ASX Value Stocks Trading Below Estimated Worth In October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has remained flat, but it has seen an impressive rise of 18% over the past year, with earnings forecasted to grow by 12% annually. In this context of steady growth and promising forecasts, identifying stocks that are trading below their estimated worth can offer potential opportunities for investors seeking value in the current market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DroneShield (ASX:DRO) | A$1.345 | A$2.68 | 49.9% |

| Charter Hall Group (ASX:CHC) | A$15.81 | A$31.43 | 49.7% |

| Genesis Minerals (ASX:GMD) | A$2.01 | A$3.92 | 48.7% |

| Ingenia Communities Group (ASX:INA) | A$4.95 | A$9.42 | 47.4% |

| MedAdvisor (ASX:MDR) | A$0.425 | A$0.85 | 50% |

| Little Green Pharma (ASX:LGP) | A$0.085 | A$0.17 | 49.8% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| IperionX (ASX:IPX) | A$3.52 | A$6.76 | 47.9% |

| Superloop (ASX:SLC) | A$1.735 | A$3.31 | 47.6% |

| Mineral Resources (ASX:MIN) | A$51.23 | A$95.56 | 46.4% |

Underneath we present a selection of stocks filtered out by our screen.

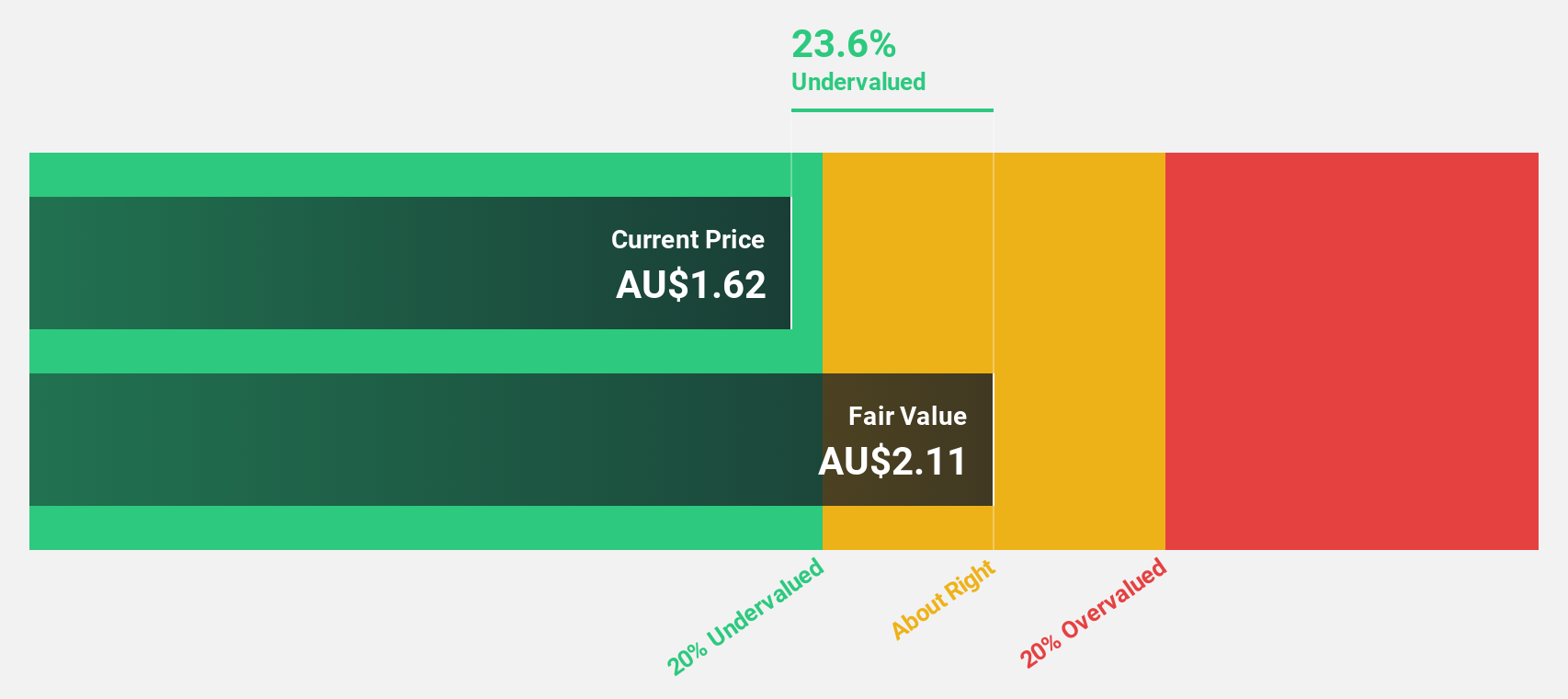

Life360 (ASX:360)

Overview: Life360, Inc. operates a technology platform for locating people, pets, and things across various regions including North America, Europe, the Middle East, Africa, and internationally with a market cap of A$4.48 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $328.68 million.

Estimated Discount To Fair Value: 29.6%

Life360 appears undervalued based on discounted cash flow analysis, trading at A$20 against an estimated fair value of A$28.42. The company is expected to achieve profitability within three years, with revenue projected to grow at 15.7% annually, outpacing the broader Australian market. Recent product enhancements and partnerships could bolster future revenue streams despite current net losses. However, shareholder dilution has occurred over the past year, which investors should consider when evaluating its potential value proposition.

- Upon reviewing our latest growth report, Life360's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Life360 with our detailed financial health report.

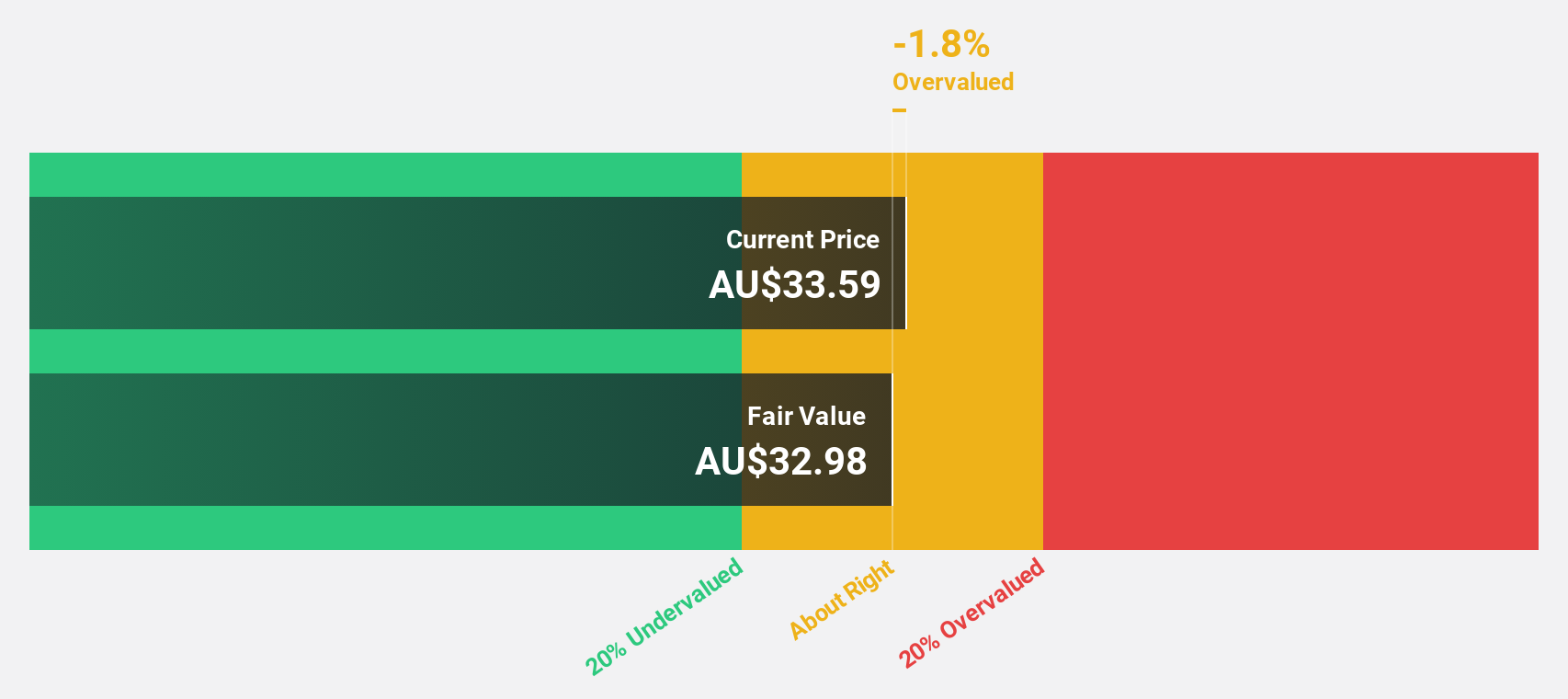

Ansell (ASX:ANN)

Overview: Ansell Limited is a global company that designs, sources, develops, manufactures, distributes, and sells hand and body protection solutions across various regions including the Asia Pacific, Europe, the Middle East, Africa, Latin America, the Caribbean, and North America with a market cap of A$4.72 billion.

Operations: The company's revenue segments consist of $834.20 million from Healthcare and $785.10 million from Industrial, including Specialty Markets.

Estimated Discount To Fair Value: 43.5%

Ansell is trading at A$32.65, significantly below its estimated fair value of A$57.77, suggesting it may be undervalued based on discounted cash flow analysis. Earnings are forecast to grow 22.5% annually, outpacing the Australian market's 12.2%. Despite a decline in profit margins from 9% to 4.7%, revenue growth is expected at 6.7% per year, faster than the market average of 5.5%. Recent earnings show reduced net income and shareholder dilution concerns remain relevant.

- Insights from our recent growth report point to a promising forecast for Ansell's business outlook.

- Get an in-depth perspective on Ansell's balance sheet by reading our health report here.

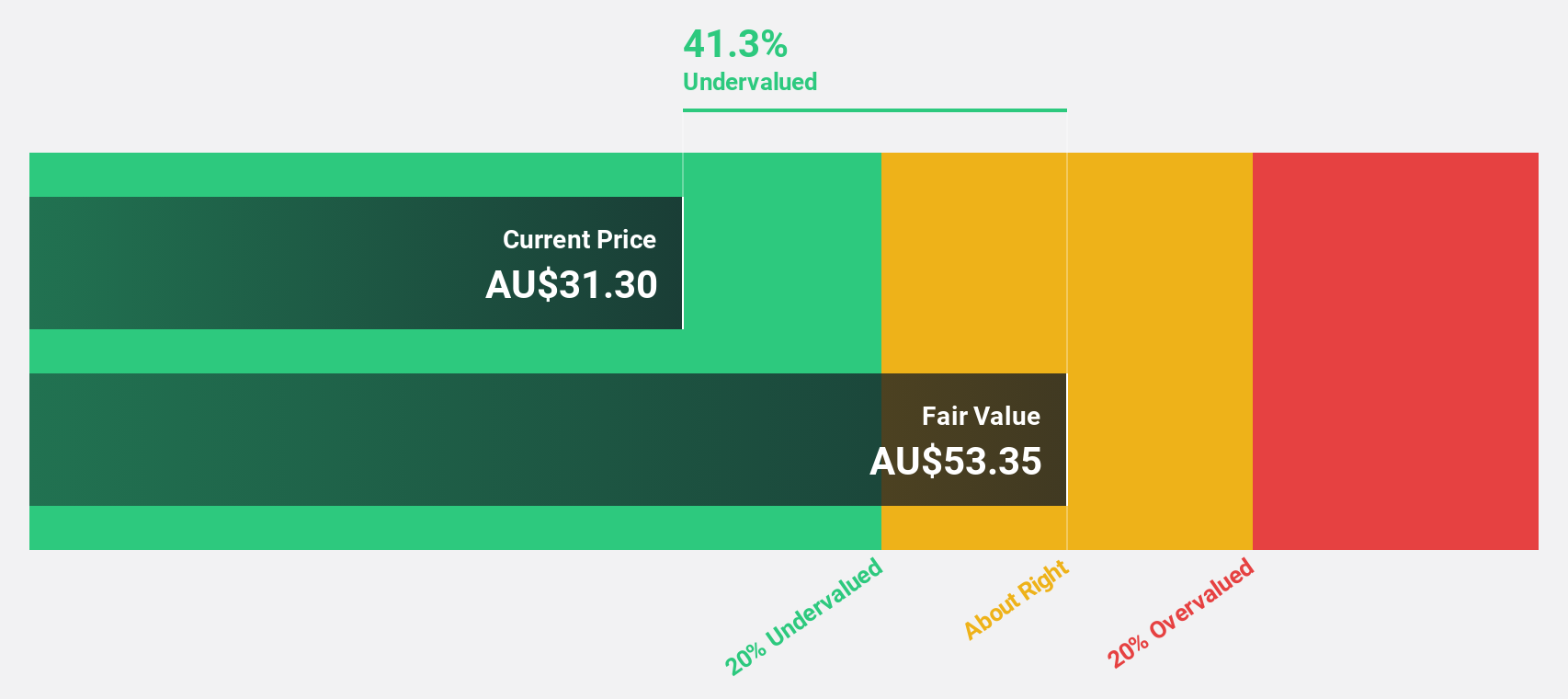

Judo Capital Holdings (ASX:JDO)

Overview: Judo Capital Holdings Limited operates through its subsidiaries to provide a range of banking products and services tailored for small and medium businesses in Australia, with a market capitalization of A$1.89 billion.

Operations: The company's revenue from banking products and services for small and medium businesses in Australia amounts to A$326.60 million.

Estimated Discount To Fair Value: 24.2%

Judo Capital Holdings is trading at A$1.69, below its estimated fair value of A$2.23, highlighting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 26.5% annually, surpassing the Australian market's 12.2%. However, the company faces challenges with a high bad loans ratio of 2.8% and a low allowance for bad loans (50%). Recent earnings show net income decreased to A$69.9 million from A$73.4 million last year.

- According our earnings growth report, there's an indication that Judo Capital Holdings might be ready to expand.

- Take a closer look at Judo Capital Holdings' balance sheet health here in our report.

Key Takeaways

- Reveal the 48 hidden gems among our Undervalued ASX Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:JDO

Judo Capital Holdings

Through its subsidiaries, engages in the provision of various banking products and services for small and medium businesses in Australia.

Reasonable growth potential with mediocre balance sheet.