- Australia

- /

- Capital Markets

- /

- ASX:AEF

Undiscovered Gems in Australia to Explore This November 2025

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has experienced a 1.5% decline, yet it remains up by 9.4% over the past year with earnings forecasted to grow by 12% annually. In this context, identifying promising stocks involves looking for companies that not only show resilience in fluctuating conditions but also possess strong growth potential and solid fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Fiducian Group | NA | 10.00% | 9.57% | ★★★★★★ |

| Joyce | NA | 9.93% | 17.54% | ★★★★★★ |

| Euroz Hartleys Group | NA | 1.82% | -25.32% | ★★★★★★ |

| Hearts and Minds Investments | NA | 56.27% | 59.19% | ★★★★★★ |

| Focus Minerals | NA | 75.35% | 51.34% | ★★★★★★ |

| Djerriwarrh Investments | 2.39% | 8.18% | 7.91% | ★★★★★★ |

| Energy World | NA | -47.50% | -44.86% | ★★★★★☆ |

| Zimplats Holdings | 5.44% | -9.79% | -42.03% | ★★★★★☆ |

| Australian United Investment | 1.90% | 5.23% | 4.56% | ★★★★☆☆ |

| Reef Casino Trust | 19.84% | 6.96% | 10.88% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Value Rating: ★★★★★★

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$790.54 million.

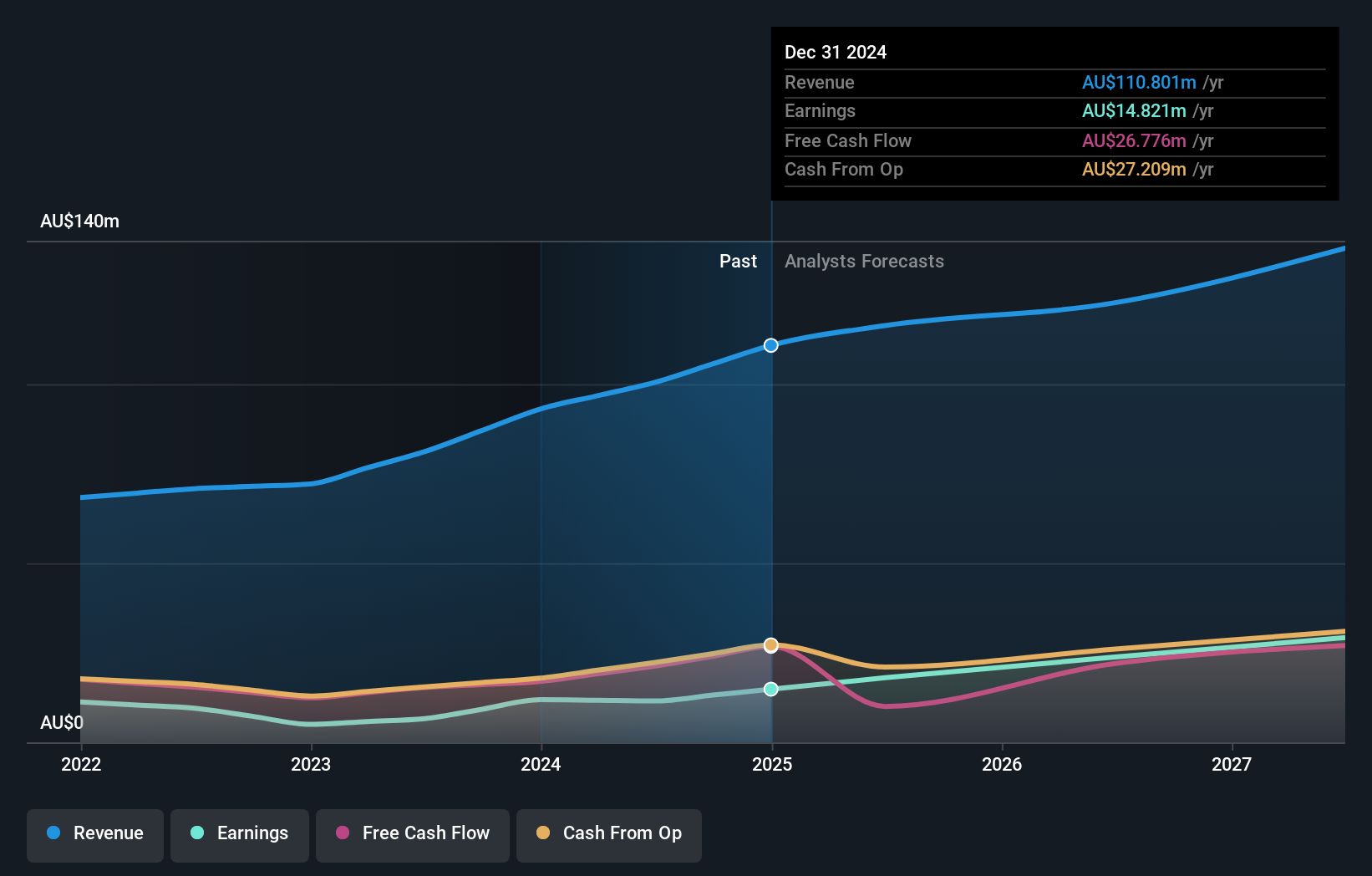

Operations: Australian Ethical Investment Ltd generates revenue primarily from its funds management segment, amounting to A$119.38 million.

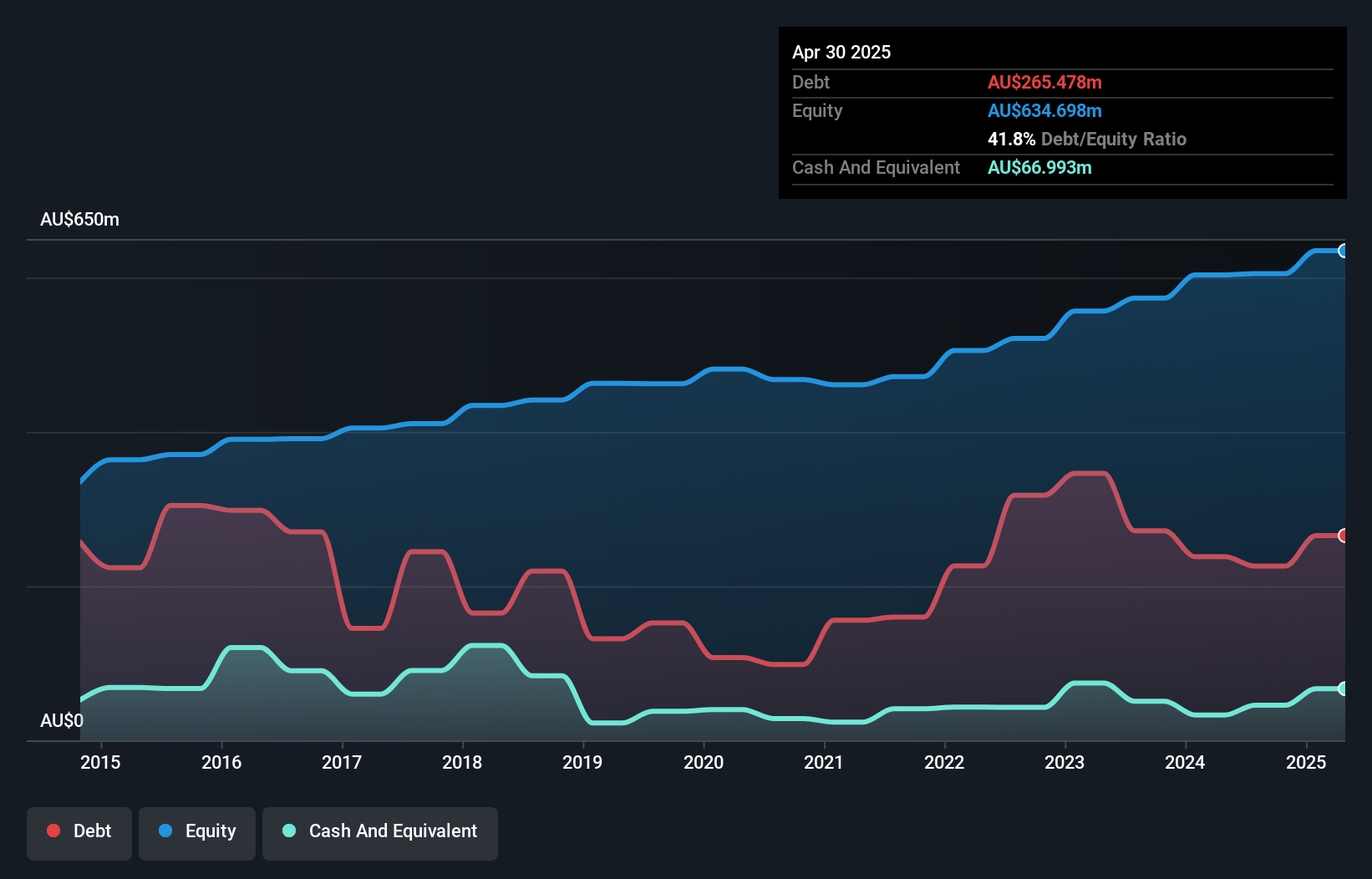

Australian Ethical Investment stands out with its robust earnings growth of 75.1% over the past year, surpassing the industry average of 19.3%. The firm reported a net income of A$20.2 million for the fiscal year ending June 2025, up from A$11.53 million previously, reflecting its strong financial performance and strategic positioning in ethical investing. With no debt on its balance sheet and high-quality earnings, Australian Ethical is well-poised to capitalize on rising demand for sustainable investments and digital platforms, despite facing potential headwinds like regulatory pressures and fee compression that could affect future profitability.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Catalyst Metals Limited is an Australian company focused on mineral exploration and evaluation, with a market capitalization of A$1.81 billion.

Operations: Catalyst Metals Limited generates revenue primarily from its operations in Western Australia, amounting to A$361.41 million.

Catalyst Metals, a dynamic player in the mining sector, has shown impressive growth with earnings soaring by 394.9% over the past year, significantly outpacing the industry average of 10.6%. The company boasts a robust financial position with more cash than its total debt and an impressive EBIT coverage of interest payments at 81 times. Recently added to major indices like S&P/ASX 200 and S&P Global BMI Index, Catalyst reported net income of A$119.27 million for the year ending June 2025, up from A$23.56 million previously. This underscores its potential as a compelling investment opportunity in Australia's resource-rich landscape.

Ricegrowers (ASX:SGLLV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ricegrowers Limited is a rice food company with operations spanning Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America and has a market cap of approximately A$1.11 billion.

Operations: Ricegrowers Limited derives its revenue primarily from the International Rice segment, contributing A$860.96 million, and the Rice Pool segment, with A$481.87 million. The Cop Rice and Riviana segments also add to its revenue streams with A$250.64 million and A$231.14 million respectively. The company's net profit margin is a key metric to consider when evaluating its financial performance over time.

Ricegrowers, with its focus on premium and health-oriented products, is making strides in high-growth markets like the Middle East and the U.S. The company has launched over 40 new products to boost profit margins and is investing in agritech for cost savings. Its net debt to equity ratio stands at a satisfactory 31.3%, while earnings have grown 23% annually over five years. Recent additions to key indices highlight its growing market presence, though challenges such as competition and crop yield issues remain. Currently trading at A$15.28, it appears fairly valued against a consensus target of A$14.00.

Next Steps

- Delve into our full catalog of 58 ASX Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:AEF

Australian Ethical Investment

Australian Ethical Investment Ltd is a publicly owned investment manager.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives