- Australia

- /

- Oil and Gas

- /

- ASX:WHC

The Bull Case For Whitehaven Coal (ASX:WHC) Could Change Following Major Queensland Cost-Cutting Initiative – Learn Why

Reviewed by Sasha Jovanovic

- Whitehaven Coal recently announced plans to remove an additional A$60 million to A$80 million in costs from its Queensland operations by the end of June 2026, focusing on operational efficiency improvements.

- This initiative reflects the company’s efforts to strengthen its financial position amid changing market dynamics and industry pressures.

- We’ll explore how these cost-cutting measures could influence Whitehaven Coal’s long-term investment appeal and earnings outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Whitehaven Coal Investment Narrative Recap

To own Whitehaven Coal, you need to believe that robust long-term coal demand in Asia and persistent global supply gaps will support strong margins and resilient revenues. The recent cost-cutting announcement increases short-term confidence in operational efficiency, but it does not materially reduce the main risk: accelerating global decarbonization policies pressuring future demand for both thermal and metallurgical coal. However, it further supports the key catalyst, Whitehaven’s drive for sustainable margin improvement through efficiency gains and disciplined cost management. Among Whitehaven’s recent announcements, their August extension of the share buyback program until March 2026 is especially relevant. Cost savings, combined with continued buybacks, reinforce management’s focus on capital efficiency during periods of market volatility, and are closely linked to investor expectations for stable shareholder returns, one of the stock’s most important short-term share price drivers. But despite these recent steps, investors should also be mindful of how rapidly increasing global ESG mandates may impact Whitehaven’s funding flexibility and long-term cost base...

Read the full narrative on Whitehaven Coal (it's free!)

Whitehaven Coal's narrative projects A$5.9 billion in revenue and A$448.9 million in earnings by 2028. This outlook assumes a -0.3% annual revenue decline and a decrease of A$200.1 million in earnings from the current A$649.0 million.

Uncover how Whitehaven Coal's forecasts yield a A$7.40 fair value, a 3% upside to its current price.

Exploring Other Perspectives

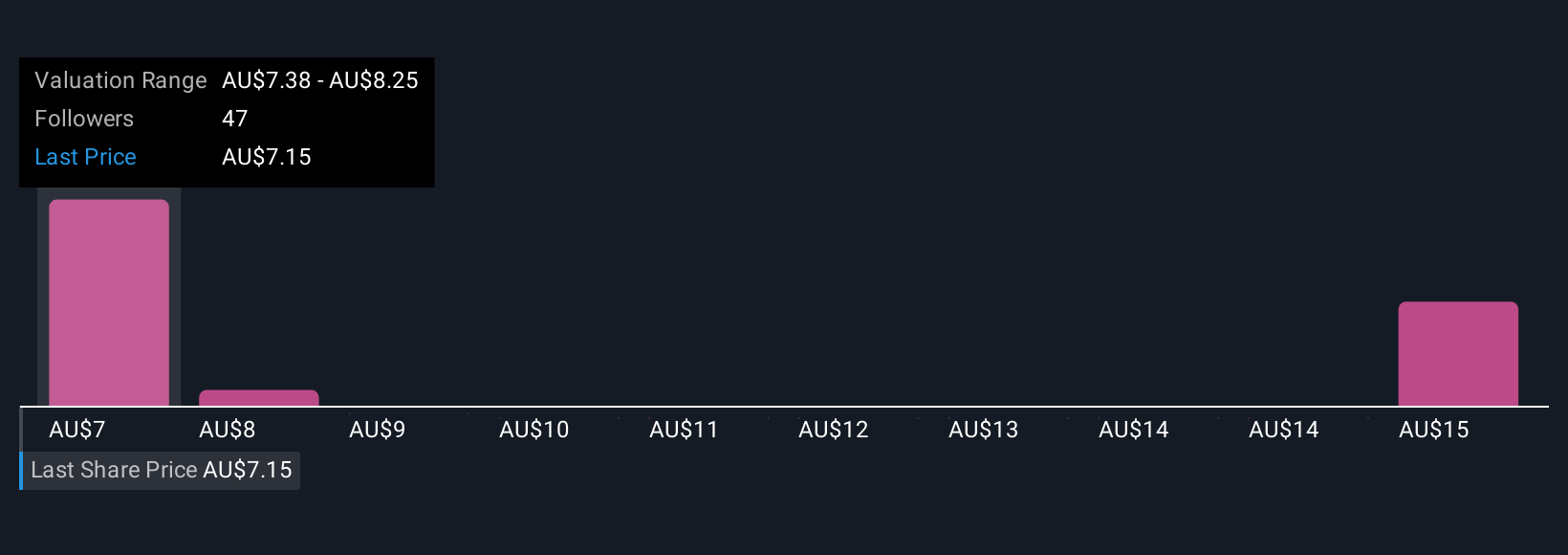

Simply Wall St Community members published six fair value estimates for Whitehaven Coal, ranging from A$7.38 to A$14.85 per share. With such diverse outlooks, it’s worth considering how Whitehaven’s efficiency efforts may help offset revenue risks from shifting demand and policy trends.

Explore 6 other fair value estimates on Whitehaven Coal - why the stock might be worth over 2x more than the current price!

Build Your Own Whitehaven Coal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Whitehaven Coal research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Whitehaven Coal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Whitehaven Coal's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whitehaven Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:WHC

Whitehaven Coal

Develops and operates coal mines in Queensland and New South Wales.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives