- Australia

- /

- Healthcare Services

- /

- ASX:SHL

How Sonic Healthcare's Valuation Disconnect May Influence ASX:SHL's Investment Story

Reviewed by Sasha Jovanovic

- In recent months, Sonic Healthcare has experienced a significant share price pullback, despite the company’s continued revenue growth and international presence across Australia, New Zealand, Europe, and North America.

- This disconnect between the market’s reaction and Sonic Healthcare’s stable financial performance has sparked renewed attention, as the company currently trades below its five-year average price-to-sales ratio.

- With Sonic Healthcare's valuation now sitting beneath historical norms despite stable revenues, we’ll examine how this shift could influence its investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Sonic Healthcare Investment Narrative Recap

To be a Sonic Healthcare shareholder, you need confidence in the ongoing demand for diagnostic services driven by aging populations and chronic disease trends. The recent share price decline, although sharp, does not immediately undermine the main near-term catalyst: the company’s ability to grow revenue through acquisitions and expanded specialty testing. However, integration risk and pressure on net margins from those acquisitions remain the primary business risks, and recent news does not materially shift these factors.

Among recent announcements, Sonic’s August 2025 earnings release stands out, reaffirming modest revenue growth and continued dividend payments. This consistent performance, even as the share price fell, suggests the business is maintaining its operational footing, at least in the immediate term, while preparations for new board appointments may add further oversight as the company balances growth and integration efforts.

Yet, in contrast to stable revenues and international reach, the potential for slower acquisition integration and diluted margins could quietly challenge Sonic Healthcare’s long-term returns, something investors should watch for...

Read the full narrative on Sonic Healthcare (it's free!)

Sonic Healthcare is projected to reach A$11.9 billion in revenue and A$752.0 million in earnings by 2028. This outlook is based on analysts forecasting 7.2% annual revenue growth and a A$238.4 million increase in earnings from the current A$513.6 million.

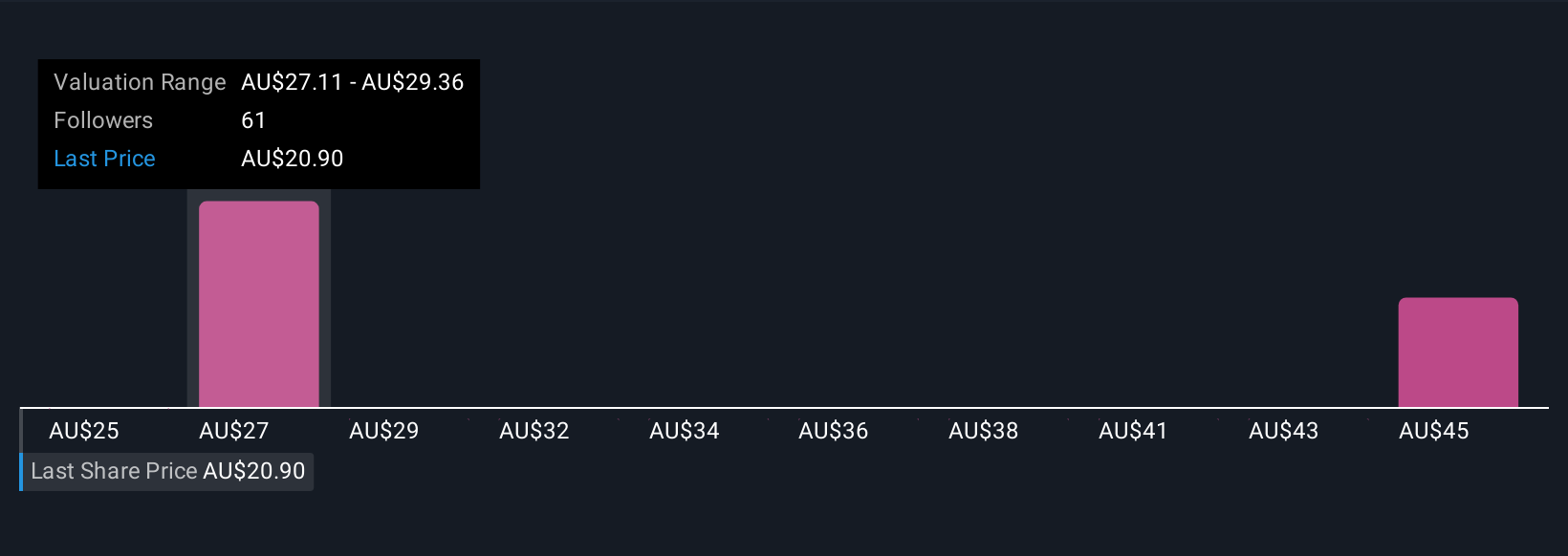

Uncover how Sonic Healthcare's forecasts yield a A$28.11 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community see Sonic Healthcare’s fair value estimates spread from A$24.86 to A$47.38 per share. While many focus on growth potential, regulatory changes in Sonic’s core markets remain a critical variable for future performance, so review different perspectives before forming your view.

Explore 7 other fair value estimates on Sonic Healthcare - why the stock might be worth over 2x more than the current price!

Build Your Own Sonic Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sonic Healthcare research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sonic Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonic Healthcare's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SHL

Sonic Healthcare

Offers medical diagnostic services, and administrative services and facilities to medical practitioners in Australia, the United States, Germany, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives