- Australia

- /

- Oil and Gas

- /

- ASX:STO

Does the Bid for Woodside Mean Opportunity or Risk for Santos in 2025?

Reviewed by Bailey Pemberton

If you have been watching Santos lately and wondering whether now is a smart time to buy, sell, or simply hold tight, you are not alone. The company’s share price has taken a few twists and turns, which can make decision-making feel like trying to catch a moving target. Over the past five years, Santos stock has jumped a solid 66.4%, but the road has hardly been smooth. Recent weeks have seen the price dip by 3.2% in the last seven days and slide nearly 15% over the past month. While that might look worrying on the surface, it is worth noting that many investors see these swings as an opportunity rather than a red flag, especially as shifting global energy dynamics start to shake up risk perceptions across the sector.

For those hunting for value, here is an interesting stat: Santos currently scores a 4 out of 6 in our valuation checks, with each check indicating a potential area of undervaluation. That means the company looks attractively priced by most standards, even if it has slipped slightly from earlier highs. But how should you interpret these numbers, and what does the market really miss about the valuation story here?

Up next, we will break down the different ways investors measure value and why the standard approaches sometimes only scratch the surface. Stick around for a deeper look at what truly matters when it comes to Santos’s real worth.

Approach 1: Santos Discounted Cash Flow (DCF) Analysis

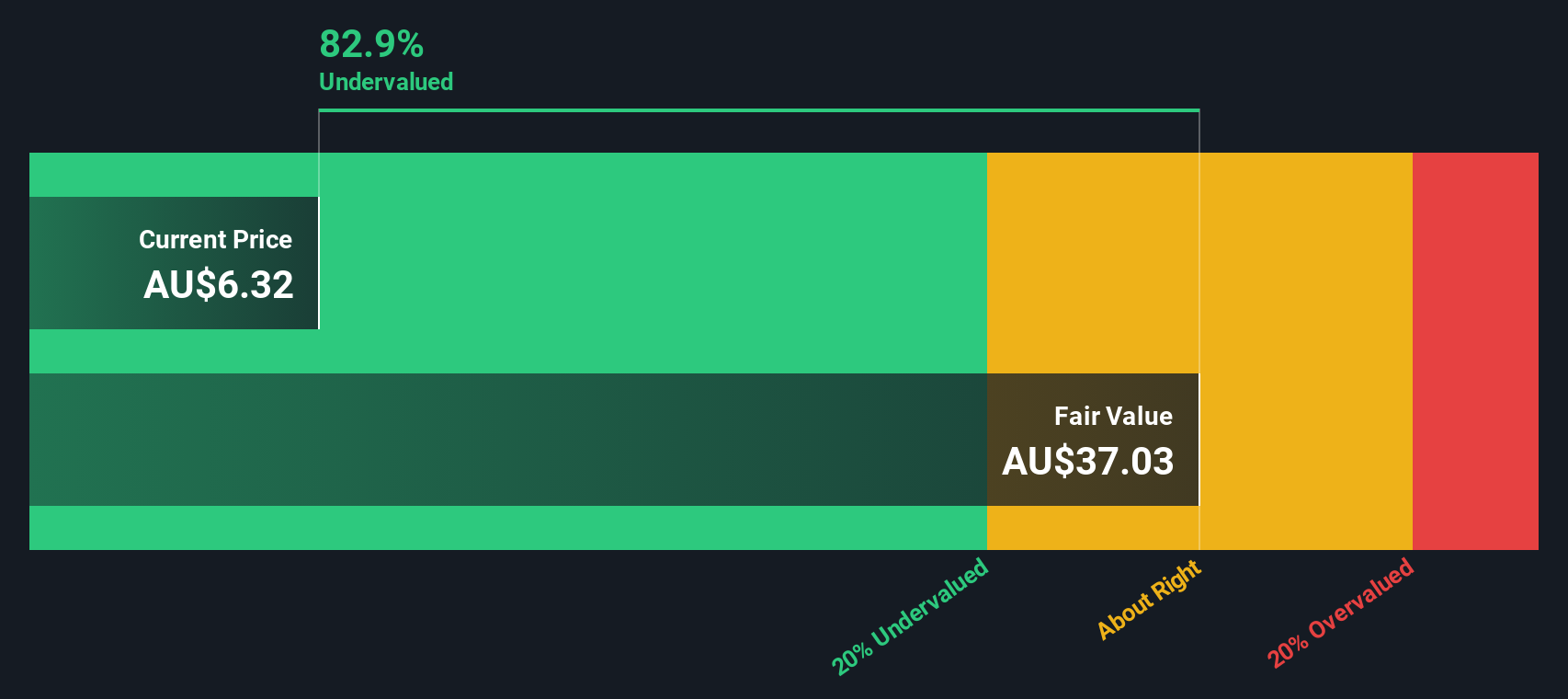

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future free cash flows, then discounting those amounts back to today’s dollars. This approach is widely used to cut through short-term market noise and focus on the underlying earning power a business is expected to generate over the long run.

For Santos, the current Free Cash Flow (FCF) stands at $982.9 Million. Analysts have projected steady growth, with estimates indicating FCF will reach $2.05 Billion in 2028. Beyond that, projections are extrapolated, and by 2035, the FCF is expected to climb to nearly $3.88 Billion. These figures reflect both external analyst estimates for the next five years as well as further projections based on industry trends after that period.

According to this model, the intrinsic value of Santos shares is estimated to be $33.23. This is significantly higher than the current trading price, which implies the shares may be undervalued by around 79.9%. In summary, the calculations suggest that the market may be missing the true long-term potential of Santos’s cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Santos is undervalued by 79.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Santos Price vs Earnings

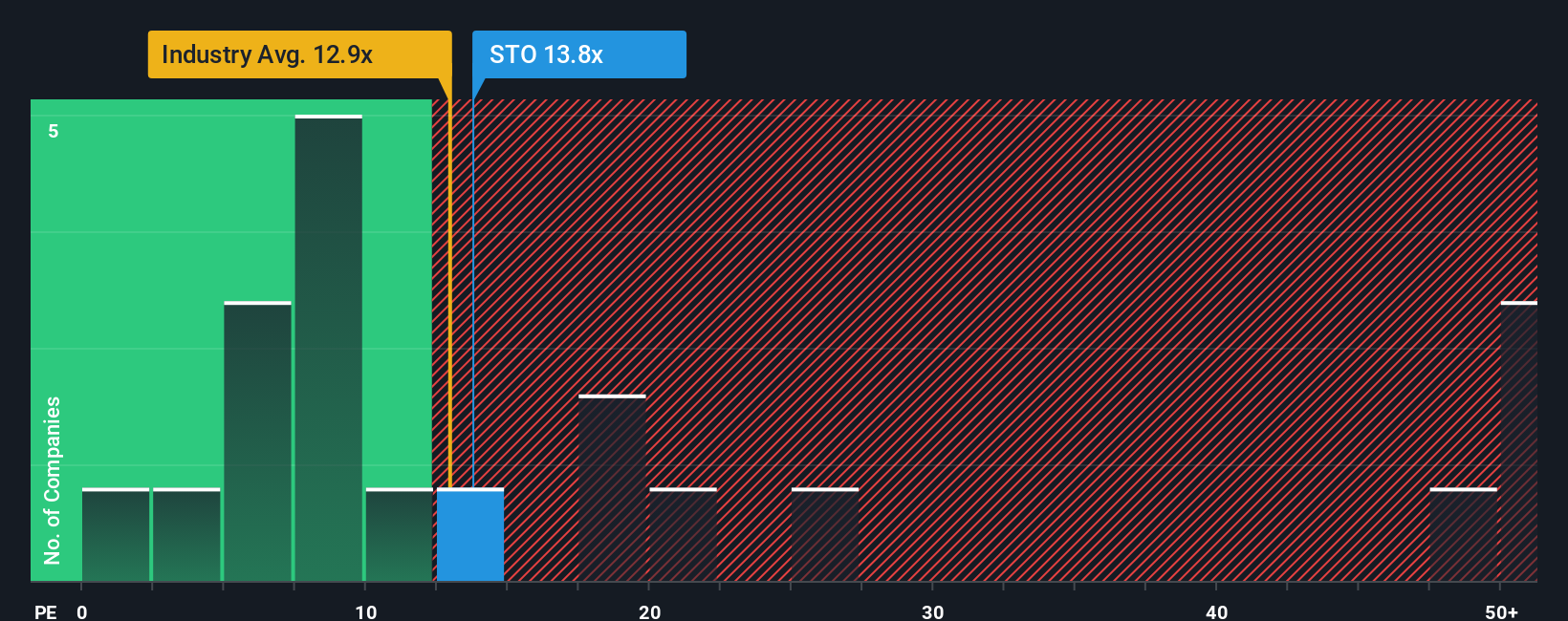

For profitable companies like Santos, the price-to-earnings (PE) ratio is one of the most widely used tools to assess valuation. It helps investors quickly gauge how much they are paying for each dollar of earnings and acts as a check against irrational pricing when solid profits are on the table.

Deciding what a “normal” or fair PE ratio should be depends on both growth prospects and risk. Strong growth typically justifies a higher PE, signaling investors expect bigger profits in the future. Increased risk usually lowers that number to reflect greater uncertainty.

Currently, Santos trades at a PE ratio of 13.92x. That is slightly above the oil and gas industry average of 12.92x and higher than the typical peer average of 10.49x. Neither is a perfect benchmark, as they do not fully capture Santos’s unique profile.

This is where Simply Wall St’s Fair Ratio offers a more tailored perspective. For Santos, the Fair Ratio stands at 15.92x, which factors in the company’s earnings growth potential, industry characteristics, profit margins, market capitalization, and risk profile. Because it weighs all these relevant factors, the Fair Ratio tends to give a more precise, individualized sense of value than a simple industry or peer comparison can provide.

Compared to its Fair Ratio, Santos’s current PE is below what you would expect given these fundamentals. This suggests the stock is undervalued based on core earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Santos Narrative

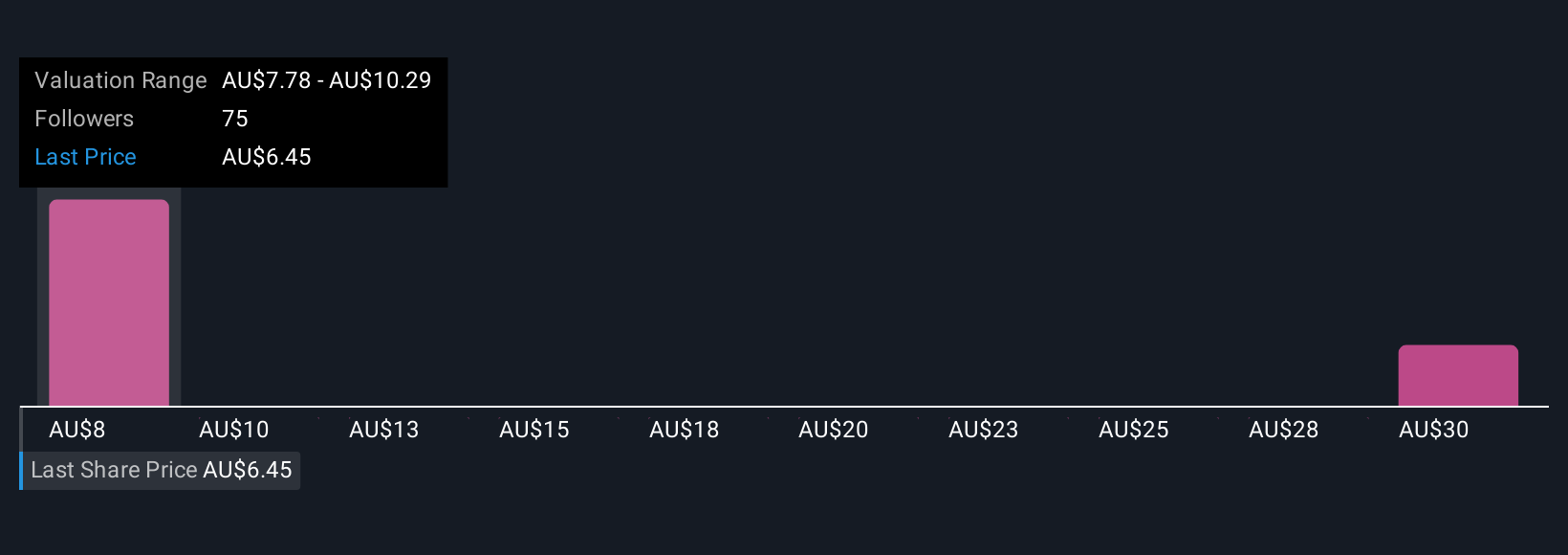

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your story behind a company, a way to tie together your assumptions about its future revenue, earnings, and margins with a clear fair value estimate. Rather than just relying on ratios or static forecasts, Narratives let you explain not only what you think will happen to Santos, but why, linking its business outlook to numbers you can compare to today’s market price.

Narratives are easy to use and available for free on Simply Wall St’s Community page, which is trusted by millions of investors. This tool helps you check if Santos is a buy or sell by showing how your assumptions about its future performance turn into a dynamic Fair Value, one that updates automatically when new news or earnings data arrives, removing much of the guesswork from your investment process.

For example, on Santos, the most optimistic Narrative expects robust LNG demand and strong project execution, leading to a fair value as high as A$9.42, while the most cautious anticipates margin pressure and slower growth, estimating a value closer to A$7.60. Narratives empower you to see and compare these perspectives in real time, making smarter decisions simple and transparent.

Do you think there's more to the story for Santos? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:STO

Santos

Explores, develops, produces, transports, and markets hydrocarbons in Australia and Papua New Guinea.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives