Over the last 7 days, the Australian market has remained flat, yet it is up 16% over the past year with earnings forecasted to grow by 12% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability within a stable economic environment.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 20.10% | 38.31% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Careteq | 37.17% | 126.21% | ★★★★★☆ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Opthea (ASX:OPT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Opthea Limited is a clinical-stage biopharmaceutical company focused on developing and commercializing drugs for eye diseases in Australia and the United States, with a market cap of A$1.07 billion.

Operations: The company generates revenue primarily from its Medical Technology and Healthcare segment, totaling $0.26 million. As a clinical-stage biopharmaceutical entity, it focuses on the development of treatments for eye diseases in key markets like Australia and the United States.

Opthea, a player in the high-growth tech sector in Australia, is navigating through a transformative phase with significant investments in R&D, crucial for its long-term success. Despite earning less than $1 million annually and currently unprofitable, Opthea's aggressive R&D spending is aimed at driving future profitability, evidenced by an anticipated earnings growth of 61.83% per year. Recent strategic hires signal a strengthening of their leadership team as they gear up for critical Phase 3 clinical trials expected to commence in early 2025. These efforts underscore Opthea's commitment to innovation and market readiness in the biotech landscape, aligning with industry trends towards advanced therapeutic solutions.

- Navigate through the intricacies of Opthea with our comprehensive health report here.

Gain insights into Opthea's historical performance by reviewing our past performance report.

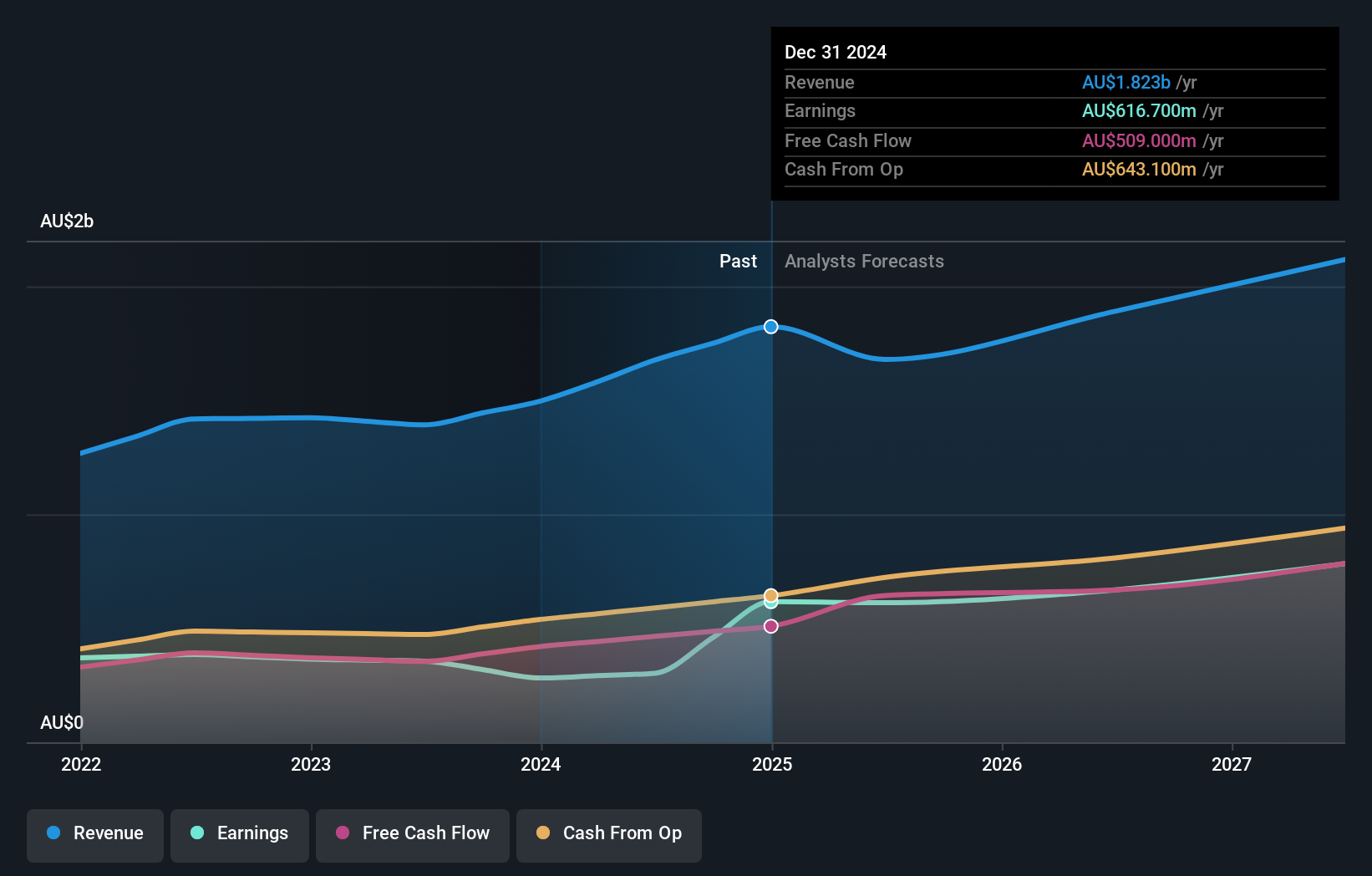

Pro Medicus (ASX:PME)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pro Medicus Limited is a healthcare informatics company that develops and supplies imaging software and radiology information system services to hospitals, imaging centers, and healthcare groups across Australia, North America, and Europe with a market cap of A$19.50 billion.

Operations: The company generates revenue primarily from producing integrated software applications for the healthcare industry, amounting to A$161.50 million. Its operations span across Australia, North America, and Europe.

Pro Medicus, a standout in Australia's tech landscape, showcases robust growth with its latest financials indicating a revenue surge to AUD 166.33 million from AUD 127.33 million last year, reflecting a significant uptick of 17% annually. This growth is complemented by an impressive net income rise to AUD 82.79 million, up from AUD 60.65 million, marking an earnings increase of nearly 18.9% per year—outpacing the broader Australian market's average. Notably, the company has committed extensively to innovation through R&D investments tailored towards enhancing its software solutions within the healthcare sector, fueling these financial gains and potentially setting new industry standards for efficiency and reliability in medical imaging technology.

- Click here to discover the nuances of Pro Medicus with our detailed analytical health report.

Examine Pro Medicus' past performance report to understand how it has performed in the past.

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market cap of A$28.58 billion.

Operations: The company generates revenue primarily from property and online advertising in Australia, contributing A$1.25 billion, followed by financial services in the same region at A$320.6 million, and operations in India at A$103.1 million. The business model focuses on leveraging digital platforms to connect real estate buyers with sellers and service providers across multiple international markets.

REA Group, navigating the competitive landscape of interactive media and services in Australia, has demonstrated resilience with a projected revenue growth of 6.5% annually. This figure modestly surpasses the Australian market's average of 5.5%, positioning REA slightly ahead in a challenging environment. Despite facing a setback with a 15% decline in earnings last year, future prospects appear brighter with an anticipated earnings growth rate of 16.8% per year—outpacing the broader market forecast of 12.2%. Contributing to this optimistic outlook is REA's strategic focus on R&D, which remains integral to its operational strategy, though specific expenditure figures are not disclosed. Recent corporate actions include an increased dividend payout at AUD 1.02 per share and substantial net income reported at AUD 302.8 million for FY2024, reflecting both challenges and recovery potential within its financial framework.

- Delve into the full analysis health report here for a deeper understanding of REA Group.

Explore historical data to track REA Group's performance over time in our Past section.

Turning Ideas Into Actions

- Investigate our full lineup of 64 ASX High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:OPT

Opthea

A clinical-stage biopharmaceutical company, develops and commercializes drugs for eye diseases in Australia and the United States.

High growth potential low.