- Australia

- /

- Hospitality

- /

- ASX:WEB

ASX Stocks Estimated To Be Undervalued By Up To 48.6% Offering Investment Opportunities

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has experienced a slight decline of 1.1%, but it remains up by 11% over the past year with earnings expected to grow by 11% annually. In this context, identifying undervalued stocks that have not yet caught up with broader market gains can offer compelling investment opportunities for those looking to capitalize on potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trajan Group Holdings (ASX:TRJ) | A$0.84 | A$1.68 | 49.9% |

| Kogan.com (ASX:KGN) | A$3.92 | A$7.71 | 49.2% |

| Kinatico (ASX:KYP) | A$0.29 | A$0.53 | 45.5% |

| IDP Education (ASX:IEL) | A$5.52 | A$10.71 | 48.5% |

| Fenix Resources (ASX:FEX) | A$0.37 | A$0.68 | 45.2% |

| Elders (ASX:ELD) | A$7.67 | A$14.04 | 45.4% |

| Credit Clear (ASX:CCR) | A$0.24 | A$0.47 | 49.2% |

| CleanSpace Holdings (ASX:CSX) | A$0.80 | A$1.40 | 43% |

| Betmakers Technology Group (ASX:BET) | A$0.17 | A$0.31 | 46% |

| Atlas Arteria (ASX:ALX) | A$5.22 | A$10.16 | 48.6% |

We're going to check out a few of the best picks from our screener tool.

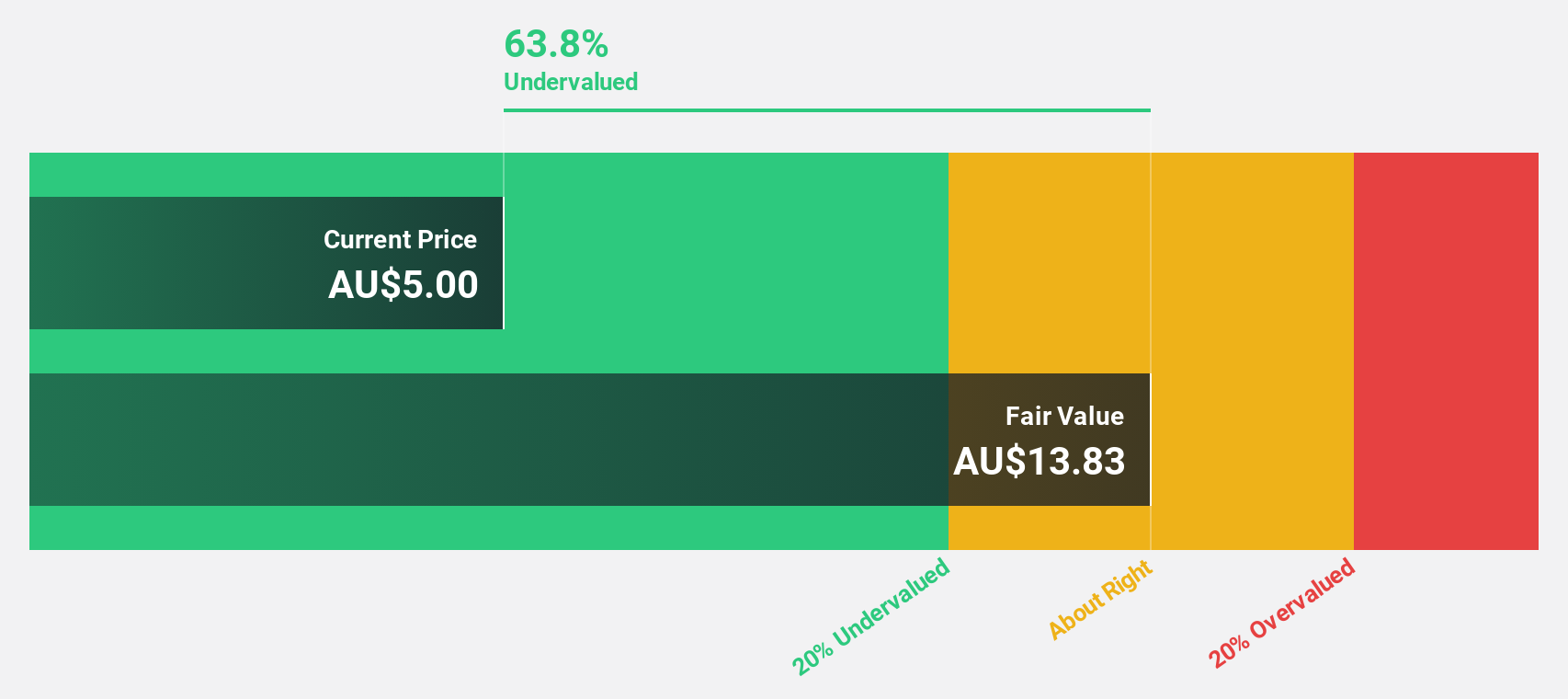

Atlas Arteria (ASX:ALX)

Overview: Atlas Arteria Limited owns, develops, and operates toll roads in France, Germany, and the United States with a market capitalization of A$7.57 billion.

Operations: The company's revenue segments include A$1.74 billion from APRR, A$40.60 million from ADELAC, A$28.40 million from Warnow Tunnel, A$135.90 million from Chicago Skyway, and A$125.40 million from Dulles Greenway.

Estimated Discount To Fair Value: 48.6%

Atlas Arteria is trading at A$5.22, significantly below its estimated fair value of A$10.16, suggesting it is undervalued based on discounted cash flow analysis. Despite a drop in net income from last year, revenue increased to A$77.5 million for H1 2025. The company reaffirmed its dividend guidance of 40 cps, supported by growing free cash flow, although the dividend yield of 7.66% isn't well covered by earnings or cash flows.

- Our growth report here indicates Atlas Arteria may be poised for an improving outlook.

- Take a closer look at Atlas Arteria's balance sheet health here in our report.

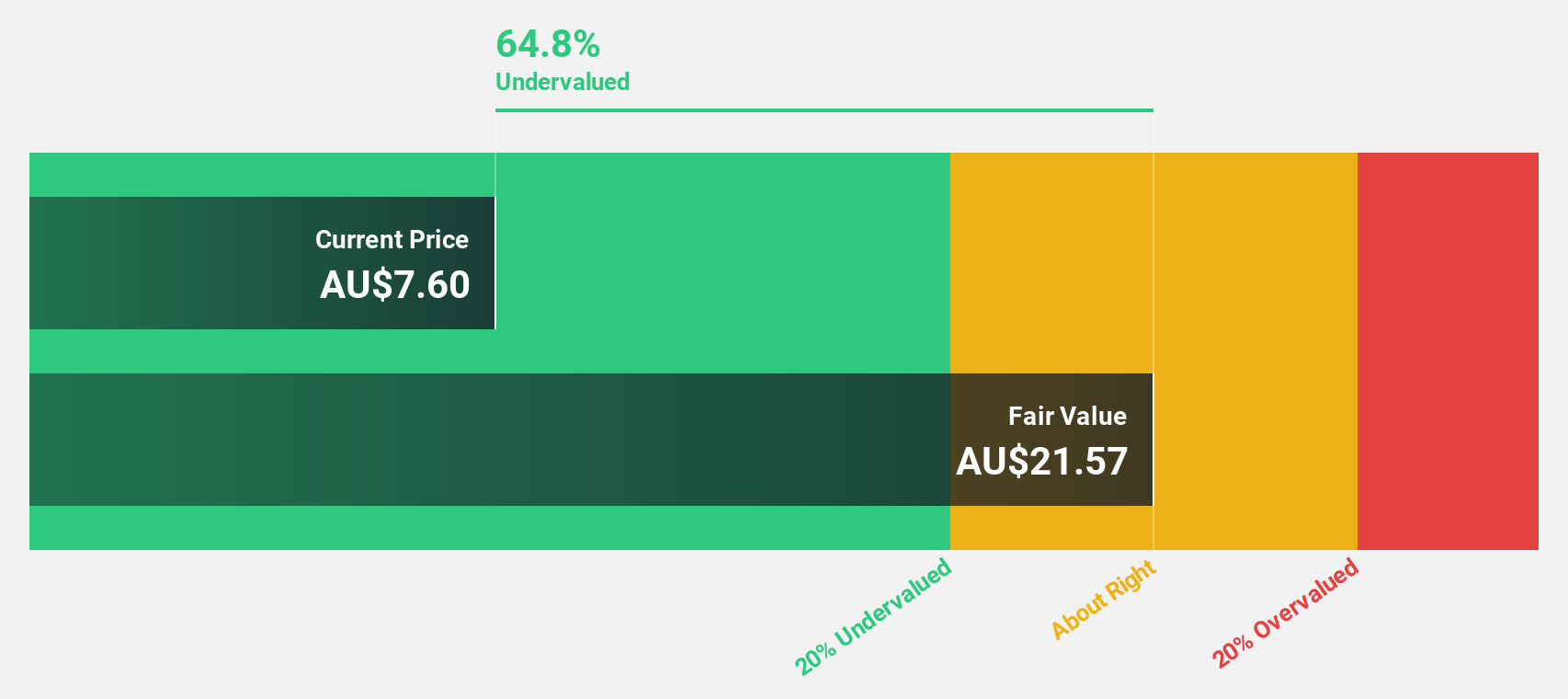

Regis Healthcare (ASX:REG)

Overview: Regis Healthcare Limited provides residential aged care services in Australia and has a market cap of A$2.35 billion.

Operations: The company generates revenue of A$1.16 billion from its residential aged care, home care, and retirement living services in Australia.

Estimated Discount To Fair Value: 26.2%

Regis Healthcare is trading at A$7.79, below its estimated fair value of A$10.55, indicating undervaluation based on discounted cash flow analysis. The company reported revenue of A$1.29 billion and net income of A$48.95 million for the fiscal year ending June 2025, marking a return to profitability from a prior net loss. Earnings are projected to grow annually at 17.8%, outpacing the broader Australian market's growth rate, despite recent large one-off items affecting results.

- Insights from our recent growth report point to a promising forecast for Regis Healthcare's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Regis Healthcare.

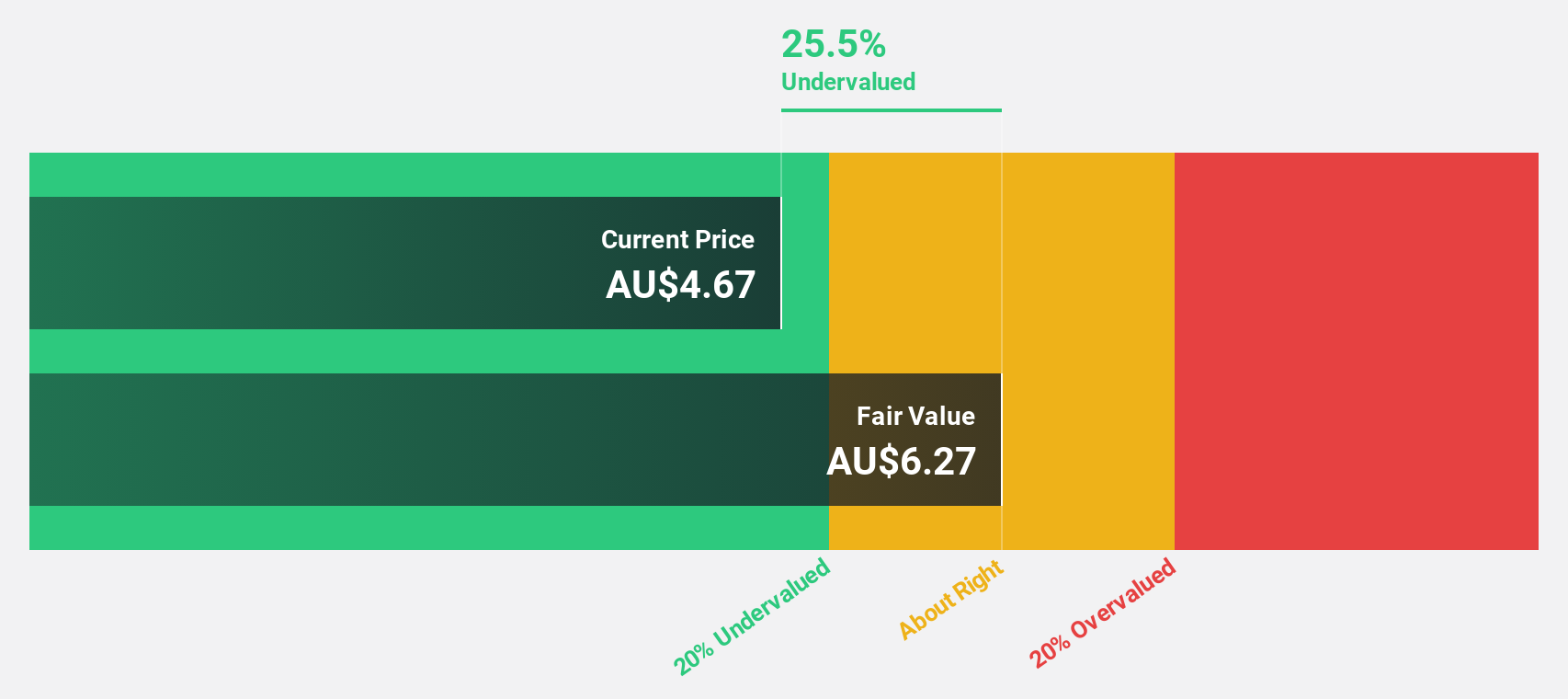

Web Travel Group (ASX:WEB)

Overview: Web Travel Group Limited offers online travel booking services across Australia, the United Arab Emirates, the United Kingdom, and other international markets with a market cap of A$1.54 billion.

Operations: The company generates revenue through its Business to Business Travel (B2B) segment, which accounts for A$328.40 million.

Estimated Discount To Fair Value: 33.1%

Web Travel Group's stock, priced at A$4.25, is trading 33.1% below its estimated fair value of A$6.35, suggesting significant undervaluation based on discounted cash flow analysis. Despite a decline in profit margins from 24.6% to 3.4%, earnings are forecast to grow substantially at 32.36% annually, surpassing the Australian market's growth rate of 10.8%. Recent board changes include the addition of experienced directors Melanie Wilson and Paul Scurrah, potentially strengthening governance and strategic direction.

- Upon reviewing our latest growth report, Web Travel Group's projected financial performance appears quite optimistic.

- Dive into the specifics of Web Travel Group here with our thorough financial health report.

Where To Now?

- Get an in-depth perspective on all 34 Undervalued ASX Stocks Based On Cash Flows by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Web Travel Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WEB

Web Travel Group

Provides online travel booking services in Australia, the United Arab Emirates, the United Kingdom, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives