- Australia

- /

- Healthtech

- /

- ASX:M7T

ASX Penny Stocks With Market Caps Up To A$200M

Reviewed by Simply Wall St

The Australian market is currently experiencing a challenging period, with significant volatility and downturns impacting investor sentiment. In such times, the appeal of penny stocks—often smaller or newer companies—remains strong for those seeking growth opportunities at lower price points. Despite their reputation as speculative investments, penny stocks can offer substantial potential when backed by solid financials and sound fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Dusk Group (ASX:DSK) | A$0.82 | A$51.68M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.89 | A$451.85M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.61 | A$273.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.07 | A$34.76M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.04 | A$3.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Praemium (ASX:PPS) | A$0.77 | A$377.96M | ✅ 5 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.13 | A$1.32B | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.58 | A$245.34M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.38 | A$131.64M | ✅ 3 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.38 | A$635.01M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 410 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Actinogen Medical (ASX:ACW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Actinogen Medical Limited is an Australian biotechnology company focused on developing therapies for neurological and neuropsychiatric diseases linked to dysregulated brain cortisol, with a market cap of A$177.83 million.

Operations: Actinogen Medical Limited does not report any revenue segments.

Market Cap: A$177.83M

Actinogen Medical, with a market cap of A$177.83 million, is a pre-revenue biotech firm focused on therapies for neurological diseases. Despite its unprofitability and increasing losses over five years, it has stable weekly volatility and an experienced board and management team. The company recently reached a significant milestone with the FDA regarding its Alzheimer's treatment pathway, which could enhance discussions with potential partners. Actinogen's short-term assets surpass liabilities, providing financial stability despite limited cash runway if free cash flow declines persist. Revenue is forecast to grow significantly, although earnings are expected to decline in the near term.

- Click to explore a detailed breakdown of our findings in Actinogen Medical's financial health report.

- Examine Actinogen Medical's earnings growth report to understand how analysts expect it to perform.

Mach7 Technologies (ASX:M7T)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mach7 Technologies Limited develops and commercializes medical imaging and data management software solutions for healthcare organizations globally, with a market cap of A$81.06 million.

Operations: The company generates revenue from Software Licenses (A$17.11 million), Professional Services (A$3.65 million), and Maintenance and Support (A$13.01 million).

