- Australia

- /

- Metals and Mining

- /

- ASX:BDM

Investors bid Burgundy Diamond Mines (ASX:BDM) up AU$43m despite increasing losses YoY, taking five-year CAGR to 45%

It hasn't been the best quarter for Burgundy Diamond Mines Limited (ASX:BDM) shareholders, since the share price has fallen 14% in that time. But that does not change the realty that the stock's performance has been terrific, over five years. To be precise, the stock price is 533% higher than it was five years ago, a wonderful performance by any measure. So we don't think the recent decline in the share price means its story is a sad one. Only time will tell if there is still too much optimism currently reflected in the share price. It really delights us to see such great share price performance for investors.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Burgundy Diamond Mines

Burgundy Diamond Mines isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 5 years Burgundy Diamond Mines saw its revenue grow at 104% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 45% per year in that time. Despite the strong run, top performers like Burgundy Diamond Mines have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

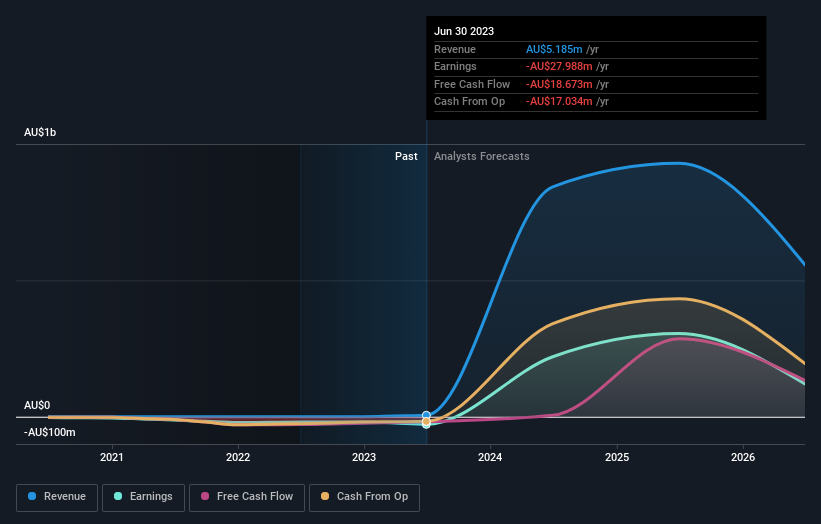

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Burgundy Diamond Mines

A Different Perspective

While the broader market gained around 3.0% in the last year, Burgundy Diamond Mines shareholders lost 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 45% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Burgundy Diamond Mines better, we need to consider many other factors. For example, we've discovered 2 warning signs for Burgundy Diamond Mines (1 is potentially serious!) that you should be aware of before investing here.

Burgundy Diamond Mines is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Burgundy Diamond Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BDM

Burgundy Diamond Mines

A resources company, focuses on the mining, production, cutting, polishing, grading, and sale of diamonds.

Undervalued with adequate balance sheet.