- Australia

- /

- Healthcare Services

- /

- ASX:HLA

We're Not So Sure You Should Rely on Healthia's (ASX:HLA) Statutory Earnings

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Healthia (ASX:HLA).

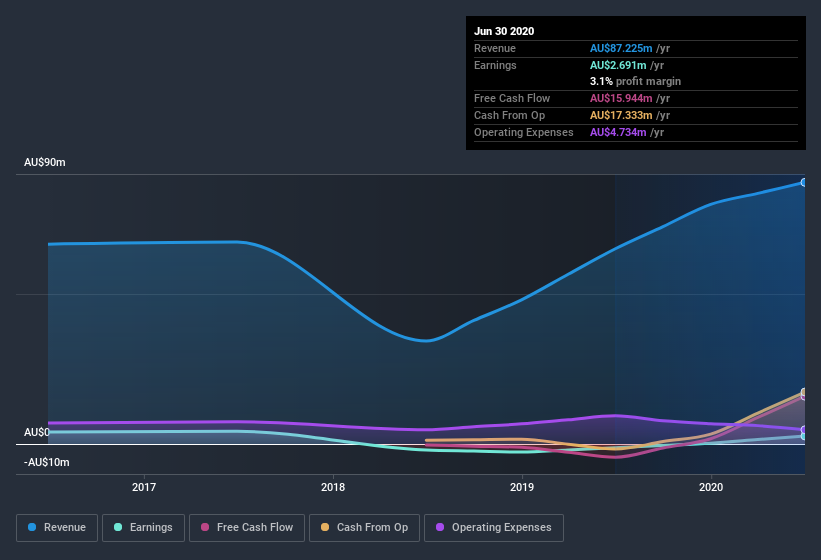

While Healthia was able to generate revenue of AU$87.2m in the last twelve months, we think its profit result of AU$2.69m was more important.

See our latest analysis for Healthia

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. So this article aims to better understand Healthia's underlying earnings power by taking a look at how dilution, and unusual items are impacting it, and considering how well those paper profits are being converted into cash flow. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Examining Cashflow Against Healthia's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Over the twelve months to June 2020, Healthia recorded an accrual ratio of -0.18. Therefore, its statutory earnings were very significantly less than its free cashflow. In fact, it had free cash flow of AU$16m in the last year, which was a lot more than its statutory profit of AU$2.69m. Given that Healthia had negative free cash flow in the prior corresponding period, the trailing twelve month resul of AU$16m would seem to be a step in the right direction. However, that's not the end of the story. We can look at how unusual items in the profit and loss statement impacted its accrual ratio, as well as explore how dilution is impacting shareholders negatively.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Healthia issued 18% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Healthia's historical EPS growth by clicking on this link.

How Is Dilution Impacting Healthia's Earnings Per Share? (EPS)

We don't have any data on the company's profits from three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. So you can see that the dilution has had a bit of an impact on shareholders. Therefore, the dilution is having a noteworthy influence on shareholder returns. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Healthia's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

The Impact Of Unusual Items On Profit

While the accrual ratio might bode well, we also note that Healthia's profit was boosted by unusual items worth AU$5.2m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Healthia's positive unusual items were quite significant relative to its profit in the year to June 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Healthia's Profit Performance

Summing up, Healthia's accrual ratio suggests that its statutory earnings are well matched by cash flow while its unusual items boosted the profit in a way that might not be repeated. Meanwhile, the dilution was a negative for shareholders. Based on these factors, we think that Healthia's statutory profits probably make it seem better than it is on an underlying level. If you want to do dive deeper into Healthia, you'd also look into what risks it is currently facing. For instance, we've identified 6 warning signs for Healthia (1 is concerning) you should be familiar with.

Our examination of Healthia has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Healthia, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Healthia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:HLA

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives