- Australia

- /

- Oil and Gas

- /

- ASX:ERA

Some Confidence Is Lacking In Energy Resources of Australia Ltd (ASX:ERA) As Shares Slide 26%

The Energy Resources of Australia Ltd (ASX:ERA) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 25%.

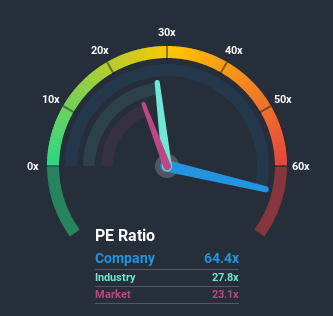

In spite of the heavy fall in price, Energy Resources of Australia may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 64.4x, since almost half of all companies in Australia have P/E ratios under 23x and even P/E's lower than 13x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, Energy Resources of Australia's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Energy Resources of Australia

How Is Energy Resources of Australia's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Energy Resources of Australia's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 74%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 30% shows it's noticeably less attractive on an annualised basis.

In light of this, it's alarming that Energy Resources of Australia's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Energy Resources of Australia's P/E

Energy Resources of Australia's shares may have retreated, but its P/E is still flying high. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Energy Resources of Australia revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You need to take note of risks, for example - Energy Resources of Australia has 2 warning signs (and 1 which is potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on Energy Resources of Australia, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you’re looking to trade Energy Resources of Australia, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Energy Resources of Australia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ASX:ERA

Energy Resources of Australia

Engages in mine rehabilitation in Australia.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives