- Australia

- /

- Metals and Mining

- /

- ASX:BDM

These 4 Measures Indicate That Burgundy Diamond Mines (ASX:BDM) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Burgundy Diamond Mines Limited (ASX:BDM) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Burgundy Diamond Mines

What Is Burgundy Diamond Mines's Net Debt?

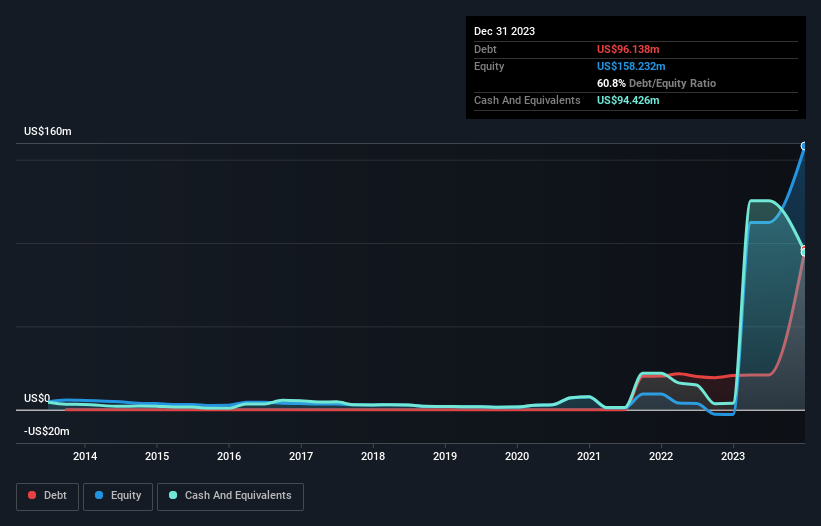

As you can see below, at the end of December 2023, Burgundy Diamond Mines had US$96.1m of debt, up from US$20.4m a year ago. Click the image for more detail. However, because it has a cash reserve of US$94.4m, its net debt is less, at about US$1.71m.

How Strong Is Burgundy Diamond Mines' Balance Sheet?

The latest balance sheet data shows that Burgundy Diamond Mines had liabilities of US$123.1m due within a year, and liabilities of US$385.6m falling due after that. Offsetting this, it had US$94.4m in cash and US$8.68m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$405.7m.

The deficiency here weighs heavily on the US$155.6m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Burgundy Diamond Mines would probably need a major re-capitalization if its creditors were to demand repayment. Burgundy Diamond Mines may have virtually no net debt, but it does have a lot of liabilities.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Burgundy Diamond Mines has a net debt to EBITDA ratio of 0.016, suggesting a very conservative balance sheet. But strangely, EBIT was only 1.4 times interest expenses, suggesting the that may paint an overly pretty picture of the stock. Notably, Burgundy Diamond Mines made a loss at the EBIT level, last year, but improved that to positive EBIT of US$25m in the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Burgundy Diamond Mines can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, Burgundy Diamond Mines actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

We feel some trepidation about Burgundy Diamond Mines's difficulty level of total liabilities, but we've got positives to focus on, too. To wit both its conversion of EBIT to free cash flow and net debt to EBITDA were encouraging signs. Taking the abovementioned factors together we do think Burgundy Diamond Mines's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with Burgundy Diamond Mines .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Burgundy Diamond Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BDM

Burgundy Diamond Mines

A resources company, focuses on the mining, production, cutting, polishing, grading, and sale of diamonds.

Good value with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026