Stock Analysis

- Australia

- /

- Medical Equipment

- /

- ASX:EMV

3 ASX Penny Stocks With Market Caps Under A$200M To Consider

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, although it is up 22% over the past year with earnings expected to grow by 12% per annum over the next few years. The term 'penny stocks' might feel like a relic of past market eras, but they still represent potential value and growth opportunities for investors when paired with strong financials. In this article, we'll explore three penny stocks that stand out for their financial strength and potential in today's evolving market landscape.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.57 | A$66.82M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$126.84M | ★★★★☆☆ |

| MaxiPARTS (ASX:MXI) | A$1.825 | A$100.95M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| Helloworld Travel (ASX:HLO) | A$1.85 | A$298M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.715 | A$1.95B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.135 | A$58.82M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.47 | A$92.11M | ★★★★★★ |

| Joyce (ASX:JYC) | A$3.90 | A$115.04M | ★★★★★★ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

We'll examine a selection from our screener results.

Carnaby Resources (ASX:CNB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Carnaby Resources Limited, along with its subsidiaries, focuses on the exploration and development of mineral properties in Australia and has a market cap of A$67.06 million.

Operations: Carnaby Resources Limited does not report any specific revenue segments as it is primarily engaged in the exploration and development of mineral properties in Australia.

Market Cap: A$67.06M

Carnaby Resources, with a market cap of A$67.06 million, remains pre-revenue and unprofitable, reporting a net loss of A$12.09 million for the year ending June 2024. Despite trading significantly below its estimated fair value, the company faces challenges such as shareholder dilution and limited cash runway under one year. Positively, Carnaby is debt-free with short-term assets exceeding liabilities and an experienced board averaging five years tenure. However, recent removal from the S&P Global BMI Index could impact investor sentiment as it navigates financial hurdles while focusing on mineral exploration in Australia.

- Unlock comprehensive insights into our analysis of Carnaby Resources stock in this financial health report.

- Review our growth performance report to gain insights into Carnaby Resources' future.

EMVision Medical Devices (ASX:EMV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EMVision Medical Devices Ltd focuses on the research, development, and commercialization of neurodiagnostic technology for stroke diagnosis and monitoring, along with other medical imaging needs in Australia, with a market cap of A$175.31 million.

Operations: The company generates revenue primarily from the research and development of medical device technology, amounting to A$11.22 million.

Market Cap: A$175.31M

EMVision Medical Devices Ltd, with a market cap of A$175.31 million, is pre-revenue and unprofitable but has demonstrated revenue growth to A$11.56 million for the year ending June 2024. The company recently launched its First Responder Proof of Concept device for stroke diagnosis in ambulances, highlighting its innovative approach in medical imaging. Despite shareholder dilution and negative return on equity at -14.74%, EMVision maintains a strong cash position exceeding short-term liabilities and has a sufficient cash runway for over two years if current free cash flow trends continue, supported by an experienced management team averaging 2.7 years tenure.

- Navigate through the intricacies of EMVision Medical Devices with our comprehensive balance sheet health report here.

- Gain insights into EMVision Medical Devices' historical outcomes by reviewing our past performance report.

Teaminvest Private Group (ASX:TIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teaminvest Private Group Limited is a private equity firm focused on middle market and mature companies through buyout and growth capital transactions, with a market cap of A$42.09 million.

Operations: The company's revenue is primarily derived from its Equity segment, which accounts for A$98.82 million, followed by the Education & Corporate segment at A$4.23 million and the Wealth segment at A$3.04 million.

Market Cap: A$42.09M

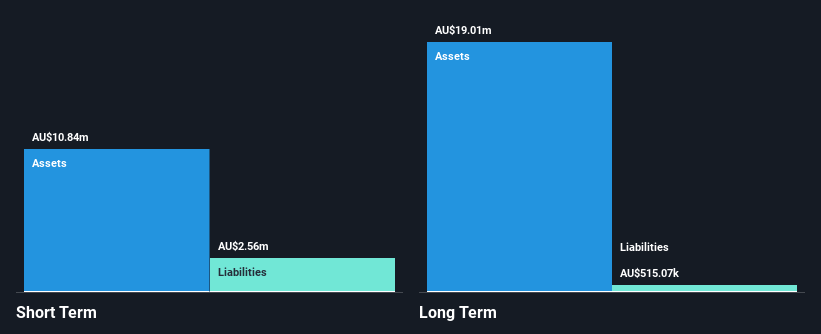

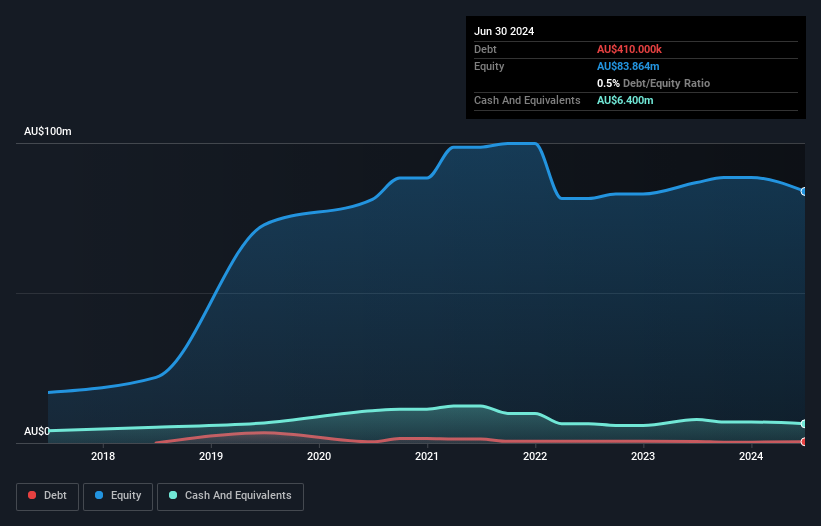

Teaminvest Private Group Limited, with a market cap of A$42.09 million, is unprofitable but maintains financial stability with short-term assets of A$40.6 million exceeding both short-term and long-term liabilities. The firm has reduced its debt to equity ratio significantly over five years, now at 0.5%, and has more cash than total debt. Despite negative return on equity at -1.47% and increasing losses over the past five years, the company declared a fully-franked final dividend of 1.50 cents per share in August 2024, reflecting confidence in its cash flow which covers debt well beyond requirements.

- Click here and access our complete financial health analysis report to understand the dynamics of Teaminvest Private Group.

- Understand Teaminvest Private Group's track record by examining our performance history report.

Turning Ideas Into Actions

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,024 more companies for you to explore.Click here to unveil our expertly curated list of 1,027 ASX Penny Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMVision Medical Devices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EMV

EMVision Medical Devices

Engages in the research, development, and commercialization of neurodiagnostic technology for stroke diagnosis and monitoring, and other medical imaging needs in Australia.