- Australia

- /

- Consumer Finance

- /

- ASX:ZIP

Assessing Zip Co (ASX:ZIP) Valuation Following Latest Share Buy-Back Announcement

Reviewed by Simply Wall St

Zip Co (ASX:ZIP) has updated the market on its share buy-back program, revealing the purchase of over 568,000 ordinary fully paid shares. These buy-backs often catch attention, as they suggest management is confident in the company’s future direction.

See our latest analysis for Zip Co.

Following this strategic buy-back, Zip Co’s recent momentum has been mixed. The share price gained 4.93% in a single day, but its 30-day share price return sits at -28.88%. The total shareholder return over the last year is down 5.99%. Despite these short-term swings, Zip’s three-year total shareholder return of 289.54% indicates significant long-term growth delivered for investors.

If Zip’s buy-back move has you rethinking growth opportunities, now is a great time to expand your horizons and discover fast growing stocks with high insider ownership

With market sentiment fluctuating and recent buy-back activity stirring interest, is Zip Co trading below its true value, or are investors already factoring in the company’s next wave of growth, leaving little room for upside?

Most Popular Narrative: 41.5% Undervalued

Zip Co’s prevailing narrative sets a fair value markedly above the recent closing price. This disconnect with the market is drawing strong attention, and its context may surprise investors watching the valuation story unfold.

Zip Co is poised to benefit from the accelerating shift toward digital payments and increasing e-commerce penetration, as evidenced by strong transaction volumes (up 30%) and targeted partnerships with platforms like Google and Stripe. These relationships are likely to drive higher transaction values and revenue growth.

Curious why Zip Co’s fair value calculation is so much higher than today’s price? The narrative bets on powerful growth levers and a bold earnings transformation. Wondering which forward-looking numbers fuel this optimism and how they compare to typical industry expectations? Find out what’s really driving this substantial undervaluation.

Result: Fair Value of $5.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased regulatory scrutiny and intensifying competition could challenge Zip Co’s growth outlook. These factors may potentially impact margins and long-term profitability.

Find out about the key risks to this Zip Co narrative.

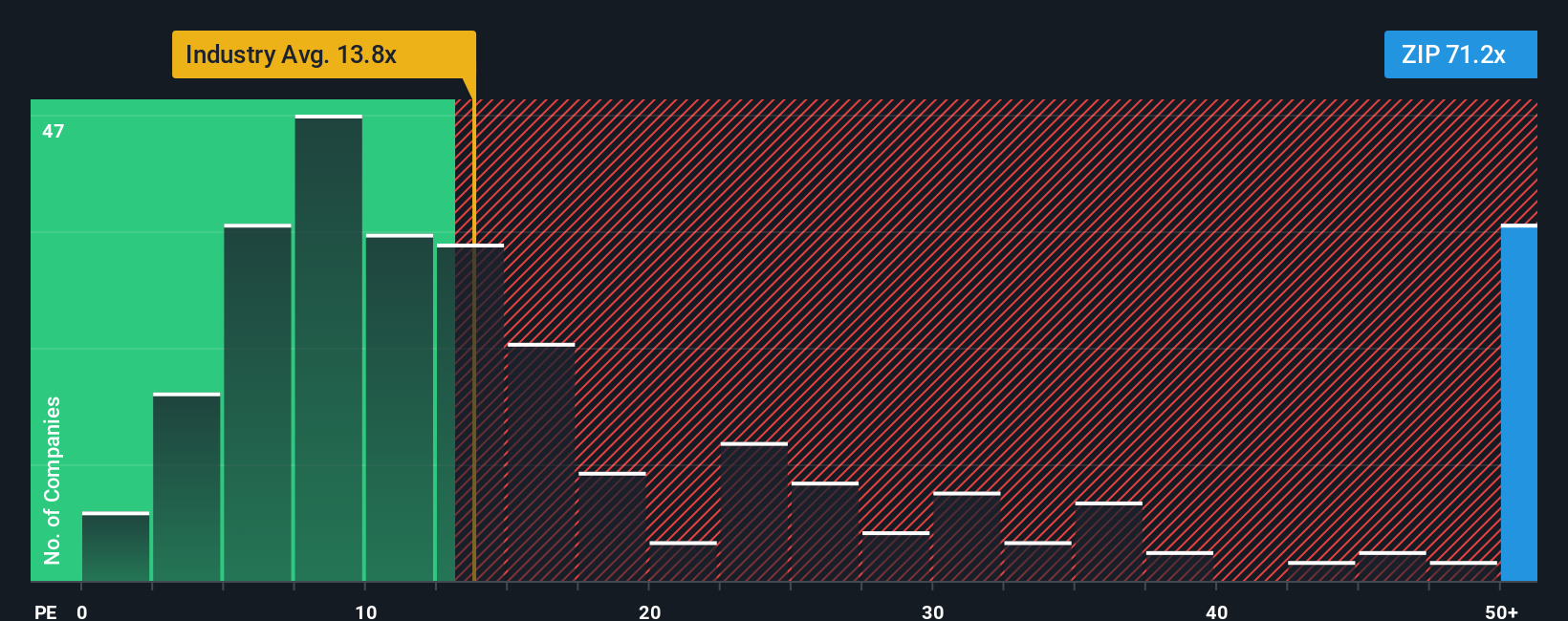

Another View: Price-to-Earnings Says Caution

While the consensus narrative calls Zip Co undervalued, the actual price-to-earnings ratio tells a different story. At 47.8x earnings, Zip is trading far above its peers' 10.9x and the industry average of 12.5x. Even compared to its fair ratio of 29.8x, the current valuation looks stretched. This suggests the market is expecting very strong growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zip Co Narrative

If you want to test your own assumptions and dig deeper into Zip Co, it’s easy to pull together a personal perspective in just a few minutes. Do it your way.

A great starting point for your Zip Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Investment Ideas?

Make the most of your next move by seeking out fresh opportunities across themes driving tomorrow’s returns. Don’t let these unique trends pass you by.

- Catch emerging opportunities by reviewing these 26 AI penny stocks at the forefront of artificial intelligence advancements and disruptive automation.

- Target strong income streams with these 15 dividend stocks with yields > 3% offering attractive yields for steady growth and reinvestment potential.

- Unlock potential with these 3589 penny stocks with strong financials featuring dynamic companies positioned for outsized gains as market sentiment shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zip Co might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:ZIP

Zip Co

Engages in the provision of digital retail finance, personal finance, and payments solutions in Australia, New Zealand, and the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives