevant consideration for shareholders. Bisalloy Steel Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 15 other fair value estimates on Bisalloy Steel Group - why the stock might be worth less than half the current price!

Build Your Own Bisalloy Steel Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bisalloy Steel Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bisalloy Steel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bisalloy Steel Group's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bisalloy Steel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BIS

Bisalloy Steel Group

Engages in the manufacture and sale of quenched and tempered, high-tensile, and abrasion resistant steel plates in Australia, Indonesia, Thailand, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives