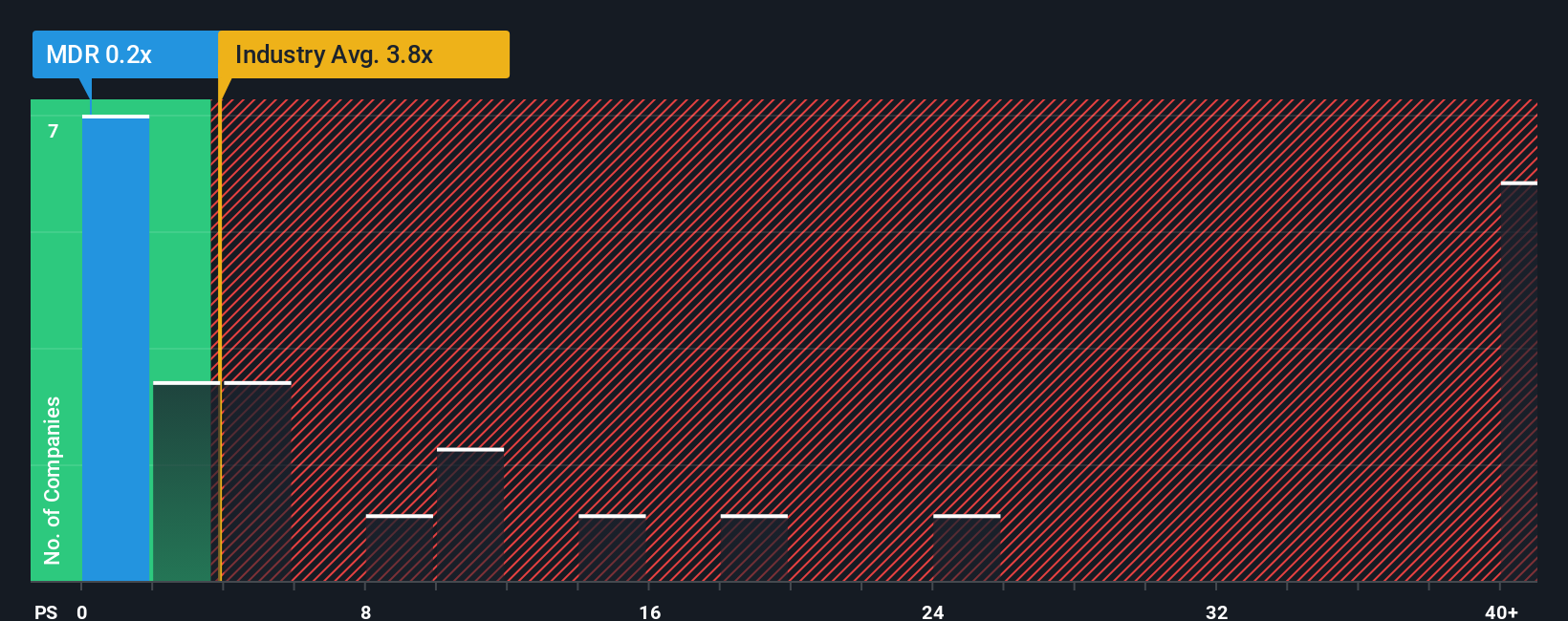

With a price-to-sales (or "P/S") ratio of 0.2x MedAdvisor Limited (ASX:MDR) may be sending very bullish signals at the moment, given that almost half of all the Healthcare Services companies in Australia have P/S ratios greater than 12.9x and even P/S higher than 135x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for MedAdvisor

How MedAdvisor Has Been Performing

MedAdvisor hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think MedAdvisor's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For MedAdvisor?

In order to justify its P/S ratio, MedAdvisor would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 36%. As a result, revenue from three years ago have also fallen 7.0% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 75% as estimated by the two analysts watching the company. With the industry predicted to deliver 491% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that MedAdvisor's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that MedAdvisor maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with MedAdvisor (at least 1 which is potentially serious), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on MedAdvisor, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:MDR

MedAdvisor

Provides pharmacy-driven patient engagement solutions in Australia, the United States, and the United Kingdom.

Undervalued with high growth potential.

Market Insights

Community Narratives