Market Cap: A$81.06M

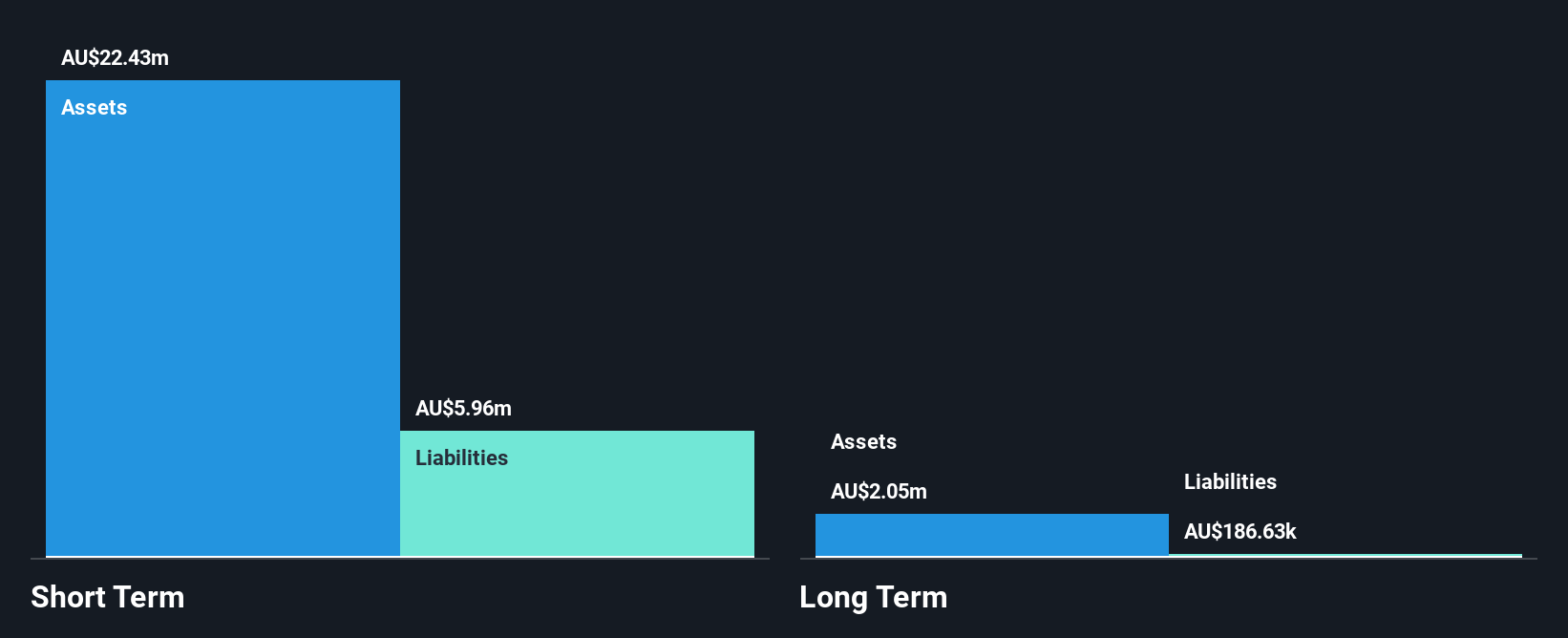

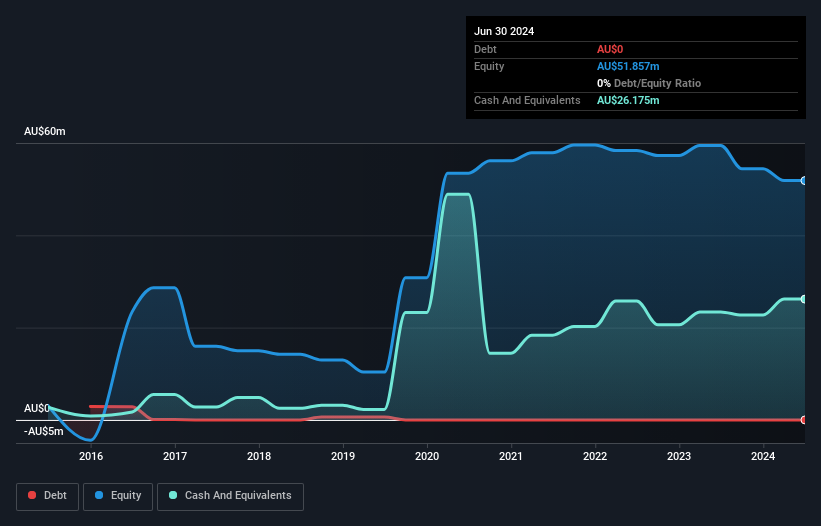

Mach7 Technologies, with a market cap of A$81.06 million, is unprofitable but shows potential in the healthcare technology sector with revenue streams from software licenses, professional services, and maintenance support totaling A$33.77 million for the year ending June 2025. The company recently appointed Daniel Lee as CFO to drive growth and profitability; however, its management team is relatively inexperienced with an average tenure of 0.3 years. Despite being dropped from the S&P/ASX Emerging Companies Index, Mach7's short-term assets exceed liabilities and it remains debt-free while maintaining a stable cash runway exceeding three years based on current free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of Mach7 Technologies.

- Assess Mach7 Technologies' future earnings estimates with our detailed growth reports.

Marmota (ASX:MEU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marmota Limited is an Australian company focused on the exploration of mineral properties, with a market capitalization of A$84.84 million.

Operations: Marmota Limited has not reported any revenue segments.

Market Cap: A$84.84M

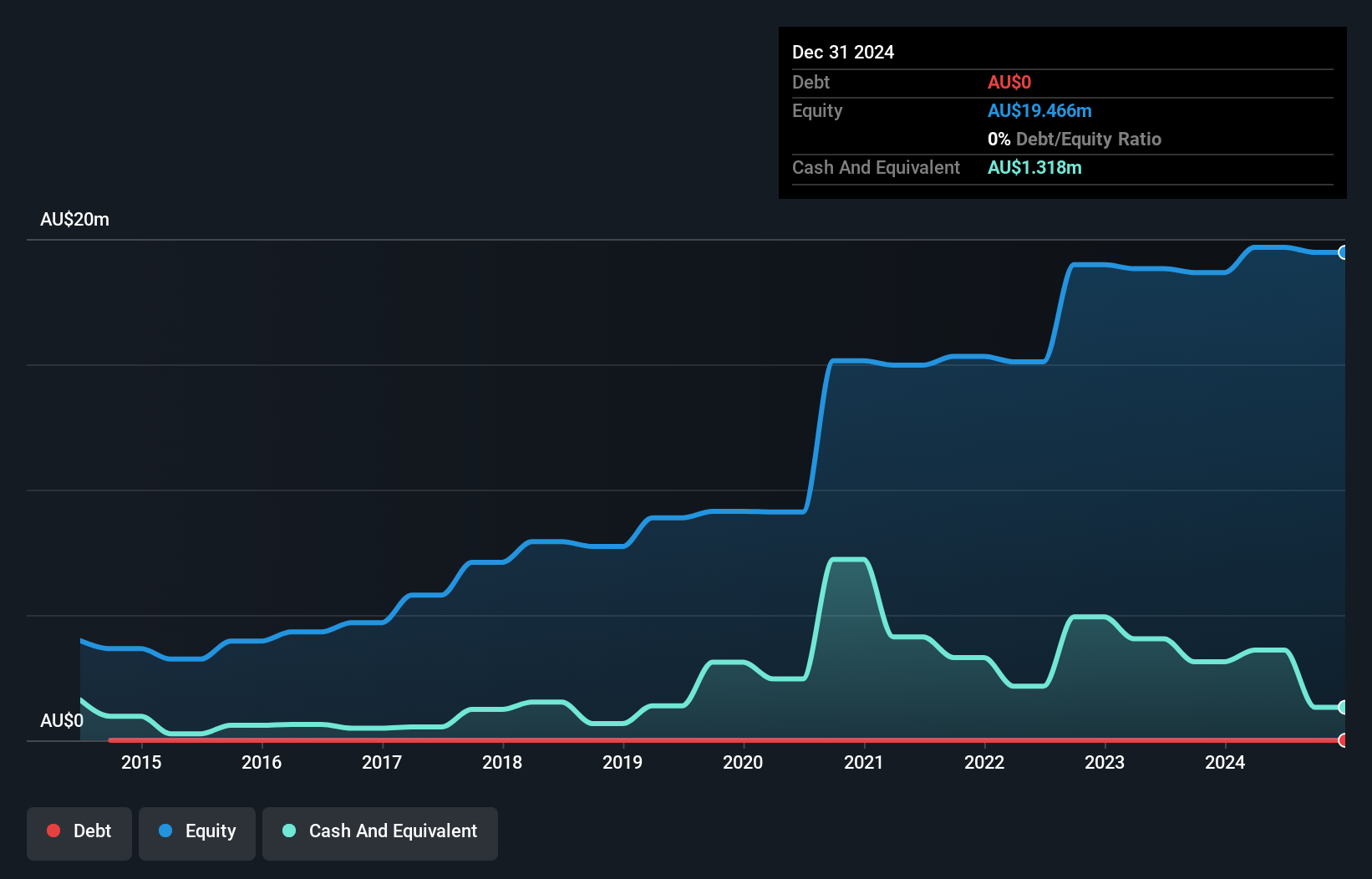

Marmota Limited, with a market cap of A$84.84 million, is pre-revenue and currently unprofitable, reporting a net loss of A$1.71 million for the year ending June 2025. Despite this, the company maintains financial stability with short-term assets of A$5 million exceeding both its short- and long-term liabilities significantly. Marmota has no debt and a cash runway extending beyond one year even if free cash flow reduces at historical rates. The management team is experienced with an average tenure of 6.2 years; however, share price volatility remains high compared to most Australian stocks over recent months.

- Click here to discover the nuances of Marmota with our detailed analytical financial health report.

- Explore historical data to track Marmota's performance over time in our past results report.

Taking Advantage

- Click here to access our complete index of 410 ASX Penny Stocks.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:M7T

Mach7 Technologies

Develops and commercializes medical imaging and data management software solutions for healthcare organizations in North America, the Asia Pacific, the Middle East, Europe, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives