- Australia

- /

- Healthtech

- /

- ASX:M7T

Mach7 Technologies Limited (ASX:M7T) Held Back By Insufficient Growth Even After Shares Climb 32%

Mach7 Technologies Limited (ASX:M7T) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 36% over that time.

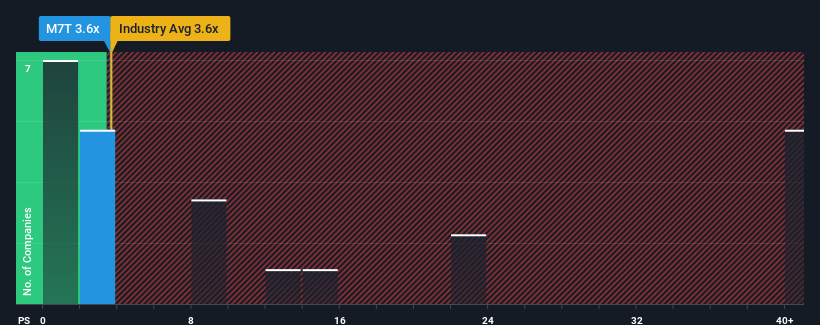

In spite of the firm bounce in price, Mach7 Technologies may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.6x, considering almost half of all companies in the Healthcare Services industry in Australia have P/S ratios greater than 10.3x and even P/S higher than 51x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Mach7 Technologies

How Has Mach7 Technologies Performed Recently?

Mach7 Technologies could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Mach7 Technologies.Is There Any Revenue Growth Forecasted For Mach7 Technologies?

The only time you'd be truly comfortable seeing a P/S as depressed as Mach7 Technologies' is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 3.1% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 53% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 23% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 36% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why Mach7 Technologies is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Mach7 Technologies' P/S

Mach7 Technologies' recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Mach7 Technologies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Mach7 Technologies you should know about.

If you're unsure about the strength of Mach7 Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:M7T

Mach7 Technologies

Develops and commercializes medical imaging and data management software solutions for healthcare organizations in North America, the Asia Pacific, the Middle East, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives