Stock Analysis

As the ASX200 shows modest gains and the industrials sector leads with a notable increase, the Australian market presents a dynamic landscape for investors in May 2024. Amid these fluctuations, dividend stocks remain a focal point for those seeking potential stability and consistent returns in their investment portfolios. In light of current market conditions, identifying stocks with robust dividends can be particularly appealing as they may offer both income and a degree of insulation against market volatility.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 6.67% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.82% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 4.55% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.74% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.69% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.56% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 7.53% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.22% | ★★★★★☆ |

| Ricegrowers (ASX:SGLLV) | 7.91% | ★★★★☆☆ |

| New Hope (ASX:NHC) | 9.15% | ★★★★☆☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited, trading as SGLLV on the ASX, is a rice food company with operations in Australia and internationally, boasting a market capitalization of approximately A$447.41 million.

Operations: Ricegrowers Limited generates revenue through various segments, including Riviana at A$219.12 million, Cop Rice at A$253.52 million, Rice Food at A$115.93 million, Rice Pool at A$487 million, and International Rice at A$821.54 million.

Dividend Yield: 7.9%

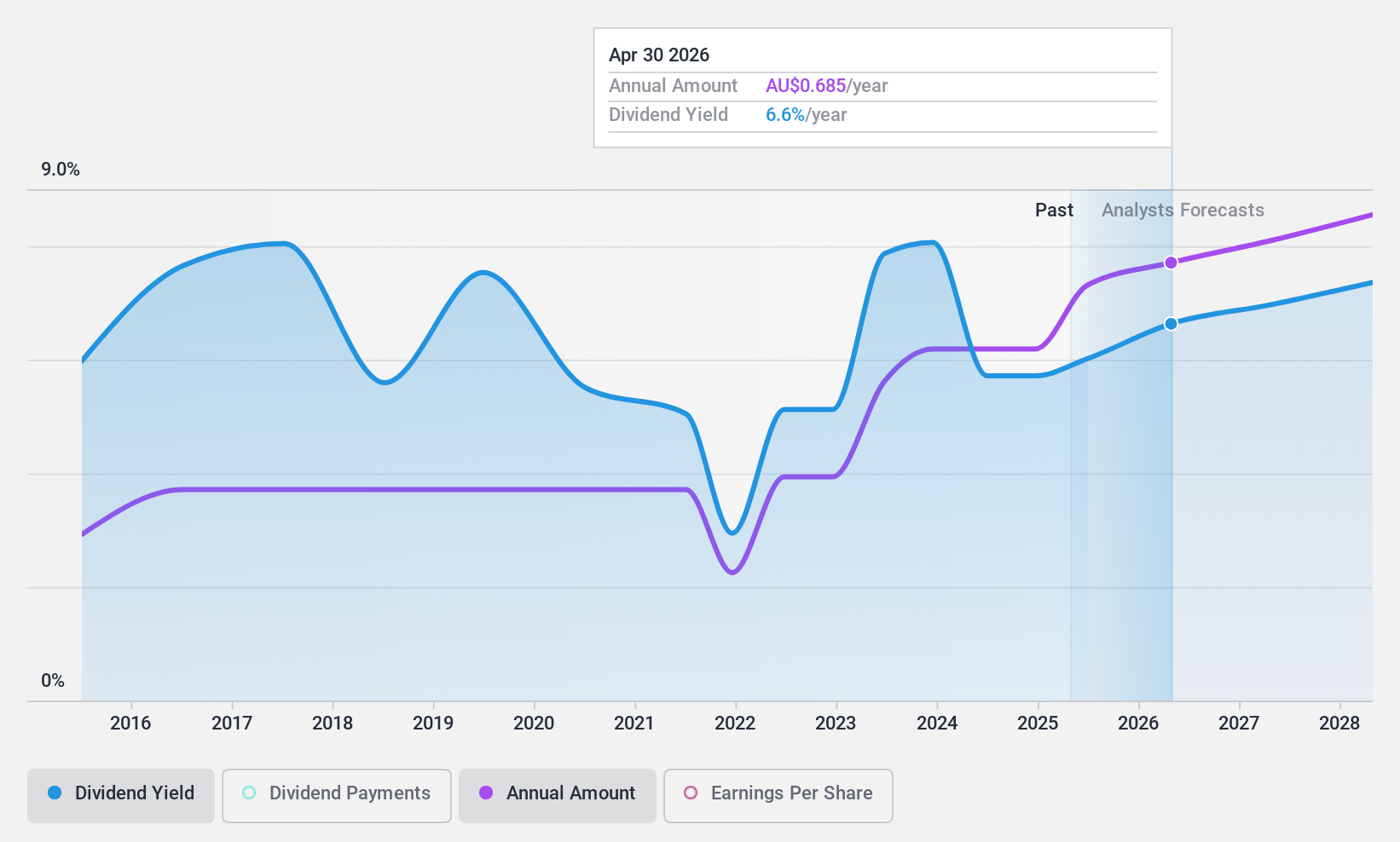

Ricegrowers, trading at A$52.2% below its fair value, offers a dividend yield of 7.91%, ranking in the top 25% in the Australian market. Despite a less than decade-long dividend history marked by volatility, its dividends are well-supported with a payout ratio of 53.9% and a cash payout ratio of 43.1%. Earnings have expanded by an annual rate of 16.2% over the past five years, with future growth projected at 4.32% per year, reinforcing the sustainability of its dividends amidst an unstable track record.

- Navigate through the intricacies of Ricegrowers with our comprehensive dividend report here.

- Our expertly prepared valuation report Ricegrowers implies its share price may be lower than expected.

nib holdings (ASX:NHF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nib Holdings Limited operates as a provider of private health insurance for residents, international students, and visitors in Australia and New Zealand, with a market capitalization of approximately A$3.71 billion.

Operations: Nib Holdings Limited generates revenue through several key segments: Australian Residents Health Insurance (A$2.55 billion), New Zealand Insurance (A$351.90 million), NIB Travel (A$109.10 million), International (Inbound) Health Insurance (A$173.20 million), and Nib Thrive (A$38 million).

Dividend Yield: 3.9%

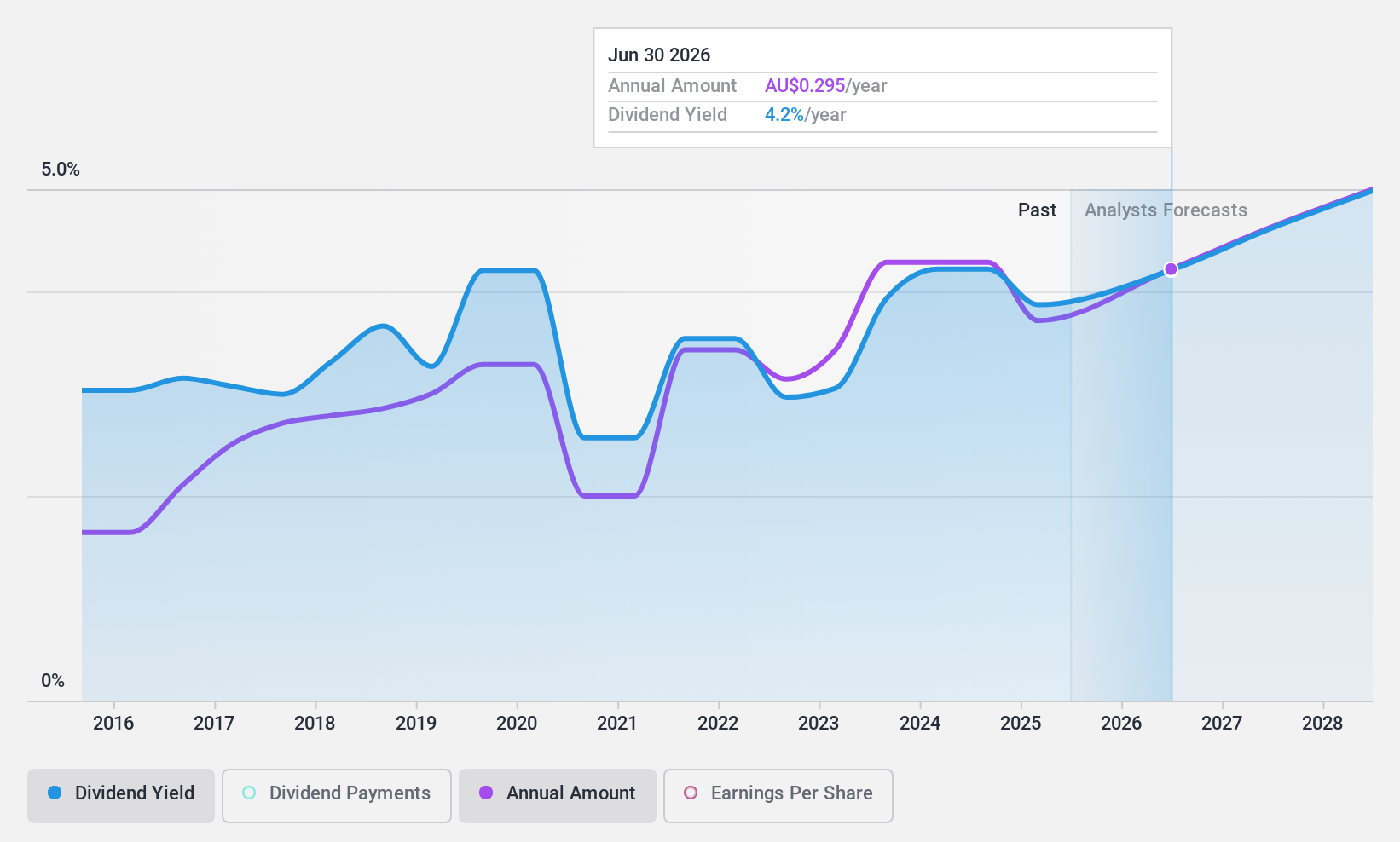

nib holdings, currently undervalued by 36%, reported a net income increase to A$106.4 million from A$89.2 million year-over-year, with earnings per share rising to A$0.22 from A$0.191. Despite this growth, its dividend track record over the past decade has been marked by instability and volatility, with significant annual fluctuations exceeding 20%. The dividends are moderately covered by earnings and cash flows, with payout ratios of 67.5% and 57.9%, respectively; however, its yield of 3.92% is low compared to the market's top quartile at 6.25%.

- Dive into the specifics of nib holdings here with our thorough dividend report.

- According our valuation report, there's an indication that nib holdings' share price might be on the cheaper side.

Korvest (ASX:KOV)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Korvest Ltd operates in Australia, specializing in hot dip galvanizing and sheet metal fabrication, with a market capitalization of approximately A$103.82 million.

Operations: Korvest Ltd generates revenue primarily through its production and industrial products segments, totaling A$10.17 million and A$96.07 million respectively.

Dividend Yield: 6.7%

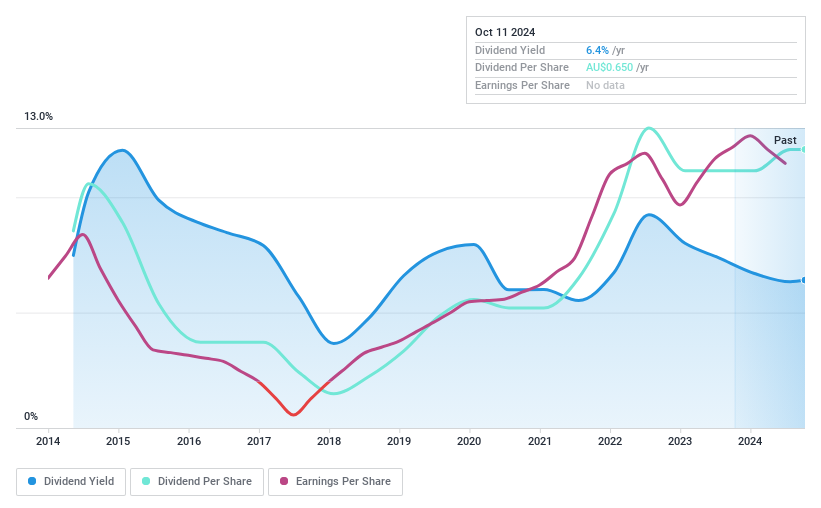

Korvest offers a dividend yield of 6.75%, positioning it above the Australian market's top quartile average of 6.25%. Its dividends are well-supported with a payout ratio of 56.3% and a cash payout ratio of 51.2%, indicating sustainability from both earnings and cash flow perspectives. Over the past decade, however, Korvest has experienced fluctuations in dividend payments, reflecting some instability and unreliability in its distribution pattern despite an overall increase in dividend amounts during this period. The stock is currently trading at a 17% discount to its estimated fair value, suggesting potential undervaluation.

- Click here to discover the nuances of Korvest with our detailed analytical dividend report.

- The analysis detailed in our Korvest valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Get an in-depth perspective on all 29 Top Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Ricegrowers is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SGLLV

Ricegrowers

Operates as a rice food company in Australia and internationally.

Flawless balance sheet, undervalued and pays a dividend.