- Australia

- /

- Medical Equipment

- /

- ASX:NAN

Top 3 ASX Stocks Estimated To Be Undervalued In July 2024

Reviewed by Simply Wall St

As the ASX200 shows signs of recovery, with sectors like Materials and Real Estate posting gains, investors might find it an opportune time to look for value in the market. Amidst these fluctuations, identifying stocks that appear undervalued could be a strategic move for those looking to potentially capitalize on market adjustments.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MaxiPARTS (ASX:MXI) | A$2.00 | A$3.94 | 49.3% |

| Ansell (ASX:ANN) | A$27.00 | A$51.43 | 47.5% |

| Count (ASX:CUP) | A$0.615 | A$1.17 | 47.6% |

| ReadyTech Holdings (ASX:RDY) | A$3.20 | A$6.19 | 48.3% |

| IPH (ASX:IPH) | A$5.96 | A$11.72 | 49.1% |

| hipages Group Holdings (ASX:HPG) | A$1.055 | A$2.06 | 48.7% |

| VEEM (ASX:VEE) | A$1.825 | A$3.54 | 48.5% |

| Red 5 (ASX:RED) | A$0.375 | A$0.74 | 49.6% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| EVT (ASX:EVT) | A$11.03 | A$21.20 | 48% |

Here's a peek at a few of the choices from the screener.

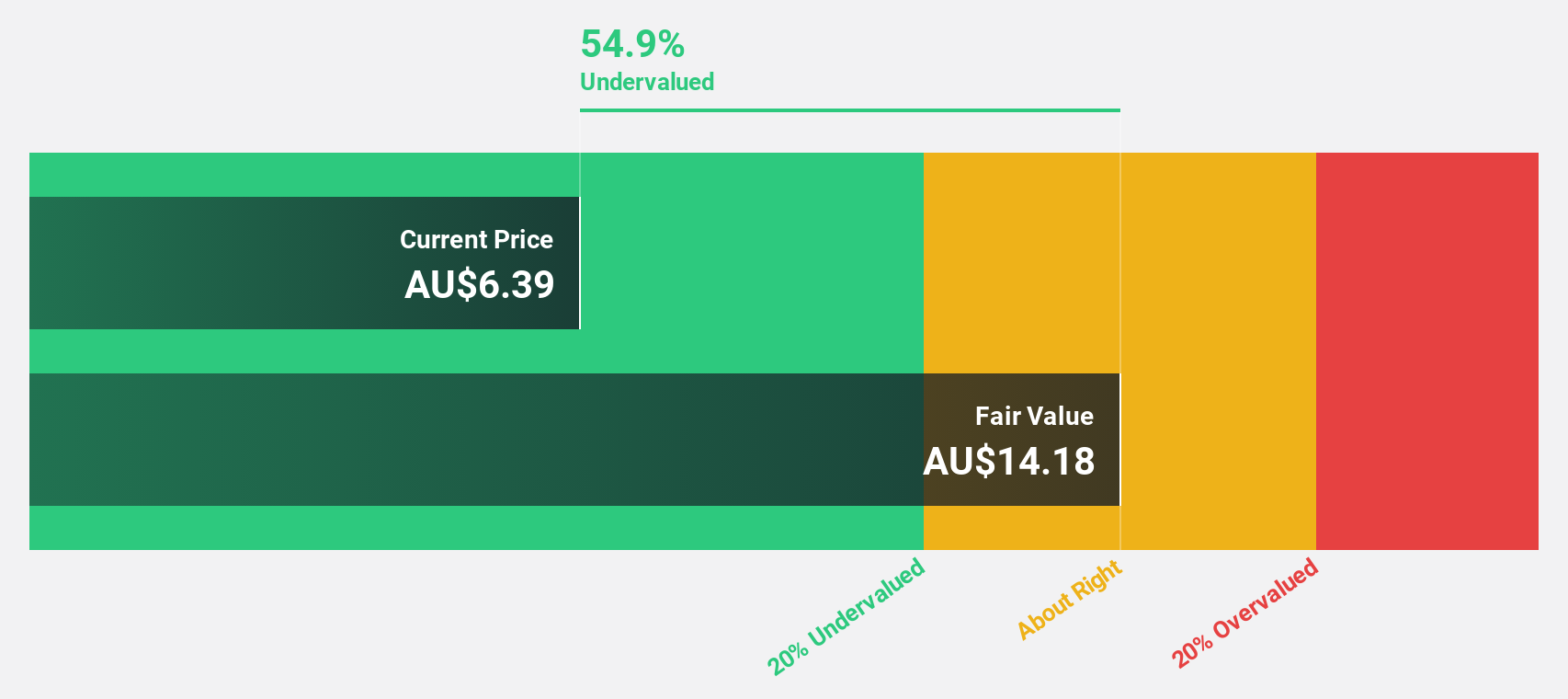

Elders (ASX:ELD)

Overview: Elders Limited is a company that offers agricultural products and services mainly to rural and regional areas in Australia, with a market capitalization of approximately A$1.46 billion.

Operations: The company generates revenue through its Branch Network (A$2.54 billion), Wholesale Products (A$341.19 million), and Feed and Processing Services (A$120.14 million).

Estimated Discount To Fair Value: 43.3%

Elders Limited, currently trading at A$9.24, is valued below our estimated fair value of A$16.28, indicating a potential undervaluation based on discounted cash flow analysis. Despite this, challenges persist as the dividend yield of 3.9% is poorly supported by earnings, and profit margins have decreased from last year's 3.4% to 2.1%. Nevertheless, Elders anticipates significant earnings growth over the next three years at an annual rate of 22.8%, outpacing the Australian market forecast of 13.2%.

- Our expertly prepared growth report on Elders implies its future financial outlook may be stronger than recent results.

- Take a closer look at Elders' balance sheet health here in our report.

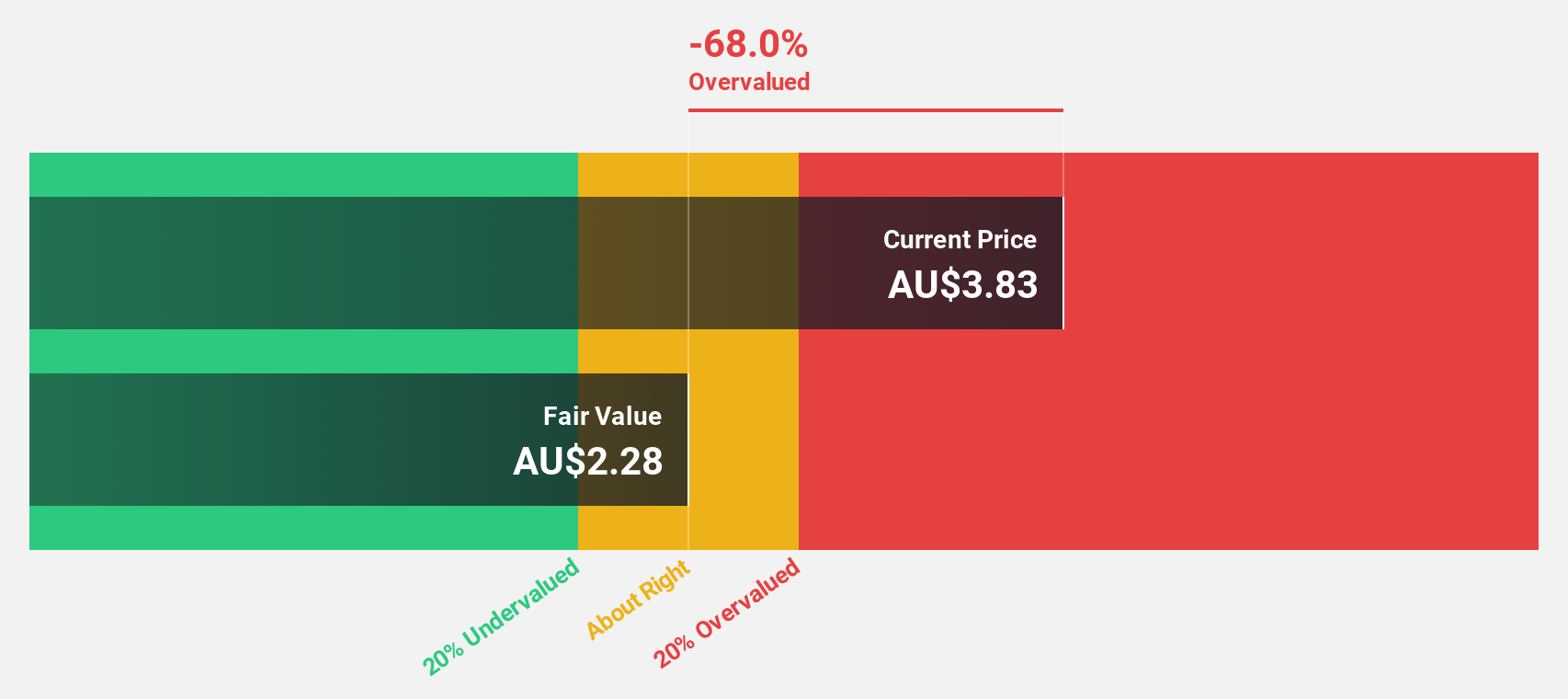

Kelsian Group (ASX:KLS)

Overview: Kelsian Group Limited operates in the provision of land and marine transport and tourism services across Australia, the United States, Singapore, and the United Kingdom, with a market capitalization of approximately A$1.35 billion.

Operations: The company's revenue is divided into three primary segments: Australian Bus operations generating A$934.76 million, International Bus services contributing A$448.87 million, and Marine and Tourism activities accounting for A$337.90 million.

Estimated Discount To Fair Value: 22.6%

Kelsian Group Limited, priced at A$5.01, is trading significantly below our fair value estimate of A$6.47, reflecting a notable undervaluation based on discounted cash flow metrics. Despite this potential for price appreciation, the company's financial health raises concerns; interest payments are poorly covered by earnings and its dividend yield of 3.49% is similarly unsupported by free cash flows. Additionally, while Kelsian's revenue growth projections are modest at 5.6% annually, its earnings are expected to surge by 25.53% per year over the next three years, outperforming the broader Australian market forecast of 13.2%. However, current profit margins have declined to 1.7%, down from last year’s 3.8%.

- Insights from our recent growth report point to a promising forecast for Kelsian Group's business outlook.

- Click here to discover the nuances of Kelsian Group with our detailed financial health report.

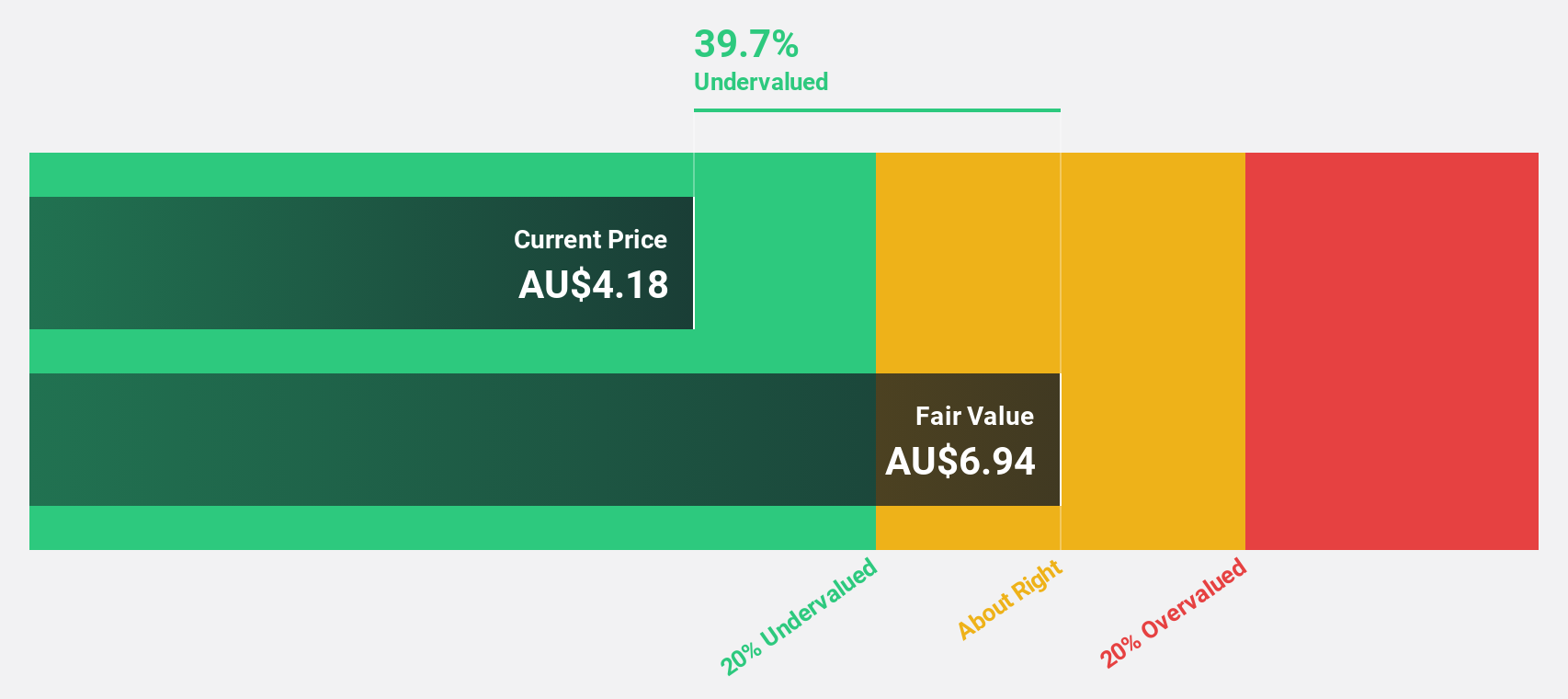

Nanosonics (ASX:NAN)

Overview: Nanosonics Limited, along with its subsidiaries, is an infection prevention company operating both in Australia and internationally, with a market capitalization of approximately A$909 million.

Operations: The company generates its revenue primarily from the healthcare equipment segment, totaling A$164.07 million.

Estimated Discount To Fair Value: 42.5%

Nanosonics, currently priced at A$3, is valued below our calculated fair value of A$5.21, indicating a potential undervaluation based on discounted cash flow analysis. The company's earnings have increased by 53.2% over the past year and are projected to grow by 22.6% annually over the next three years, outpacing the Australian market's forecast growth. Despite these positives, significant insider selling in recent months and a forecasted low return on equity of 12.4% in three years may raise concerns for potential investors.

- Our earnings growth report unveils the potential for significant increases in Nanosonics' future results.

- Dive into the specifics of Nanosonics here with our thorough financial health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 45 Undervalued ASX Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanosonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NAN

Flawless balance sheet with reasonable growth potential.