- Australia

- /

- Metals and Mining

- /

- ASX:ASM

Here's Why We're Watching Australian Strategic Materials' (ASX:ASM) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Australian Strategic Materials (ASX:ASM) shareholders be worried about its cash burn? In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Australian Strategic Materials

When Might Australian Strategic Materials Run Out Of Money?

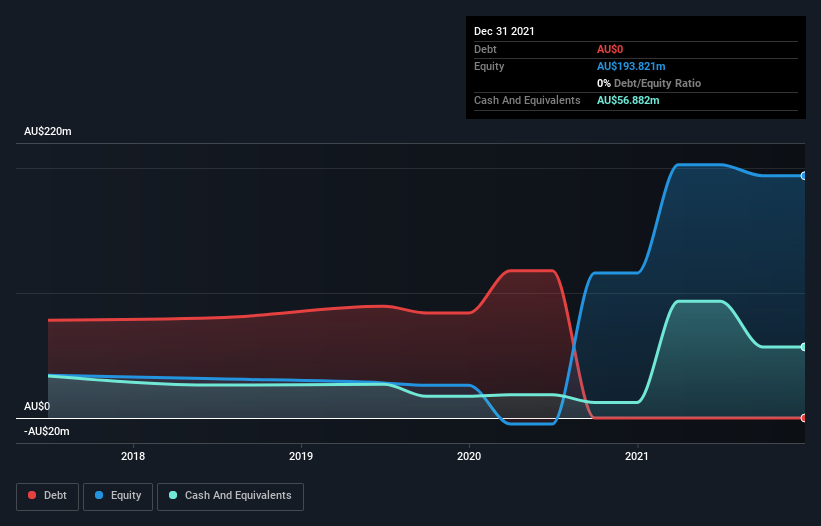

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In December 2021, Australian Strategic Materials had AU$57m in cash, and was debt-free. In the last year, its cash burn was AU$49m. So it had a cash runway of approximately 14 months from December 2021. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. Depicted below, you can see how its cash holdings have changed over time.

How Is Australian Strategic Materials' Cash Burn Changing Over Time?

Whilst it's great to see that Australian Strategic Materials has already begun generating revenue from operations, last year it only produced AU$1.5m, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. Remarkably, it actually increased its cash burn by 469% in the last year. Given that sharp increase in spending, the company's cash runway will shrink rapidly as it depletes its cash reserves. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Australian Strategic Materials is growing revenue over time by checking this visualization of past revenue growth.

How Easily Can Australian Strategic Materials Raise Cash?

While Australian Strategic Materials does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Australian Strategic Materials' cash burn of AU$49m is about 6.0% of its AU$818m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Australian Strategic Materials' Cash Burn Situation?

On this analysis of Australian Strategic Materials' cash burn, we think its cash burn relative to its market cap was reassuring, while its increasing cash burn has us a bit worried. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Australian Strategic Materials (of which 1 doesn't sit too well with us!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ASM

Australian Strategic Materials

Operates as an integrated producer of critical metals for technologies in Australia.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives