- Australia

- /

- Oil and Gas

- /

- ASX:PEN

If You Had Bought Peninsula Energy's (ASX:PEN) Shares Five Years Ago You Would Be Down 91%

Over the last month the Peninsula Energy Limited (ASX:PEN) has been much stronger than before, rebounding by 48%. But will that repair the damage for the weary investors who have owned this stock as it declined over half a decade? Probably not. Five years have seen the share price descend precipitously, down a full 91%. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Peninsula Energy

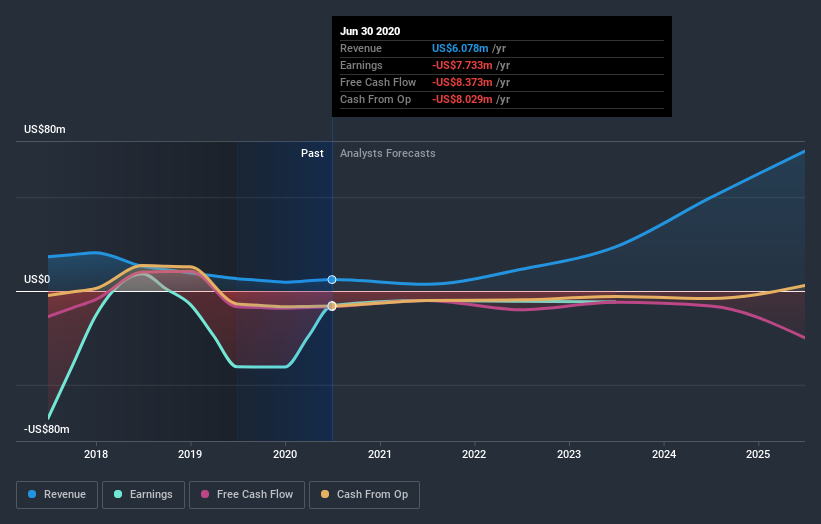

Given that Peninsula Energy didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Peninsula Energy saw its revenue increase by 2.8% per year. That's not a very high growth rate considering it doesn't make profits. It's not so sure that share price crash of 14% per year is completely deserved, but the market is doubtless disappointed. While we're definitely wary of the stock, after that kind of performance, it could be an over-reaction. A company like this generally needs to produce profits before it can find favour with new investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Peninsula Energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Peninsula Energy had a tough year, with a total loss of 44%, against a market gain of about 0.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 14% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Peninsula Energy better, we need to consider many other factors. Even so, be aware that Peninsula Energy is showing 4 warning signs in our investment analysis , and 1 of those can't be ignored...

Of course Peninsula Energy may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you’re looking to trade Peninsula Energy, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:PEN

Peninsula Energy

Operates as a uranium exploration company in the United States.

Exceptional growth potential with excellent balance sheet.