Monash IVF Group Limited (ASX:MVF) will pay a dividend of A$0.025 on the 11th of October. This will take the dividend yield to an attractive 3.7%, providing a nice boost to shareholder returns.

View our latest analysis for Monash IVF Group

Monash IVF Group Is Paying Out More Than It Is Earning

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. However, prior to this announcement, Monash IVF Group's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Over the next year, EPS is forecast to grow rapidly. If recent patterns in the dividend continues, we would start to get a bit worried, with the payout ratio possibly reaching 194%.

Dividend Volatility

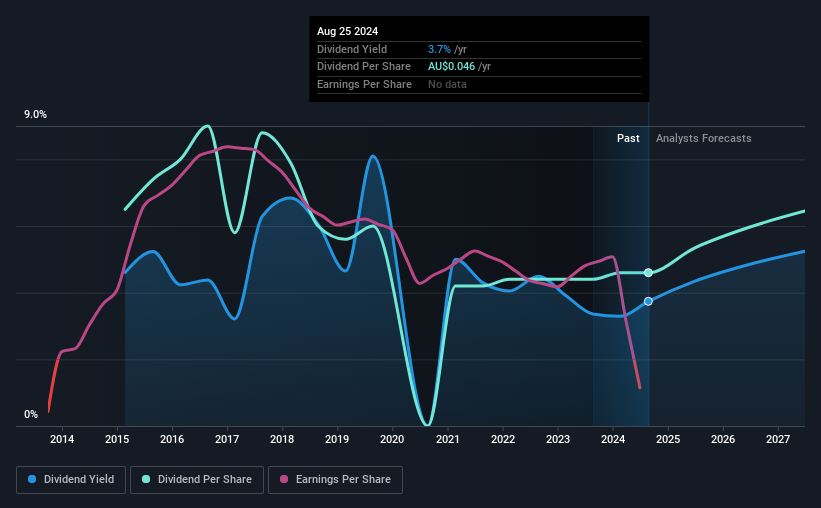

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The annual payment during the last 10 years was A$0.065 in 2014, and the most recent fiscal year payment was A$0.046. The dividend has shrunk at around 3.4% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Monash IVF Group's earnings per share has shrunk at 17% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On Monash IVF Group's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would probably look elsewhere for an income investment.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for Monash IVF Group that investors should know about before committing capital to this stock. Is Monash IVF Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MVF

Monash IVF Group

Engages in the provision of assisted reproductive and specialist women imaging services in Australia and Malaysia.

Very undervalued second-rate dividend payer.

Market Insights

Community Narratives