- Australia

- /

- Healthtech

- /

- ASX:BMT

A Piece Of The Puzzle Missing From Beamtree Holdings Limited's (ASX:BMT) 40% Share Price Climb

Beamtree Holdings Limited (ASX:BMT) shareholders have had their patience rewarded with a 40% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 50% in the last year.

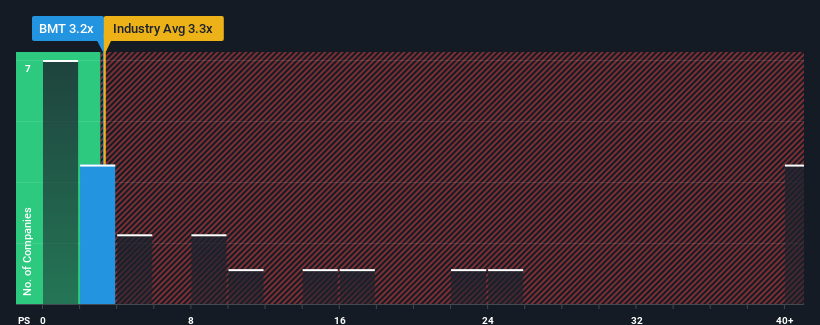

Even after such a large jump in price, Beamtree Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.2x, considering almost half of all companies in the Healthcare Services industry in Australia have P/S ratios greater than 5.4x and even P/S higher than 22x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Beamtree Holdings

How Beamtree Holdings Has Been Performing

Recent times haven't been great for Beamtree Holdings as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beamtree Holdings.How Is Beamtree Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Beamtree Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. The latest three year period has also seen an excellent 236% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 27% per year during the coming three years according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 25% per year, which is not materially different.

In light of this, it's peculiar that Beamtree Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift Beamtree Holdings' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Beamtree Holdings' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Beamtree Holdings you should be aware of.

If these risks are making you reconsider your opinion on Beamtree Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beamtree Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:BMT

Beamtree Holdings

Provides artificial intelligence-based decision support software and data insight solutions, and other software services to the healthcare industry in Australia and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives