- Australia

- /

- Metals and Mining

- /

- ASX:A1G

Loss-making African Gold (ASX:A1G) has seen earnings and shareholder returns follow the same downward trajectory over past -0.6%

African Gold Limited (ASX:A1G) shareholders should be happy to see the share price up 17% in the last month. But in truth the last year hasn't been good for the share price. The cold reality is that the stock has dropped 11% in one year, under-performing the market.

On a more encouraging note the company has added AU$2.4m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

View our latest analysis for African Gold

With zero revenue generated over twelve months, we don't think that African Gold has proved its business plan yet. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that African Gold finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is usually a significant chance that they will need more money for business development, putting them at the mercy of capital markets to raise equity. So the share price itself impacts the value of the shares (as it determines the cost of capital). While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

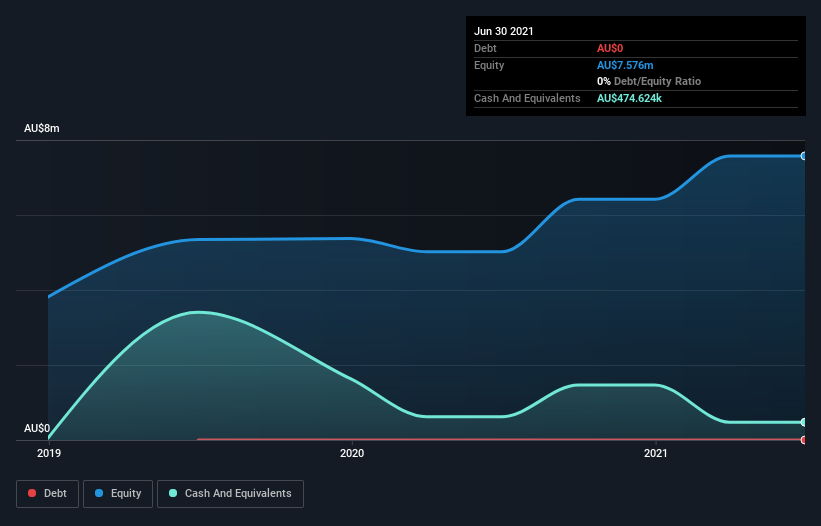

When it reported in June 2021 African Gold had minimal cash in excess of all liabilities consider its expenditure: just AU$40k to be specific. So if it has not already moved to replenish reserves, we think the near-term chances of a capital raising event are pretty high. With that in mind, you can understand why the share price dropped 11% in the last year. The image below shows how African Gold's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. What if insiders are ditching the stock hand over fist? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between African Gold's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. African Gold hasn't been paying dividends, but its TSR of -0.6% exceeds its share price return of -11%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While African Gold shareholders are down 0.6% for the year, the market itself is up 16%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. Notably, the loss over the last year isn't as bad as the 8.7% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that African Gold is showing 4 warning signs in our investment analysis , and 3 of those are concerning...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:A1G

African Gold

Engages in acquiring, exploring, evaluating, and exploiting mineral resource projects in Africa.

Flawless balance sheet with low risk.

Market Insights

Community Narratives