Stock Analysis

- Australia

- /

- Construction

- /

- ASX:NWH

Elders Leads Three Undervalued Small Caps With Insider Actions In Australia

Reviewed by Simply Wall St

In the past year, the Australian market has shown a robust performance with a 9.1% increase, alongside an unchanged status over the last week and expectations of earnings growth at an annual rate of 14%. In this context, identifying undervalued small caps like Elders that show promising insider actions can offer intriguing opportunities for investors looking to potentially benefit from market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Corporate Travel Management | 17.1x | 2.6x | 49.43% | ★★★★★★ |

| Healius | NA | 0.6x | 41.93% | ★★★★★☆ |

| Dicker Data | 21.9x | 0.8x | 1.10% | ★★★★☆☆ |

| Elders | 22.6x | 0.5x | 44.05% | ★★★★☆☆ |

| Eagers Automotive | 9.7x | 0.3x | 33.83% | ★★★★☆☆ |

| Codan | 29.1x | 4.3x | 27.23% | ★★★★☆☆ |

| Strike Energy | 294.7x | 72.2x | 49.84% | ★★★★☆☆ |

| RAM Essential Services Property Fund | NA | 5.9x | 37.84% | ★★★★☆☆ |

| Gold Road Resources | 16.7x | 4.1x | 46.20% | ★★★☆☆☆ |

| Coventry Group | 281.0x | 0.4x | -6.80% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

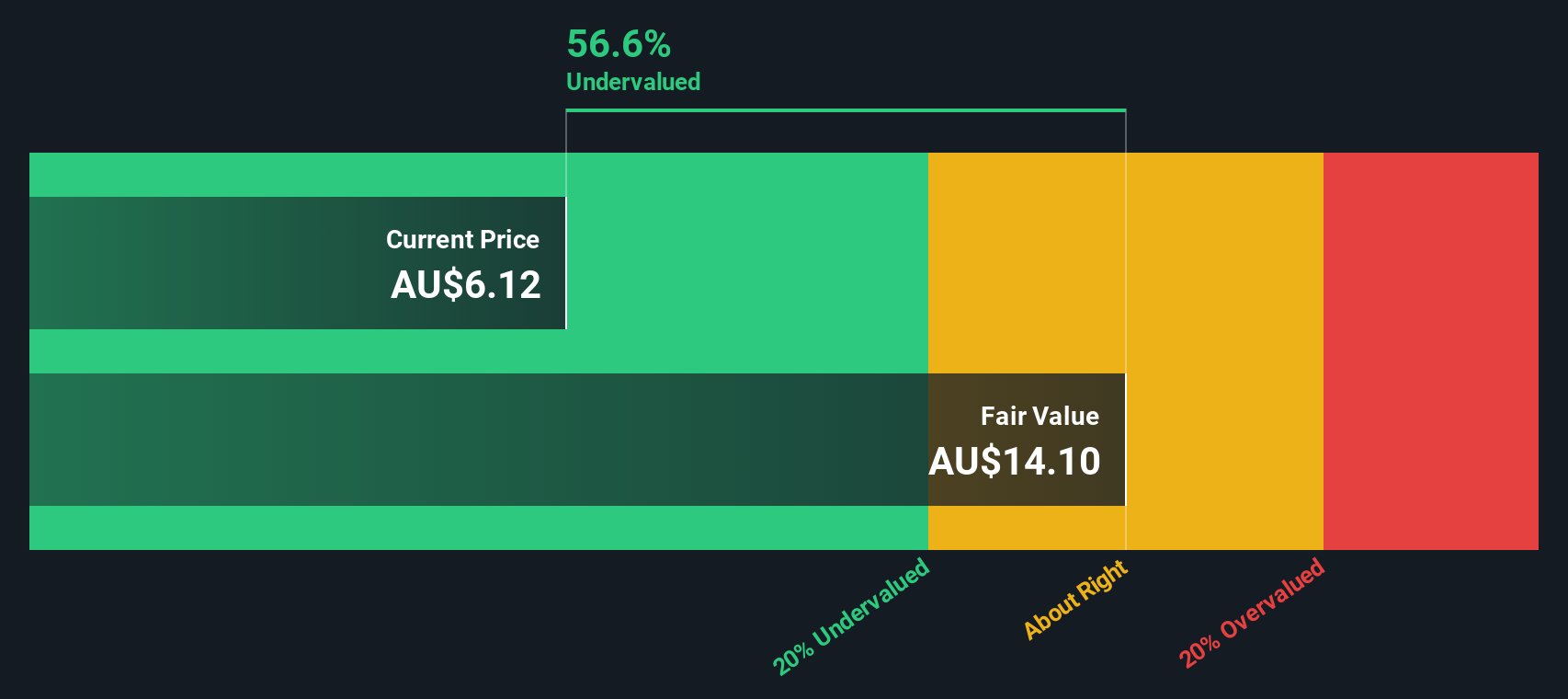

Elders (ASX:ELD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is a diversified agribusiness company, involved in branch network services, wholesale products, feed and processing services, and corporate operations.

Operations: Branch Network, Wholesale Products, and Feed and Processing Services collectively generated A$3.00 billion in revenue, with a gross profit margin of 19.41% by the latest period. The company's net income has shown variability but recorded A$63.58 million most recently.

PE: 22.6x

Elders Limited, a notable player in the Australian market, recently reaffirmed its earnings guidance for FY 2024, projecting an EBIT between A$120 million and A$140 million. Despite a challenging half-year with sales dropping to A$1.34 billion from A$1.66 billion and net income decreasing to A$11.59 million from A$48.85 million, insider confidence remains evident as they recently purchased shares, signaling belief in the company's potential rebound. Adding strategic depth, Glenn Davis joins as a non-executive director by November 2024, bringing extensive legal and corporate governance expertise.

- Dive into the specifics of Elders here with our thorough valuation report.

Review our historical performance report to gain insights into Elders''s past performance.

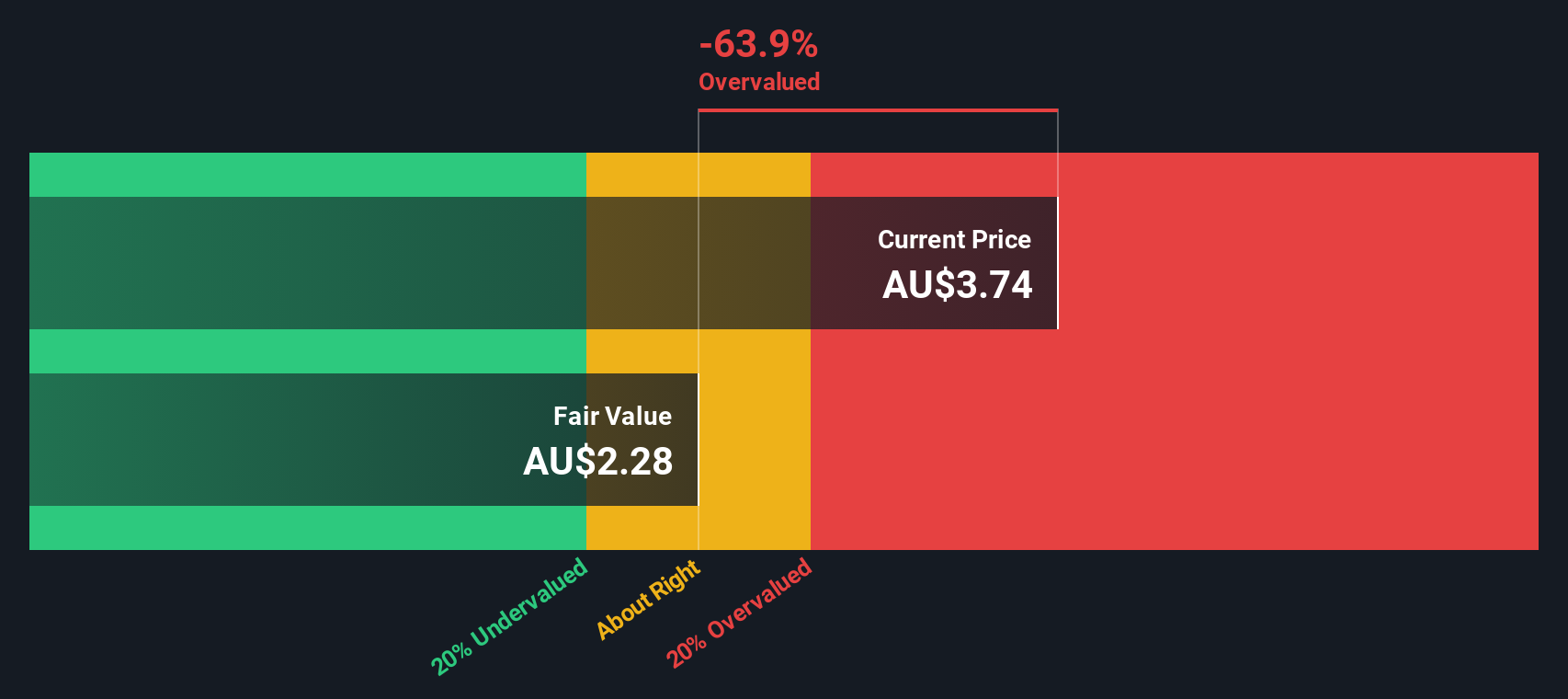

Kelsian Group (ASX:KLS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kelsian Group is a diversified transport company operating in sectors including bus services in Australia and internationally, as well as marine and tourism, with a market capitalization of approximately A$1.02 billion.

Operations: The company's gross profit margin has shown a varied trend, increasing from 28.20% in September 2013 to a peak of 44.30% in December 2016, before fluctuating and slightly decreasing to approximately 25.44% by December 2023. This financial metric reflects the proportion of revenue that exceeds the cost of goods sold, indicating how efficiently management is generating revenue relative to direct production costs over this period.

PE: 47.0x

Recently, Kelsian Group has shown insider confidence with strategic share purchases, signaling strong belief in the company’s potential. Despite a challenging environment where profit margins dipped from 3.8% to 1.7% last year, earnings are expected to rise by approximately 25% annually. At the recent Macquarie Australia Conference, management underscored initiatives poised to enhance financial standing and address issues related to its reliance on external borrowing—a factor considered higher risk compared to customer deposits. These insights suggest that Kelsian is navigating its challenges with a clear strategy for growth.

- Click here and access our complete valuation analysis report to understand the dynamics of Kelsian Group.

Understand Kelsian Group's track record by examining our Past report.

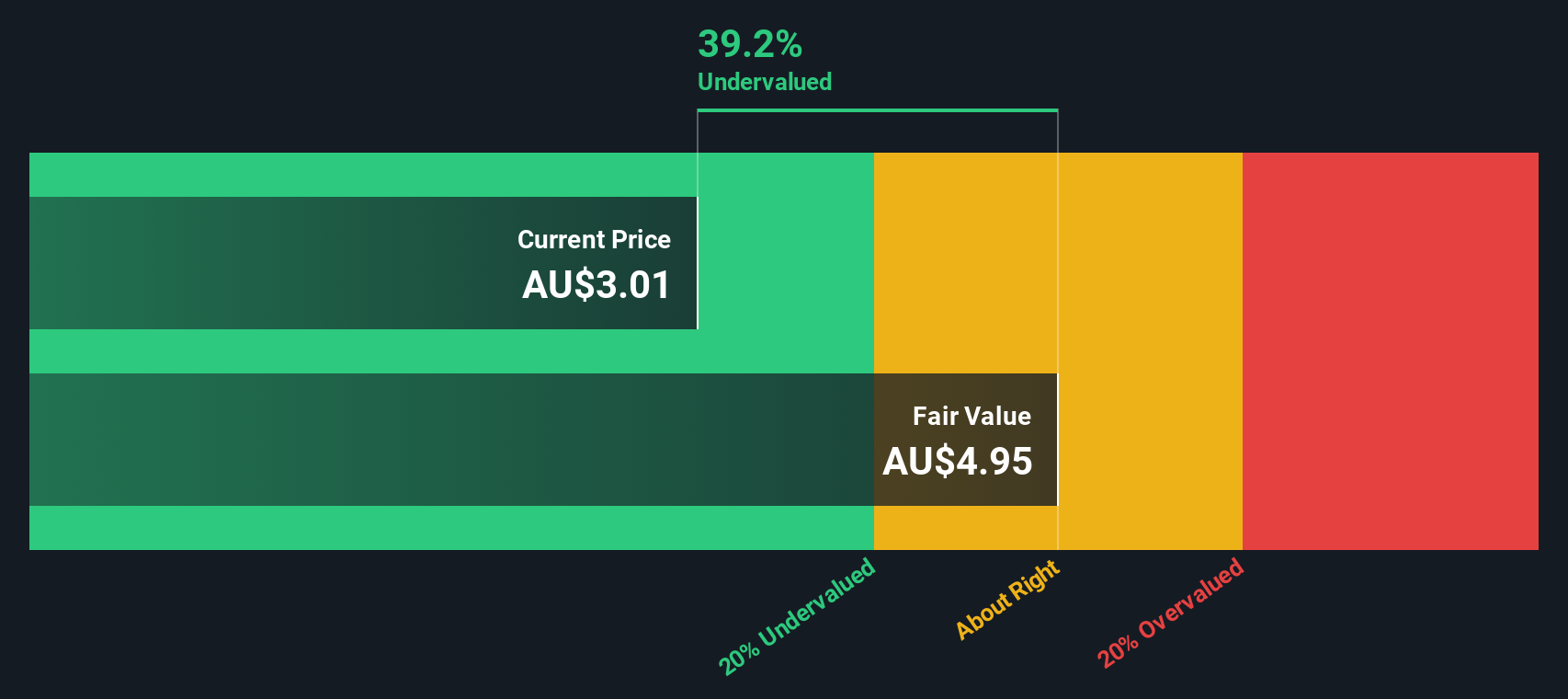

NRW Holdings (ASX:NWH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NRW Holdings is an Australian company specializing in civil construction and mining services, with a market capitalization of approximately A$1.20 billion.

Operations: The company generates its highest revenue from the Mining segment, contributing A$1.49 billion, followed by MET and Civil segments at A$739.07 million and A$593.62 million respectively. The gross profit margin as of the latest report stands at 47.41%.

PE: 16.9x

Recently, NRW Holdings reaffirmed its revenue outlook for FY 2024 at A$2.9 billion, reflecting steady financial expectations. With earnings projected to grow by 13.33% annually, the company's strategic moves appear promising. Notably, insiders have shown confidence in NRW's prospects through recent share purchases, signaling strong belief in its potential. Additionally, the firm successfully raised A$5.26 million through a follow-on equity offering priced at A$2.56 per share on July 11, 2024—further bolstering its capital structure without relying on high-risk funding sources like external borrowing alone.

- Click here to discover the nuances of NRW Holdings with our detailed analytical valuation report.

Gain insights into NRW Holdings' past trends and performance with our Past report.

Make It Happen

- Embark on your investment journey to our 22 Undervalued ASX Small Caps With Insider Buying selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether NRW Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NWH

NRW Holdings

Through its subsidiaries, provides diversified contract services to the resources and infrastructure sectors in Australia.

Flawless balance sheet average dividend payer.