We often see insiders buying up shares in companies that perform well over the long term. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So we'll take a look at whether insiders have been buying or selling shares in Micro-X Limited (ASX:MX1).

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Micro-X

The Last 12 Months Of Insider Transactions At Micro-X

Over the last year, we can see that the biggest insider purchase was by Independent Non Executive Chairman Patrick O'Brien for AU$230k worth of shares, at about AU$0.14 per share. Although we like to see insider buying, we note that this large purchase was at significantly below the recent price of AU$0.39. Because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

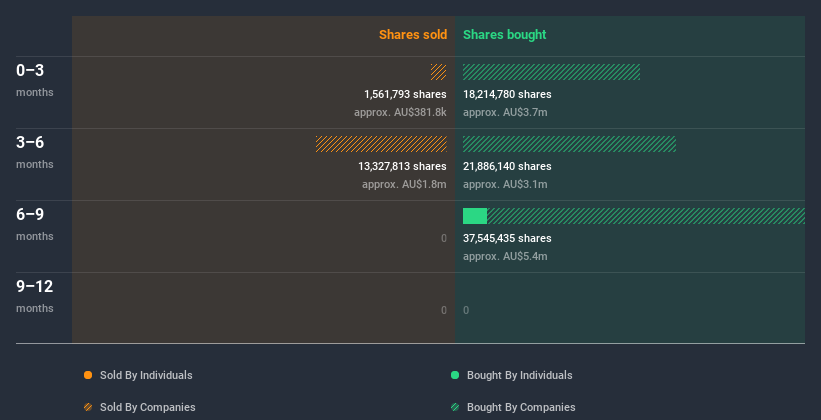

While Micro-X insiders bought shares during the last year, they didn't sell. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are always plenty of stocks that insiders are buying. So if that suits your style you could check each stock one by one or you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It appears that Micro-X insiders own 9.8% of the company, worth about AU$14m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

What Might The Insider Transactions At Micro-X Tell Us?

The fact that there have been no Micro-X insider transactions recently certainly doesn't bother us. However, our analysis of transactions over the last year is heartening. Insiders own shares in Micro-X and we see no evidence to suggest they are worried about the future. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For instance, we've identified 3 warning signs for Micro-X (1 doesn't sit too well with us) you should be aware of.

Of course Micro-X may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Micro-X or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:MX1

Micro-X

Designs, develops, manufactures, and commercializes imaging products for healthcare, defense, and security markets through cold cathode X-ray technology.

Exceptional growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026