- Australia

- /

- Medical Equipment

- /

- ASX:NXS

Take Care Before Jumping Onto Next Science Limited (ASX:NXS) Even Though It's 36% Cheaper

Unfortunately for some shareholders, the Next Science Limited (ASX:NXS) share price has dived 36% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

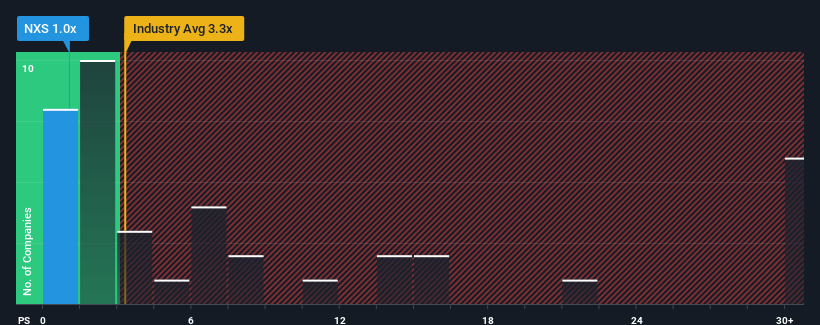

Since its price has dipped substantially, Next Science's price-to-sales (or "P/S") ratio of 1x might make it look like a strong buy right now compared to the wider Medical Equipment industry in Australia, where around half of the companies have P/S ratios above 3.4x and even P/S above 16x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Next Science

What Does Next Science's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Next Science has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Next Science's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Next Science's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 42% last year. The strong recent performance means it was also able to grow revenue by 270% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 48% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 14%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Next Science's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Next Science's P/S Mean For Investors?

Having almost fallen off a cliff, Next Science's share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Next Science currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Next Science (1 can't be ignored) you should be aware of.

If you're unsure about the strength of Next Science's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Next Science might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NXS

Next Science

Engages in the research, development, and commercialization of technologies that resolve the issues in human health caused by biofilms, incumbent bacteria, fungus, viruses, and infections in North America, Australia, and New Zealand.

Slight risk and slightly overvalued.

Market Insights

Community Narratives